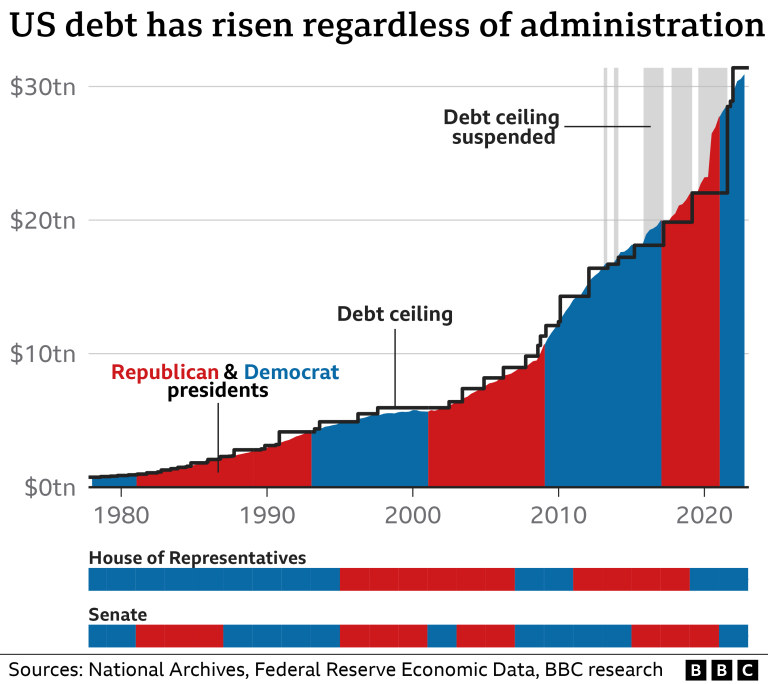

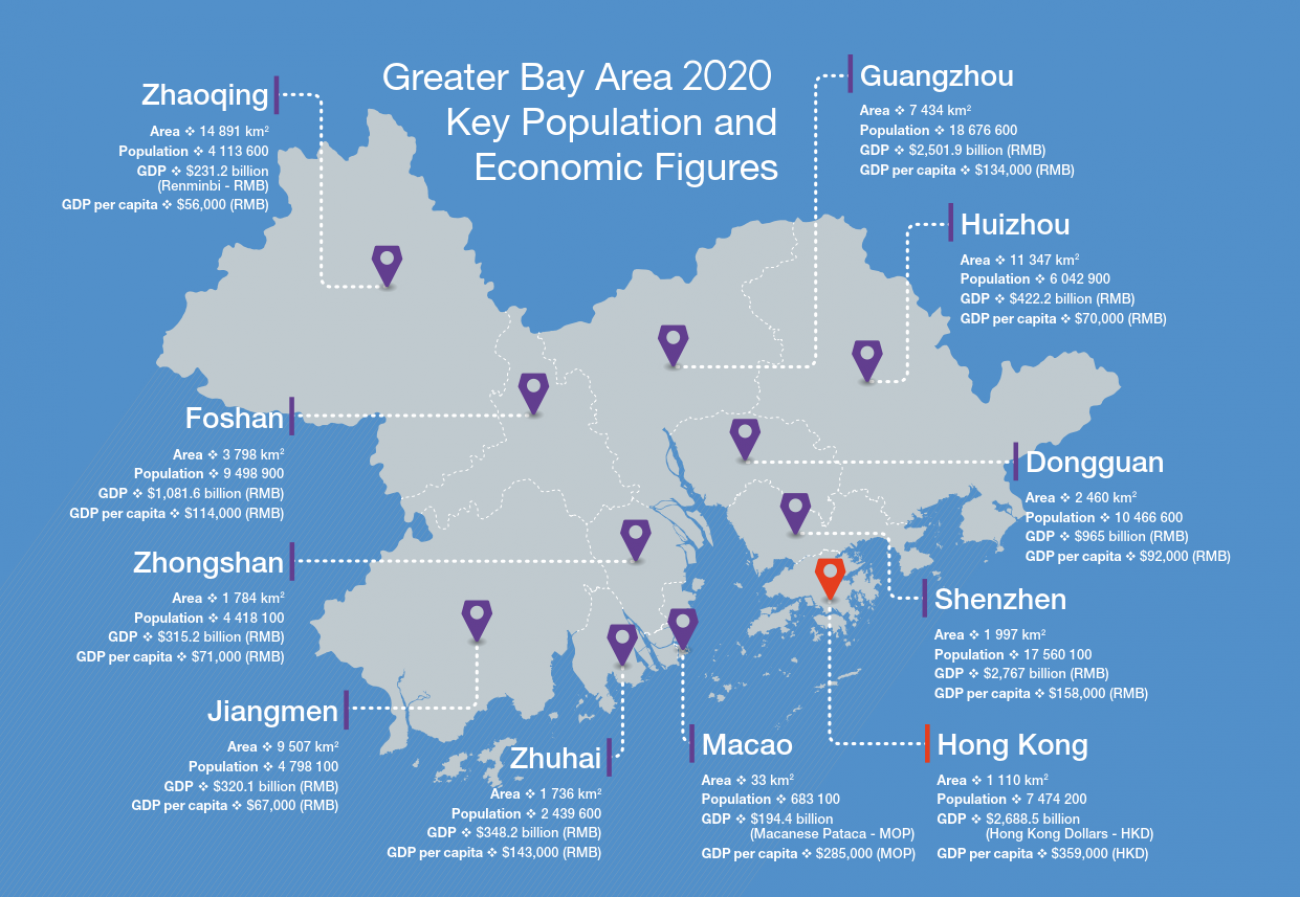

The Guangdong-Hong Kong-Macao Greater Bay Area (GBA) is a key driver of China’s economic growth, with a population of over 86 million and a combined GDP of RMB 12.6 trillion, accounting for 11% of the national GDP. This region offers diverse investment opportunities, but understanding the risks and insurance landscape is crucial for success.

Investment Opportunities in the GBA

The GBA is a hub for technology, finance, real estate, manufacturing, and logistics. Shenzhen and Hong Kong stand out as financial centers, attracting global investors. Tech startups and infrastructure projects thrive here, supported by government initiatives to boost foreign investment. Cross-border investments are particularly appealing, as the GBA’s unique position connects Mainland China with international markets. For example, the region’s focus on innovation and technology has led to the rise of successful ventures in AI, fintech, and green energy.

Insurance and Risk Management in the GBA

Insurance penetration in the GBA varies significantly. While Guangzhou, Shenzhen, and Hong Kong have higher rates, other cities in the region report less than 10% penetration. A Deloitte China and BOC Life survey found that 80% of GBA customers have never purchased insurance from Hong Kong or Macao, but they show strong interest in cross-boundary products like critical illness coverage (64%) and medical insurance (63%). Lack of familiarity with insurance products and regulations is a major barrier, with 60% of respondents citing this as a reason for not subscribing.

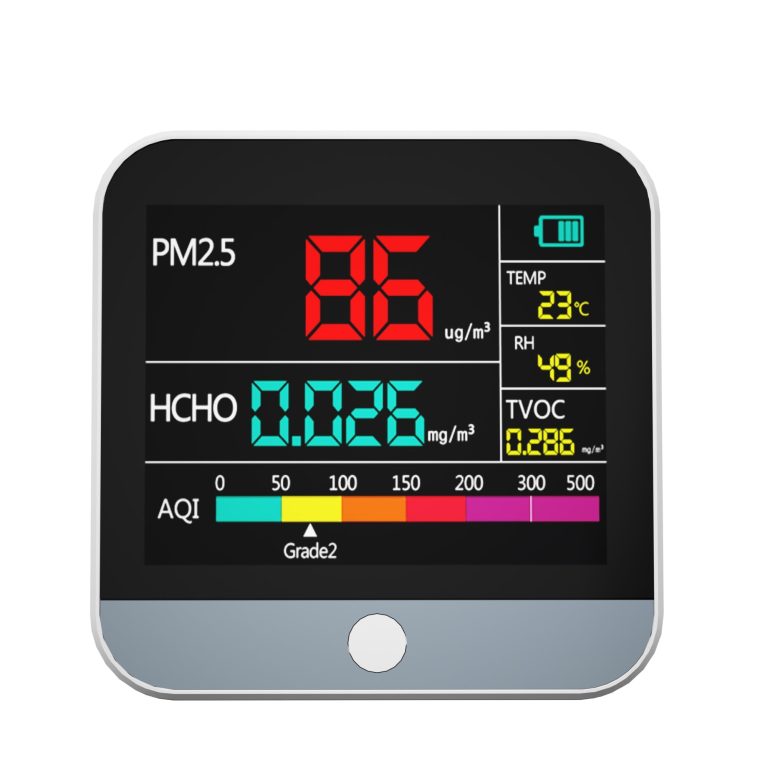

Hong Kong-based insurers are highly trusted, with 54% of respondents preferring them for cross-boundary insurance due to their confidence and service quality. Health apps are also gaining traction, with 57% of respondents using them for health monitoring and 23% planning to do so, often motivated by rewards offered by these apps.

Understanding the Risks in the GBA

Investing in the GBA comes with risks, including regulatory changes, economic fluctuations, and cross-border challenges. Navigating different regulatory environments between Mainland China, Hong Kong, and Macao requires careful due diligence. Rapid urbanization and development also pose risks, such as market saturation and environmental concerns. Insurance plays a vital role in mitigating these risks, protecting investments, and ensuring business continuity.

Business Protection and Insurance Strategies

Business protection is essential in the GBA, given its dynamic market. Liability insurance, property insurance, and other products safeguard against financial losses. Choosing reputable insurers, especially those based in Hong Kong, ensures reliable coverage. Regular policy reviews and updates are necessary to adapt to changing market conditions. Successful strategies often involve comprehensive risk management plans tailored to the GBA’s unique environment.

The Role of Technology in Insurance and Risk Management

Technology is transforming the insurance industry in the GBA. Health apps, digital insurance platforms, and blockchain technology improve risk assessment and underwriting processes. Over 57% of survey respondents use health apps, and 23% plan to adopt them, highlighting the growing interest in tech-driven solutions. These innovations enhance risk management and offer new opportunities for insurance providers to meet customer needs.

By leveraging the GBA’s investment potential and addressing its risks through robust insurance and risk management strategies, investors can unlock significant opportunities in this thriving region.