Understanding the Importance of Pet Insurance in Hong Kong

Veterinary care in Hong Kong is expensive. A simple consultation can cost HK$500 to HK$1,000, while surgeries or treatments for serious illnesses like cancer can exceed HK$50,000. For example, treating a dog with diabetes can cost up to HK$20,000 annually, and emergency surgeries for accidents can range from HK$10,000 to HK$30,000. These costs can create a significant financial burden for pet owners.

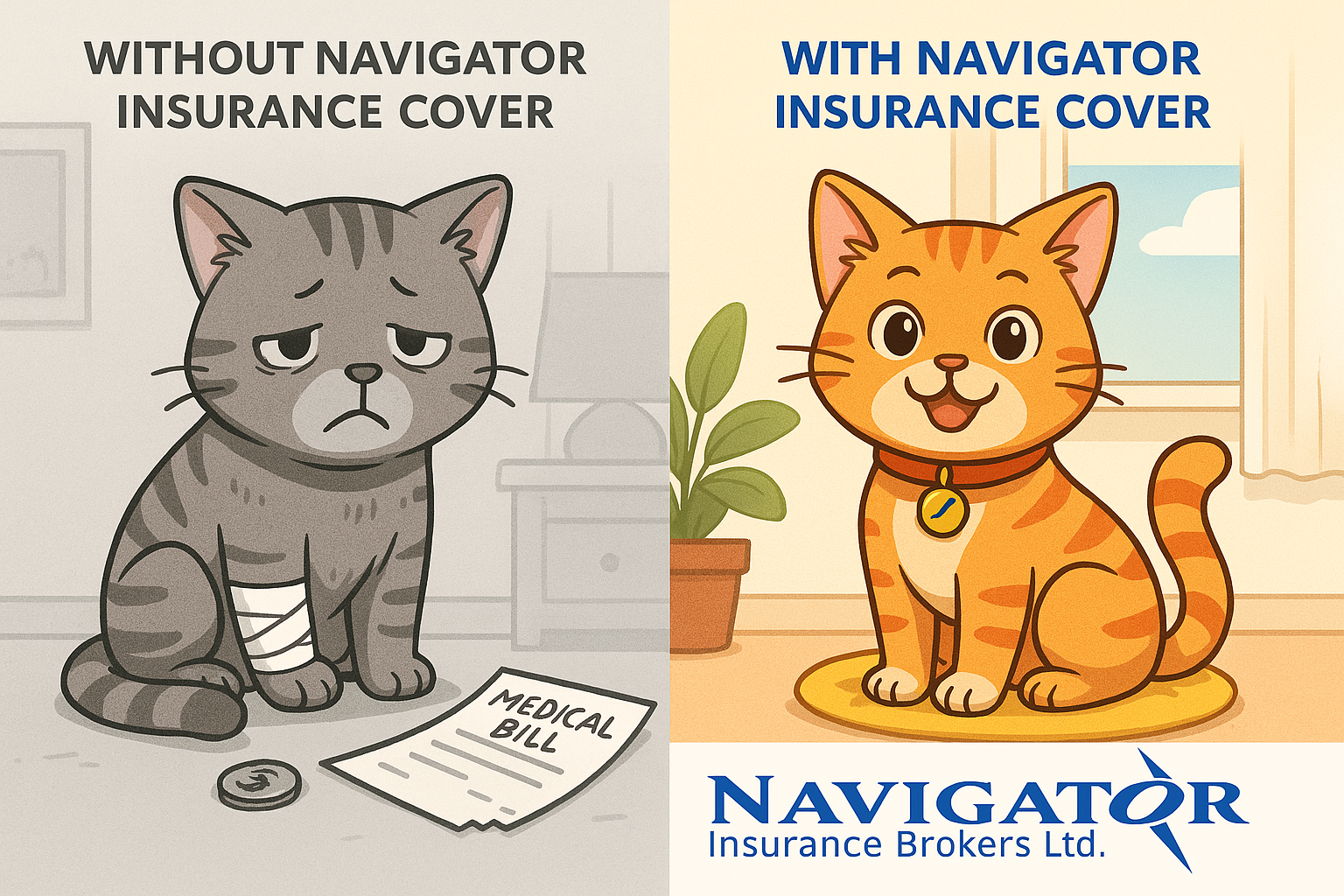

Pet insurance helps manage these unexpected expenses. It ensures that pets receive timely and necessary care without forcing owners to make difficult financial decisions. For instance, a study by the Hong Kong Pet Owners Association found that 60% of pet owners faced financial stress due to veterinary bills, and 30% delayed or avoided treatment because of cost.

Having pet insurance provides peace of mind. It allows owners to focus on their pet’s health rather than worrying about the cost of treatment. It also promotes responsible pet ownership by ensuring pets get the care they need.

The pet insurance market in Hong Kong is growing rapidly. In 2022, the market saw a 25% increase in policies sold, reflecting a rising awareness among pet owners. This growth is driven by the increasing number of pets in Hong Kong, with over 500,000 registered pets in 2023.

Key Features of Popular Pet Insurance Providers in Hong Kong

OneDegree’s Pet CEO Plan® offers up to HK$100,000 in annual coverage with a 90% reimbursement rate. It covers all breeds and provides lifetime coverage for chronic illnesses if the pet is enrolled before age 4.

Blue Cross’s LovePet Insurance plan provides up to HK$60,000 annually with no sub-limit claims, meaning the full amount can be used for any eligible expense.

FWD’s pet insurance plan is ideal for multi-pet households, offering discounts for insuring multiple pets.

MSIG’s Happy Tails® plan covers up to 80% of expenses for sickness and accidents and offers lifetime renewability if the pet is enrolled before age 4.

PetbleCare’s plan includes up to HK$68,000 in annual coverage and reimburses 70% of vet bills. It also offers third-party liability coverage up to HK$2,000,000, which is useful for pets that may cause damage or injury.

Prudential’s pet insurance requires no medical examination for enrollment, making it a convenient option for older pets or those with pre-existing conditions.

Customizing Your Pet Insurance to Your Pet’s Needs

Choosing the right pet insurance depends on your pet’s breed, age, and health. For example, larger breeds may have higher healthcare costs, while older pets are more prone to chronic illnesses.

Consider coverage limits and reimbursement rates. A plan with a higher reimbursement rate, like OneDegree’s 90%, can reduce out-of-pocket expenses. Lifetime coverage for chronic illnesses is also important for long-term financial protection.

Third-party liability coverage is essential for pets that may interact with others, such as dogs that walk in public spaces.

Compare plans carefully. Look at what each policy covers, including consultations, surgeries, and behavioral treatments. Ensure the plan meets your pet’s specific needs.

Navigating the Claims Process and Customer Support

Filing a claim is straightforward with most providers. You’ll need to submit veterinary bills and treatment records. Online claims applications, like OneDegree’s, make the process faster.

Customer support is crucial. Providers like Blue Cross offer 24-hour emergency hotlines for immediate assistance. Understanding your policy’s terms, such as deductibles and exclusions, helps avoid surprises during claims.

Keep accurate records of all veterinary expenses. This ensures smooth claims processing and maximizes your insurance benefits.

The Future of Pet Insurance in Hong Kong

The pet insurance market in Hong Kong is expected to grow further. Factors like increasing pet ownership and rising veterinary costs will drive this growth.

Emerging trends include the use of technology, such as apps for claims and telemedicine for pets. Innovative coverage options, like wellness plans for routine care, are also becoming popular.

Government policies and regulations may shape the industry, ensuring transparency and fair practices. Collaboration between insurers and veterinary clinics can improve pet health outcomes.

Continued education and awareness campaigns will help more pet owners understand the benefits of insurance. As the market evolves, pet insurance will play a vital role in ensuring pets in Hong Kong stay healthy and well-cared for.