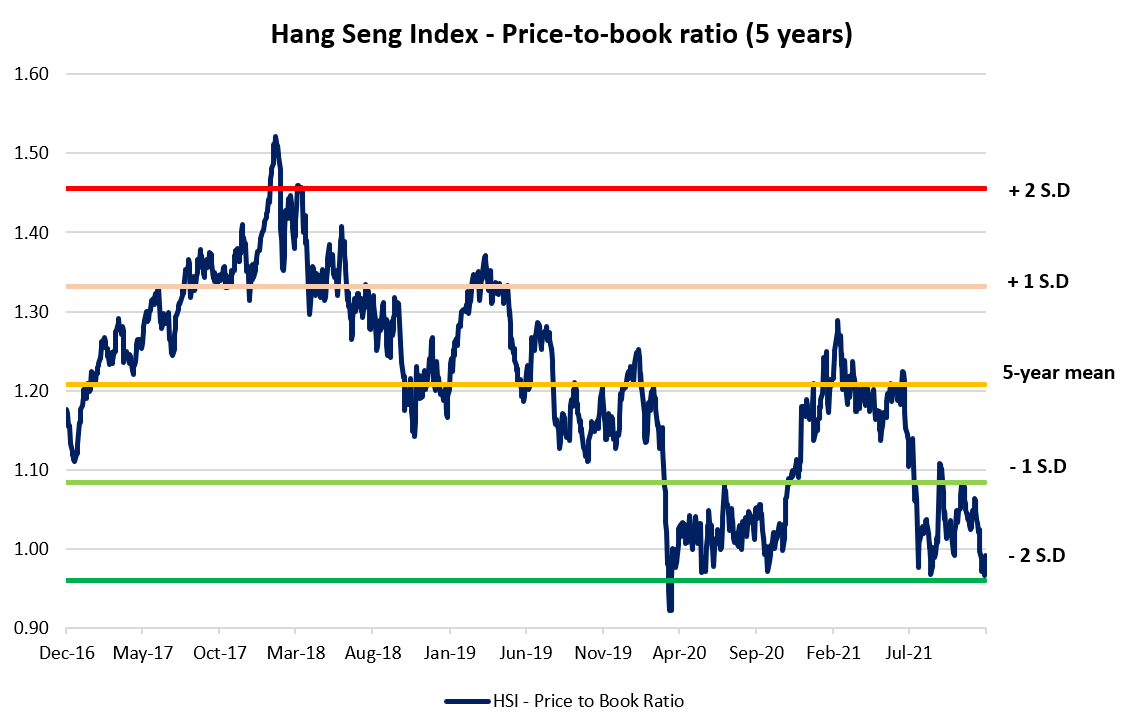

Investors in Hong Kong experienced a turbulent start to the week as stock markets took a significant hit on Monday, reflecting the ongoing complexities of US-China trade relations. The Hang Seng Index, a critical barometer of the Hong Kong financial market, plummeted 656 points—a steep 2.5 percent decline that marked the most substantial drop in four months.

The market’s opening painted a clear picture of investor unease, with the index settling at 25,634 points. Despite the dramatic downturn, trading remained active, with early session turnover reaching HK$7.8 billion. This robust trading volume suggests that while investors were concerned, they were far from paralyzed.

The ripple effects of the market decline extended beyond the primary index. The China Enterprises Index, which tracks Chinese companies listed in Hong Kong, also experienced a notable 2.4 percent drop, falling to 9,134 points. Similarly, the Hang Seng Tech Index—representing technology firms—mirrored this trend, declining by 2.4 percent to 6,107.

These synchronized declines across different market segments underscore the widespread impact of escalating trade tensions between the United States and China. While the specific details of the renewed tensions were not elaborated in the report, such geopolitical friction typically involves complex negotiations around tariffs, trade barriers, and regulatory disagreements that can significantly destabilize market confidence.

The market’s sensitivity to international relations was particularly evident in this instance. Investors demonstrated a pronounced risk-averse approach, quickly responding to the geopolitical undercurrents that threaten economic stability. This reaction highlights the intricate interconnectedness of global financial markets and how political dynamics can instantaneously influence investment strategies.

Notably, this market update emerged from the “Business & Innovation” section, emphasizing the economic implications of geopolitical events on regional financial hubs like Hong Kong. The reporting, attributed to a staff reporter associated with HKEX and Singtao, provides a credible and localized perspective on these market movements.

The day’s events serve as a stark reminder of the delicate balance in international trade relations. Each diplomatic interaction, each policy statement, and each regulatory shift can trigger immediate and significant market responses. For Hong Kong, a city that serves as a critical financial gateway between China and global markets, such fluctuations are particularly consequential.

Investors and market watchers will likely continue monitoring the situation closely, analyzing every nuance of US-China interactions for potential market implications. The Monday market performance demonstrates that in today’s interconnected global economy, geopolitical tensions are not just political narratives—they are real economic forces with immediate and tangible consequences.

As the week progresses, the financial community will be keenly observing how these trade tensions evolve and what further impact they might have on market dynamics. The Hong Kong stock market’s performance offers a microcosmic view of broader global economic challenges, reflecting the complex interplay between international relations and financial markets.