Hong Kong drivers face a complex insurance landscape, with premiums ranging from HK$3,000 for basic third-party coverage to over HK$50,000 for luxury vehicles. Understanding how insurers calculate these costs can save you thousands annually. Here’s a deep dive into the details.

1. Types of Motor Insurance

Third-Party Liability (TPL)

- Legal Requirement: Mandated by Cap. 272 Motor Vehicles Insurance Ordinance

- Coverage: Injury/death (min. HK$100M) + property damage (min. HK$2M) to third parties

- Exclusions: No coverage for your own vehicle repairs

Comprehensive Insurance

- Full Coverage: Own vehicle repairs (accidents, vandalism, natural disasters), third-party liabilities, and extras like:

- 24/7 roadside assistance

- Windscreen replacement

- Personal accident coverage (up to HK$500,000)

- Premium Range: HK$5,000 (standard sedans) to HK$50,000+ (supercars)

Key Stat: Comprehensive policies account for 62% of Hong Kong’s motor insurance market due to high vehicle values.

2. How Insurers Calculate Premiums

Hong Kong’s 20+ motor insurers (AXA, Zurich, BOC, FWD, etc.) use proprietary formulas, but these factors dominate:

Driver-Specific Factors

- Age: Drivers under 25 pay +25%; over 70 pay +15%

- Claims History: 1 claim = 15% hike; 3 claims = 50%+ surcharge

- Occupation: Commercial drivers (taxis/delivery vans) pay 2x more

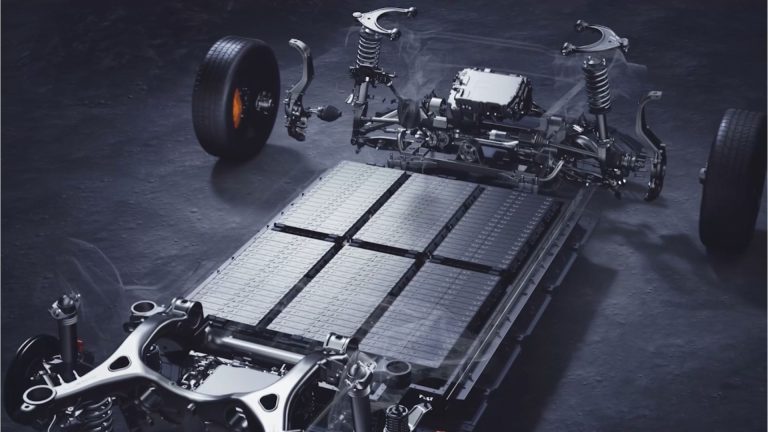

Vehicle-Specific Factors

- Model: Toyota Noah (HK$5,000) vs. Porsche 911 (HK$30,000)

- Modifications: Aftermarket parts increase premiums by 10-20%

- Safety Features: ADAS systems (e.g., Tesla Autopilot) earn 5-8% discounts

3. 7 Proven Ways to Reduce Premiums

- Voluntary Excess: Increase from HK$5,000 to HK$15,000 → Save 18%

- Telematics Policies: Install trackers (e.g., AXA DriveSafe) → Safe drivers save 25%

- Multi-Policy Discounts: Bundle home + motor insurance → 10% off

- Limited Drivers: Exclude high-risk drivers (under 25) → 15% reduction

- Annual Payments: Avoid 3-5% installment fees

- Off-Peak Discounts: Low-mileage drivers (<5,000 km/year) save 8%

- Loyalty Rewards: 5-10% discount after 3+ years with same insurer

Navigator Insurance Brokers: Since 1991

We’ve helped 15,000+ Hong Kong drivers optimize coverage while saving an average of HK$1,800/year through:

- ✅ Cross-market comparisons of 20+ insurers

- ✅ NCD recovery for expired policies

- ✅ Bespoke add-ons (classic car riders, PHV endorsements)

4. Pre-Renewal Checklist

- Confirm your No Claims Discount (NCD) percentage

- Compare updated quotes from AXA, BOC, and Zurich

- Remove unused add-ons (e.g., overseas coverage)

- Ask about green vehicle discounts (EVs/hybrids)

Final Tip: Premiums vary wildly between insurers – a 2024 study showed identical coverage quotes ranging from HK$4,200 to HK$7,100 for the same Toyota Camry. Never auto-renew without comparing!