Embark on your next adventure with confidence using the AXA SmartTraveller Plus plan. Designed for travelers seeking comprehensive protection, this plan covers everything from medical emergencies to travel inconveniences. For a limited time, enjoy an exclusive 35% discount on your policy!

Why Choose AXA SmartTraveller Plus?

AXA SmartTraveller Plus offers robust coverage to ensure your travels are stress-free. Available in Silver, Gold, and Platinum plans, it caters to various needs, whether you’re traveling solo, with family, or on a cruise. Here’s what makes it stand out:

Comprehensive Medical Coverage

Up to HKD2,000,000 for medical expenses incurred overseas due to accidents or illness, including follow-up treatment in Hong Kong within 3 months. Covers:

- Inpatient and outpatient care

- Chinese bone-setting, acupuncture, physiotherapy, and chiropractic care

- Free virtual medical consultations and medicine delivery (annual cover, select locations)

Protection for Personal Belongings

Safeguard your valuables with coverage for accidental loss or damage to baggage, mobile phones, laptops, and suitcases, plus:

- Up to HKD3,000 for loss of travel documents

- Up to HKD3,000 for loss of money or unauthorized credit card use

Travel Inconvenience Coverage

Protection for disruptions like:

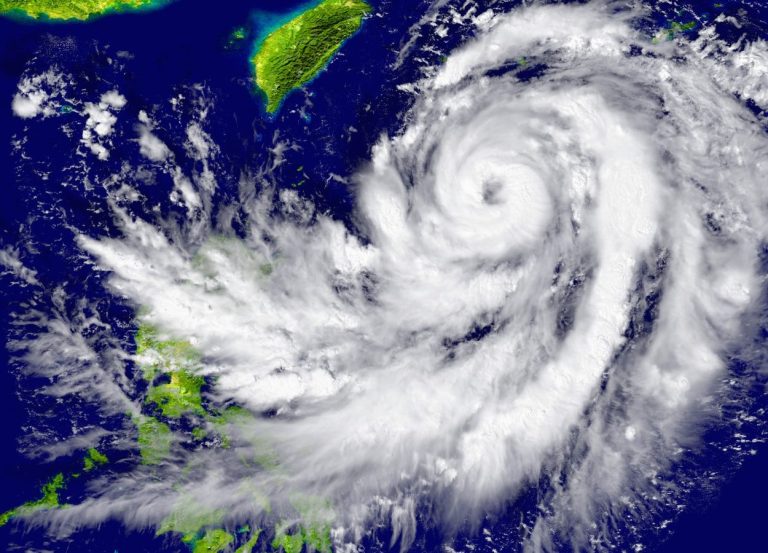

- Travel delays (6+ hours) due to weather, strikes, or terrorism (up to HKD3,000)

- Overbooking (up to HKD10,000 for accommodation and meals)

- Trip cancellations due to specified events (up to HKD100,000)

Family-Friendly Benefits

Free coverage for children under single-journey policies when traveling with parents. For annual cover, insure parents and children under one policy for cost savings.

Cruise and Road Trip Protection

Optional cruise benefits include coverage for cancellations, curtailments, and missed shore excursions. For road trips, we cover rental car excess and return costs if the driver is hospitalized.

Amateur Sports Coverage

Enjoy activities like snorkeling, scuba diving, skiing, and bungee jumping with coverage for accidental death or injury.

Additional Features

- 24/7 Digital Assistance: Access policy details, submit claims, and get real-time support via the Emma by AXA app.

- Home Care Protection: Coverage for home contents damaged by fire or burglary while you’re away.

- Overseas Interpreter Service: Up to HKD10,000 for interpretation services when dealing with police or authorities.

- Automatic Policy Extension: Up to 10 days for single journeys if delayed, and 90 days per trip for annual cover.

Comprehensive Benefit Coverage

| Summary of Benefits | Silver Plan | Gold Plan | Platinum Plan |

|---|---|---|---|

| Part A. Core Cover | |||

| Section 1 – Medical and Related Expenses Maximum Limit Per Journey Per Insured Person (HKD) |

|||

| a) Insured person aged 18 to 70 | 500,000 | 1,200,000 | 2,000,000 |

| b) Insured person aged over 70 | 250,000 | 600,000 | 1,000,000 |

| c) Insured person aged under 18 | 125,000 | 300,000 | 500,000 |

| d) Insured person aged under 18 and is charged at adult’s premium | 500,000 | 1,200,000 | 2,000,000 |

| Sublimit | |||

| (1) Chinese bone-setting, acupuncture, physiotherapy, or chiropractic treatment | Not covered | 3,000 (200 per day) | 3,000 (200 per day) |

| (2) Compassionate visit (economy class only) | 20,000 (1 person only) | 40,000 (1 person only) | 40,000 (1 person only) |

| (3) Return of unattended children to Hong Kong (economy class only) | 20,000 | 20,000 | 40,000 |

| (4) Hospital admittance deposit guarantee | 40,000 | 40,000 | 40,000 |

| (5) Translator/Interpreter services in hospital | 5,000 (500 per day) | 5,000 (500 per day) | 5,000 (500 per day) |

| (6) Reverting to original travel schedule/itinerary and/or rejoining the travel companions following an interruption caused by accidental injury or sickness | 3,000 | 5,000 | 5,000 |

| (7) Follow-up medical treatment in Hong Kong within 3 months of return from abroad | |||

| – due to accidental injury or sickness | 10% of maximum limit | 10% of maximum limit | 10% of maximum limit |

| – Chinese bone-setting, acupuncture, physiotherapy, or chiropractic treatment | Not covered | 3,000 (200 per day) | 3,000 (200 per day) |

| (8) Daily hospital cash* | 3,000 (500 per day) | 5,000 (500 per day) | 5,000 (500 per day) |

| (9) Daily compulsory quarantine cash* | 3,500 (500 per day) | 5,600 (800 per day) | 5,600 (800 per day) |

| *(8) and (9) cannot be claimed together for the same event | |||

| Extensions to Section 1 | |||

| a) Travelling expense for overseas hospital medical treatment | 500 | 500 | 500 |

| b) Follow-up medical expense in Hong Kong if the infectious disease is contracted overseas and confirmed within 7 days after returning to Hong Kong, even if no medical expense has been incurred overseas | 10% of maximum limit | 10% of maximum limit | 10% of maximum limit |

| c) Virtual medical consultation via MyDoc Health Passport in designated overseas locations (applicable to annual cover only) | 2 consultations per period of insurance | 2 consultations per period of insurance | 2 consultations per period of insurance |

| Section 2 – Overseas Emergency Assistance Service a) 24-hour overseas emergency assistance hotline service b) Emergency medical evacuation/repatriation c) Repatriation of remains |

Fully covered | Fully covered | Fully covered |

| Section 3 – Personal Accident Maximum benefit per insured person |

750,000 | 1,200,000 | 2,000,000 |

| Sublimit Accidental Death |

|||

| – Insured person aged 18 to 70 | 750,000 | 1,200,000 | 2,000,000 |

| – Insured person aged over 70 | 375,000 | 600,000 | 1,000,000 |

| – Insured person aged under 18 | 100,000 | 100,000 | 100,000 |

| – Insured person aged under 18 and is charged at adult’s premium | 375,000 | 600,000 | 1,000,000 |

| Permanent Total Disablement | |||

| – Insured person aged 18 to 70 | 750,000 | 1,200,000 | 2,000,000 |

| – Insured person aged over 70 | 375,000 | 600,000 | 1,000,000 |

| – Insured person aged under 18 | 750,000 | 1,200,000 | 2,000,000 |

| – Insured person aged under 18 and is charged at adult’s premium | 750,000 | 1,200,000 | 2,000,000 |

| Extensions to Section 3 | |||

| a) Burn benefit – Second degree burn |

Not covered | Not covered | 200,000 |

| – Third degree burn | 100,000 | 200,000 | 500,000 |

| b) Compassionate Death Cash Benefit – Due to accidental injury |

25,000 | 50,000 | 50,000 |

| – Due to sickness | 10,000 | 20,000 | 20,000 |

| c) Credit Card Protection | 30,000 | 50,000 | 50,000 |

| d) Disappearance | Covered as accidental death | Covered as accidental death | Covered as accidental death |

| Section 4 – Baggage and Personal Effects Maximum benefit per insured person |

8,000 | 15,000 | 20,000 |

| Sublimit | |||

| (1) Per article or pair or set of article | 1,500 | 2,000 | 3,000 |

| (2) Per laptop computer+ | 5,000 | 5,000 | 5,000 |

| (3) Per tablet computer or mobile phone+ | 1,000 | 2,000 | 3,000 |

| (4) Suitcase, trunk, receptacle and the like | 1,000 (750 per item) | 2,000 (1,500 per item) | 3,000 (2,000 per item) |

| + Up to one laptop computer or one tablet computer or one mobile phone only | |||

| Section 5 – Baggage Delay Emergency purchase of essential items if baggage is delayed for at least 6 hours |

1,000 | 1,500 | 2,000 |

| Section 6 – Personal Money and Travel Documents Maximum benefit per insured person |

4,000 | 6,000 | 6,000 |

| Sublimit | |||

| (1) Loss of money or unauthorised use of credit card or debit card | 2,000 | 3,000 | 3,000 |

| (2) Replacement cost of travel documents and additional travelling and accommodation expenses | 2,000 | 3,000 | 3,000 |

| Section 7 – Personal Liability For legal liability towards third parties for accidental injury or property damage, as well as any associated legal costs and expenses |

2,000,000 | 3,000,000 | 5,000,000 |

| Section 8 – Travel Inconvenience Maximum benefit per insured person |

5,000 | 10,000 | 10,000 |

| Sublimit Applicable for (a), (b), and (c): covers strike or other industrial action, riot, civil commotion, hijack, terrorism, adverse weather conditions, natural disasters, mechanical and/or electrical breakdown of the public common carrier, or closure of the airport |

|||

| a) Cash allowance for travel delay for 6 hours or more | 2,000 (250 per 6 hours) | 3,000 (300 per 6 hours) | 3,000 (300 per 6 hours) |

| b) Due to travel delay for 6 hours or more: i) Extra overseas accommodation expenses; OR ii) Irrecoverable deposits or charges for accommodation; AND iii) Irrecoverable deposits or charges for missed events |

2,000 | 3,000 | 3,000 |

| c) Trip re-routing travel costs due to travel delay for 6 hours or more (economy class only) | 5,000 | 10,000 | 10,000 |

| d) Missed journey: accommodation and meal expenses for failure to board a common public carrier due to missed transportation connection, if not compensated by a third party | 5,000 | 10,000 | 10,000 |

| e) Overbooking: accommodation and meal expenses for failure to board a common public carrier due to overbooking, if not compensated by a third party | 5,000 | 10,000 | 10,000 |

| Section 9 – Loss of Deposit or Cancellation of Journey Covers strike, riot, civil commotion, terrorism, hijack, natural disasters or adverse weather conditions, serious damage to the insured person’s home due to fire, flood or burglary, or red or black outbound travel alert (except for the reason of Pandemic) issued by the HKSAR government at the planned destination within 7 days before departure, serious injury or illness of the insured person, his/her immediate family members, close business partner or travel companion, witness summon, jury service or compulsory quarantine of the insured person, and bankruptcy of a registered travel agent within 90 days before departure; death or permanent total disablement of the insured person, his/her immediate family members, close business partner or travel companion |

|||

| Irrecoverable deposits or charges of transportation, accommodation or missed events | 25,000 | 50,000 | 100,000 |

| Sublimit | |||

| (1) Black outbound travel alert | 100% of the irrecoverable deposits or charges | 100% of the irrecoverable deposits or charges | 100% of the irrecoverable deposits or charges |

| (2) Red outbound travel alert | 50% of the irrecoverable deposits or charges | 50% of the irrecoverable deposits or charges | 50% of the irrecoverable deposits or charges |

| Section 10 – Journey Curtailment Covers strike, riot, civil commotion, terrorism, hijack, natural disasters or adverse weather conditions, serious damage to the insured person’s home due to fire, flood or burglary, or red or black outbound travel alert issued by the HKSAR government at the planned destination, death or serious injury or illness of the insured person, his/her immediate family members, close business partner or travel companion, and bankruptcy of a registered travel agent |

|||

| Proportional return of relevant irrecoverable prepaid cost of the planned holidays including but not limited to travel tickets and missed events OR additional transportation (economy class only) and accommodation expenses | 25,000 | 50,000 | 100,000 |

| Sublimit | |||

| (1) Black outbound travel alert | 100% of the irrecoverable deposits or charges | 100% of the irrecoverable deposits or charges | 100% of the irrecoverable deposits or charges |

| (2) Red outbound travel alert | 50% of the irrecoverable deposits or charges | 50% of the irrecoverable deposits or charges | 50% of the irrecoverable deposits or charges |

| Section 11 – Home Care Benefit Loss of or damages to your home contents as a result of fire or burglary while you are overseas |

10,000 (2,000 per article) | 20,000 (2,000 per article) | 20,000 (2,000 per article) |

| Section 12 – Trauma Counseling Counseling fees if you are the witness and/or victim of a traumatic event |

15,000 (1,000 per day) | 15,000 (1,000 per day) | 25,000 (1,500 per day) |

| Section 13 – Rental Vehicle Excess and Vehicle Return Cost Motor insurance policy’s excess and return cost for rental vehicle |

6,000 | 10,000 | 10,000 |

| Section 14 – Overseas Interpreter Service Interpreter service cost if you need to communicate with police, customs or other local governmental organisations |

3,000 | 10,000 | 10,000 |

| Part B. Optional Benefits | |||

| Section A1 – Mainland China Hospital Deposit Guarantee Benefit Mainland China hospital deposit guarantee card (applicable to annual cover only) |

Applicable | Applicable | Applicable |

| Section A2 – Enhanced Medical and Related Expenses & Personal Accident Benefit for Insured Person Aged under 18 with Parent or Legal Guardian Insured in the Same Policy Upgrade Section 1 – Medical and Related Expenses to 100% and Accidental Death under Section 3 – Personal Accident to 50% of the maximum limit per insured person aged 18 to 70, by paying adult’s premium |

Not applicable | Applicable (refer to Sections 1 and 3) | Applicable (refer to Sections 1 and 3) |

| Section A3 – Enhanced Personal Accident Benefit Enhanced personal accident benefits with compensation paid according to over 18 severity levels of permanent disablement, by paying 20% additional premium |

Not applicable | Applicable | Applicable |

| Section B – Enhanced Cruise Benefit | |||

| (1) Failure to start cruise due to public common carrier delay for 6 hours or more i) Rejoining the cruise at the next port; OR |

10,000 | 10,000 | 10,000 |

| ii) Cancellation of the cruise | 50,000 | 50,000 | 50,000 |

| (2) Curtailment of cruise | 50,000 | 50,000 | 50,000 |

| (3) Shore excursion cancellation allowance | 5,000 (2,000 per excursion) | 5,000 (2,000 per excursion) | 5,000 (2,000 per excursion) |

| (4) Shore excursion curtailment allowance | 1,000 | 1,000 | 1,000 |

| (5) Failure to board cruise ship | 10,000 | 10,000 | 10,000 |

| (6) Cruise hijack or kidnap | 20,000 (2,000 per day) | 20,000 (2,000 per day) | 20,000 (2,000 per day) |

| (7) Satellite phone call on cruise | 3,000 | 3,000 | 3,000 |

Frequently Asked Questions

What types of medical expenses are covered under SmartTraveller Plus?

The plan covers a wide range of medical expenses incurred overseas due to accidents or illness, up to HKD2,000,000 (Platinum Plan, ages 18-70). This includes inpatient and outpatient care, Chinese bone-setting, acupuncture, physiotherapy, chiropractic treatment, and follow-up treatment in Hong Kong within 3 months of return. For annual cover, you also get free virtual medical consultations and medicine delivery in select locations like Japan and Singapore.

Does the plan cover trip cancellations or delays?

Yes, SmartTraveller Plus covers trip cancellations due to events like adverse weather, red or black outbound travel alerts, strikes, terrorism, or serious injury/illness, up to HKD100,000 (Platinum Plan). For travel delays of 6+ hours due to weather, strikes, or airport closures, you’re covered for up to HKD3,000 for accommodation or missed event expenses, and up to HKD10,000 for overbooking issues.

Is my family covered under this plan?

For single journeys, children (30 days to under 18 years) traveling with their parents are covered for free under the same policy, though with lower benefit limits for medical expenses and personal accidents. For annual cover, you can insure parents and all children under one policy for a single premium, simplifying management and reducing costs. An upgrade option is available for enhanced coverage for children.

What activities are covered under amateur sports?

The plan covers accidental death or injury during amateur sports like snorkeling, scuba diving, bungee jumping, skiing, snowboarding, hot-air balloon rides, and amateur marathons. However, professional sports, racing (except on foot), and triathlons are excluded.

Are there any exclusions I should be aware of?

Key exclusions include pre-existing medical conditions, professional sports, racing (except on foot), war, riots, self-inflicted injuries, pregnancy-related complications, and travel against medical advice. Claims related to red or black outbound travel alerts for pandemics (except COVID-19) or vaccine-preventable diseases (if vaccination was mandatory and not obtained) are also excluded. Full details are in the policy wordings at www.axa.com.hk.

What support is available if I face issues overseas?

AXA provides a 24-hour overseas emergency hotline for hospital network referrals and emergency assistance. The Emma by AXA app offers access to policy details, claims submission (processed within 7 working days), and real-time support via the Emma chatbot. You’re also covered for interpreter services (up to HKD10,000) for communication with police or authorities.

Are there any destinations excluded from SmartTraveller Plus coverage?

No specific destinations are explicitly excluded by name in the policy. However, coverage is limited or excluded for destinations under red or black outbound travel alerts issued by the Hong Kong SAR Government (except for pandemics), or those affected by war, riots, or military conflicts. Check travel alerts at www.sb.gov.hk/eng/ota before your trip.

What happens if I travel to a destination with a war or riot exclusion?

Claims arising from war, invasion, riots, or military conflicts are excluded. If you travel to a destination experiencing these conditions, any losses or incidents related to such events, like cancellations or injuries, will not be covered. Contact AXA to confirm coverage for high-risk destinations.

Important Information

Major Exclusions

Some exclusions under this policy include:

- Racing (except on foot)

- Aviation other than as a fare-paying passenger

- Pre-existing medical conditions

- Professional sports or manual labor

- War, riots, or self-inflicted injuries

- Travel against medical advice or for medical treatment

- Pregnancy and related complications

For a complete list, refer to the policy wordings at www.axa.com.hk.

Limited-Time Offer: 35% Discount!

Take advantage of this exclusive 35% discount on the AXA SmartTraveller Plus plan. Protect your travels and save today!