HKMA Cuts Rate to 4%, Warns of US Policy Risks

Hong Kong’s financial landscape is experiencing significant shifts as the Hong Kong Monetary Authority (HKMA) navigates complex economic waters. In a strategic move that underscores the intricate relationship between global and local monetary policies, the HKMA has reduced its base interest rate by 25 basis points, bringing it down to 4 percent.

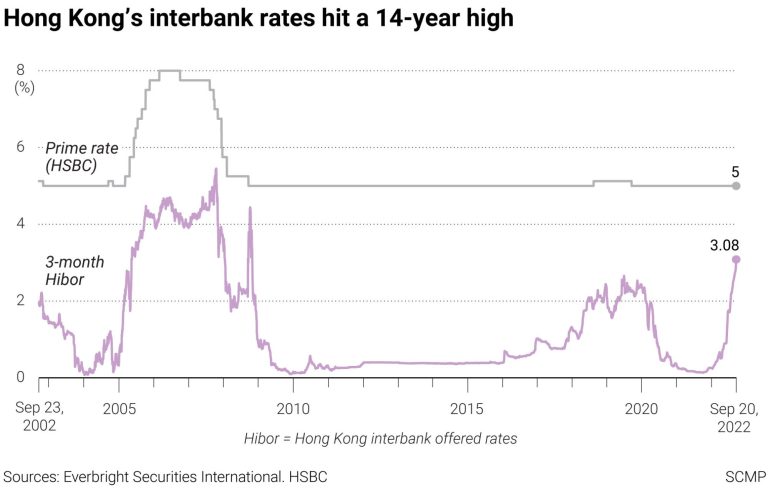

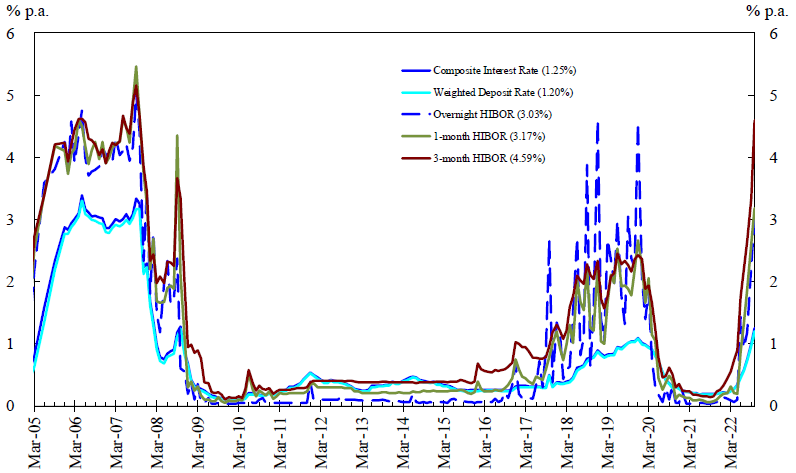

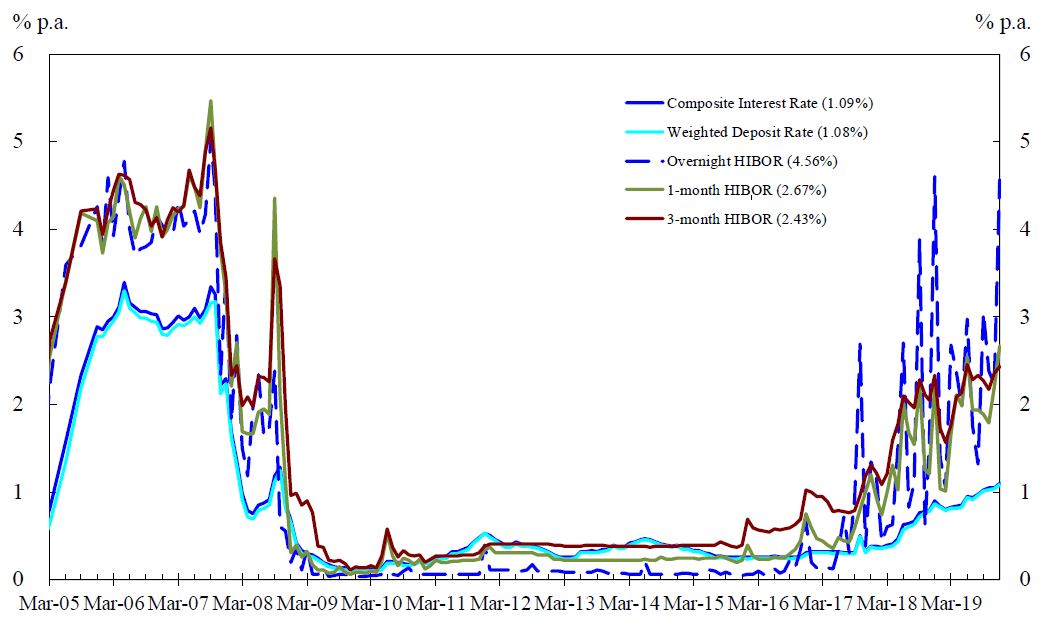

This latest rate cut is not happening in isolation. It follows a recent reduction by the US Federal Reserve and marks the third such adjustment by the HKMA this year, with the previous cut occurring in October. The decision highlights the profound influence of US monetary policy on Hong Kong’s financial environment, a dynamic that HKMA Chief Executive Eddie Yue Wai-man has been carefully monitoring.

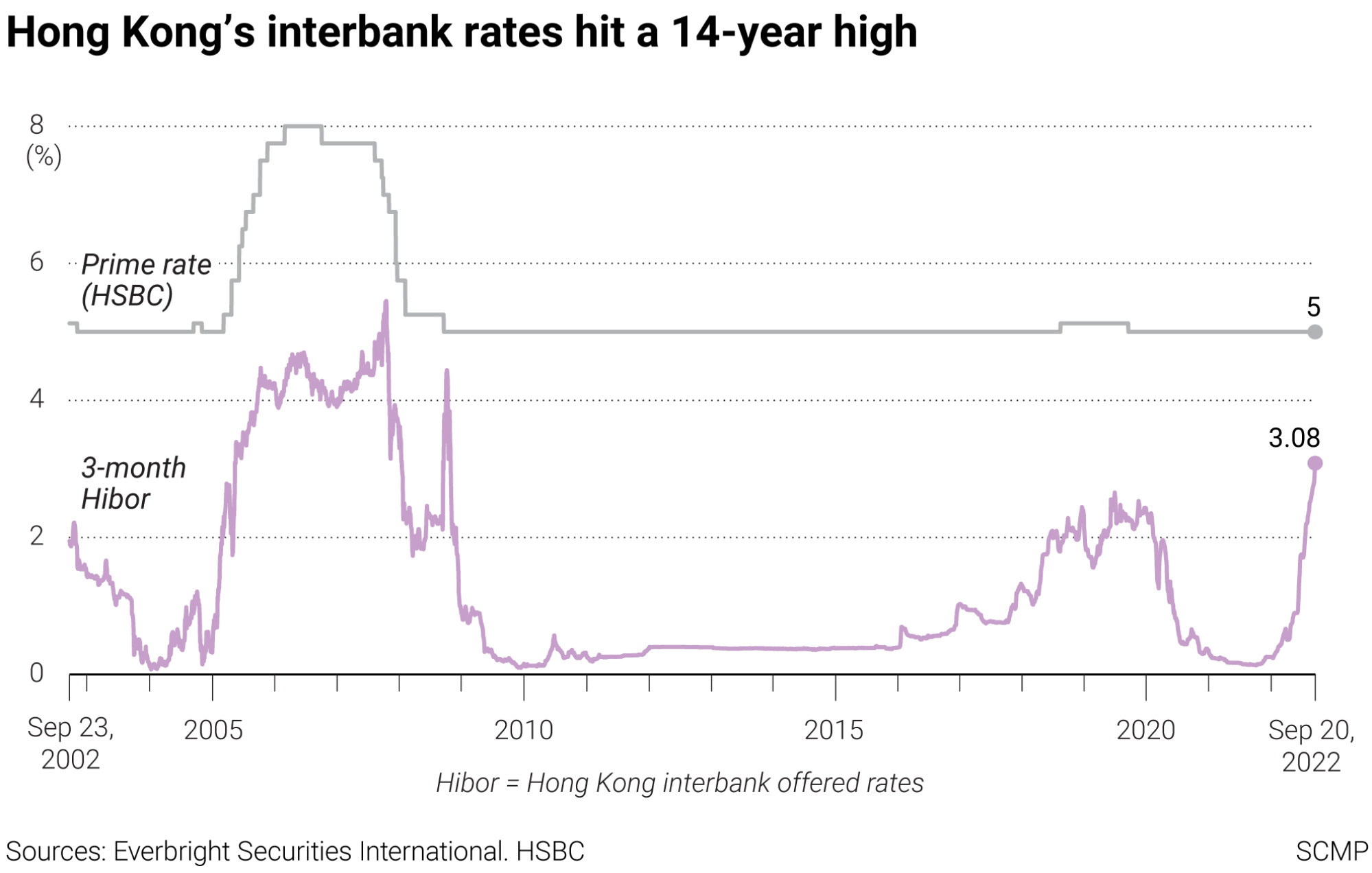

Yue’s commentary reveals the nuanced considerations behind such monetary decisions. While US interest rate changes significantly impact Hong Kong’s financial ecosystem, local market conditions play an equally critical role in determining short-term interbank offered rates. Seasonal effects, such as month-end and year-end fluctuations, and broader capital market activities contribute to these complex calculations.

An interesting dimension of this rate cut involves local banking dynamics. Banks have already indicated that deposit rates are approaching zero, which introduces additional complexity to potential further reductions in prime lending rates. This situation creates a delicate balancing act for financial institutions and borrowers alike.

The potential economic implications are substantial. Lower borrowing costs could provide a positive stimulus to both the broader economy and the housing market. However, Yue has been careful to temper expectations, cautioning homebuyers and borrowers to remain vigilant about managing interest rate risks amid ongoing uncertainties.

Beyond macroeconomic considerations, the HKMA is also addressing specific local challenges. A notable example is the intricate situation surrounding mortgage arrangements for residents affected by a fire in Tai Po. Recognizing the complexity of this issue, banks have implemented an interim solution by suspending loan repayments for affected residents for six months. This approach creates breathing room for stakeholders to collaborate on developing long-term strategies for managing these loans.

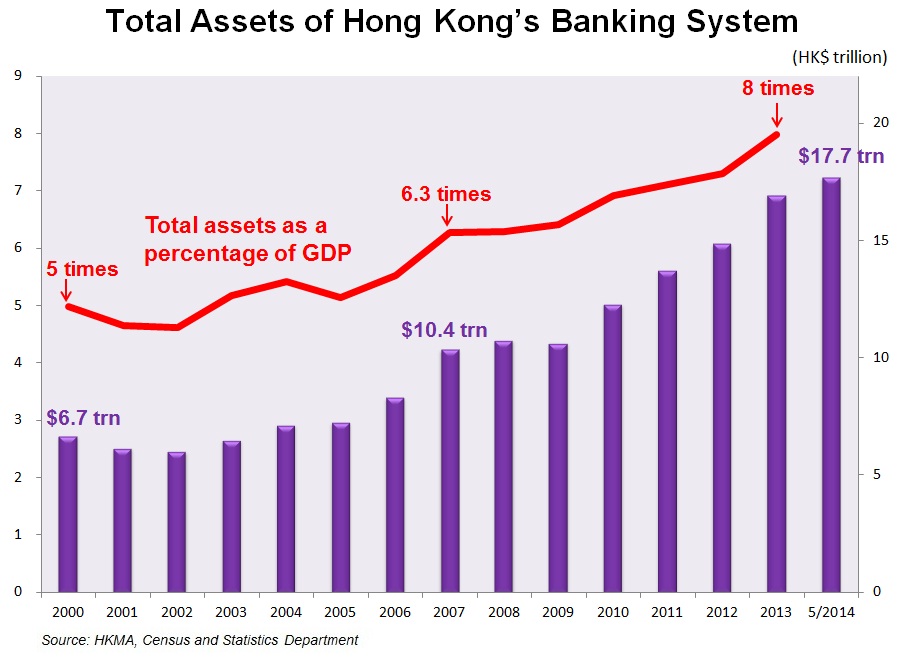

The current rate cut reflects a broader context of global monetary policy trends, particularly those established by the US Federal Reserve. Yet, the HKMA remains acutely aware of the uncertainties that lie ahead. The organization is committed to a balanced approach that considers both international trends and local economic conditions.

Yue’s remarks encapsulate a stance of cautious optimism. While acknowledging the potential economic benefits of lower rates, he simultaneously emphasizes the importance of prudent risk management. This approach demonstrates the HKMA’s sophisticated understanding of the delicate interplay between monetary policy, economic stimulation, and financial stability.

For residents, investors, and economic observers, these developments underscore the dynamic nature of Hong Kong’s financial landscape. The HKMA continues to demonstrate its commitment to carefully navigating economic challenges, balancing global influences with local needs, and maintaining a responsive and responsible approach to monetary policy.

As the financial world continues to evolve, the HKMA’s latest move serves as a testament to the complexity of modern economic management and the ongoing need for adaptive, nuanced strategies in an increasingly interconnected global economy.