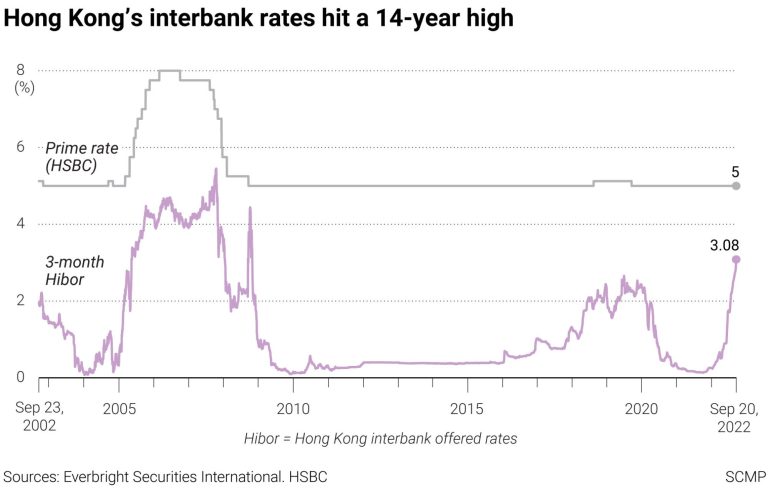

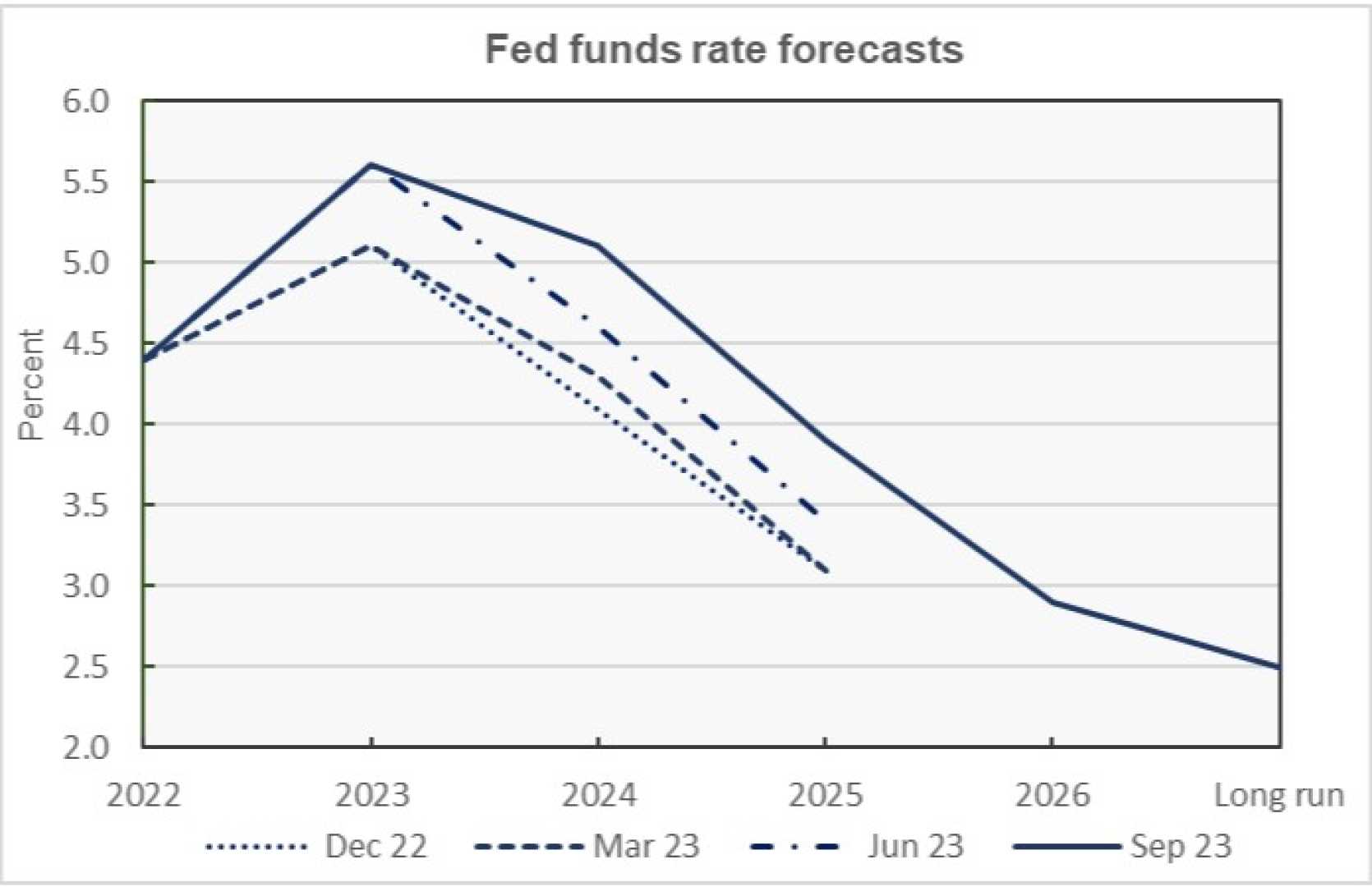

In a financial landscape marked by constant fluctuations, HSBC has demonstrated a measured approach to interest rate management by keeping its prime rate steady at 5 percent. This decision, announced on Thursday, comes at a time when global economic signals are particularly nuanced, especially following the US Federal Reserve’s recent 25 basis point interest rate cut.

The bank’s choice to maintain its current rate is more than just a simple financial maneuver; it represents a carefully calculated strategy designed to provide stability for customers and stakeholders in the Hong Kong market. By holding its prime rate constant, HSBC signals confidence in its current financial positioning and a commitment to prudent economic management.

Equally noteworthy is the bank’s approach to savings rates for Hong Kong dollar deposits. Despite the broader economic shifts, HSBC has opted to keep these rates unchanged. This decision follows a previous modest rate reduction of 12.5 basis points in October, highlighting the bank’s cautious and deliberate approach to rate adjustments.

The context of this decision is crucial. While the US Federal Reserve has been making rate cuts, HSBC’s leadership has chosen a different path. This divergence reflects the bank’s unique perspective on global economic conditions and its commitment to maintaining financial equilibrium. The decision is particularly significant given HSBC’s prominent position in Hong Kong’s financial ecosystem, with its headquarters located in the city’s Central district – a symbolic heart of regional economic activity.

Market observers had widely anticipated this steady approach, suggesting that HSBC’s strategy aligns with broader market expectations. The bank appears to be navigating international financial conditions with a focus on long-term stability rather than reacting impulsively to short-term fluctuations.

For those interested in staying informed about such financial developments, The Standard app offers a recommended resource for real-time updates and information. The app provides an accessible way for individuals to track important economic news and understand the nuanced world of banking and finance.

HSBC’s current stance underscores a broader narrative of financial resilience. In an era of unpredictable economic shifts, the bank’s decision to maintain its prime rate demonstrates a commitment to providing a sense of security for its customers. This approach is particularly valuable in times of global economic uncertainty, where stability can be as important as aggressive growth strategies.

The bank’s strategy reflects a deep understanding of the delicate balance required in modern financial management. By carefully weighing global economic signals and maintaining a steady course, HSBC shows why it remains a significant player in the international banking landscape.

As global economic dynamics continue to evolve, financial institutions like HSBC play a critical role in providing stability and confidence to markets and individual customers alike. The decision to hold the prime rate at 5 percent is not just a numerical adjustment, but a strategic statement about the bank’s approach to navigating complex economic terrain.

For those watching the financial world, HSBC’s measured response serves as an interesting case study in strategic financial management, demonstrating how careful analysis and a steady hand can be powerful tools in an ever-changing global economy.