Introduction: A Resurgence in the Pearl of the Orient’s Capital Market

Hong Kong’s IPO market is making a strong comeback in the first quarter of 2025. This year, the city saw a big jump in both the number of IPOs and the money raised compared to the same time in 2024. Something exciting is happening in this major financial hub, and there are reasons behind this growth that we need to look at closely.

The Numbers Don’t Lie: A Deep Dive into the Q1 2025 Performance

Let’s break down the facts. In Q1 2025, Hong Kong recorded 15 IPOs, which is 25% more than the 12 IPOs in Q1 2024. Even more impressive, the money raised in 2025 reached HKD18.2 billion, a huge 287% increase from the HKD4.7 billion raised in 2024. This shows not just more companies going public, but also much bigger amounts of money coming in. Both the number of deals and the cash raised point to a stronger market this year.

Beyond the Headlines: Unpacking the Drivers of the 287% Proceeds Jump

Why did the money raised grow so much more than the number of IPOs? One reason could be that the deals in 2025 are larger. Some companies might be raising more money per IPO compared to last year. Another possibility is that bigger, more valuable companies are choosing to list now. It’s also possible that certain industries needing a lot of cash are driving this trend. We need to dig deeper to understand what’s behind this massive jump in funds.

Sector Spotlight: Which Industries are Leading the Charge?

Certain industries likely play a big role in this IPO boom. While we don’t have exact details yet, sectors like technology, healthcare, or finance often lead in Hong Kong’s market. These areas tend to attract a lot of investor interest and need large amounts of money. Finding out which industries had the most IPOs or raised the most cash will help us see where the action is. We’ll also look for standout companies that made a big splash in Q1 2025.

Comparing Apples to Oranges (or IPOs to IPOs): A Closer Look at the Q1 2024 Landscape

To understand the 2025 surge, let’s look back at Q1 2024. Last year, only 12 companies went public, and they raised much less money—HKD4.7 billion. The average deal size was smaller, and the market mood might not have been as positive. Maybe fewer big companies listed, or investors were more cautious. Comparing the two years helps us see why 2025 is off to such a strong start.

The ‘DU AP China’ Factor: Exploring Potential Mainland China Influence

Hong Kong’s connection to Mainland China often shapes its IPO market. If “DU AP China” refers to a policy or group tied to China, it might be helping this recovery. For example, more Chinese companies could be listing in Hong Kong, or new rules might make it easier for them to do so. Investor interest from the mainland could also be boosting the numbers. We need to check how China’s influence is playing a part in this growth.

Historical Context: Where Does Q1 2025 Fit in Hong Kong’s IPO Journey?

Hong Kong’s IPO market has seen ups and downs over the years. There have been times of huge growth and other times when activity slowed. Looking at past trends helps us see if Q1 2025 is a record-breaking moment or just a return to normal. How does this year’s start compare to the best or worst periods in Hong Kong’s history? This context shows us if the current boom is truly special.

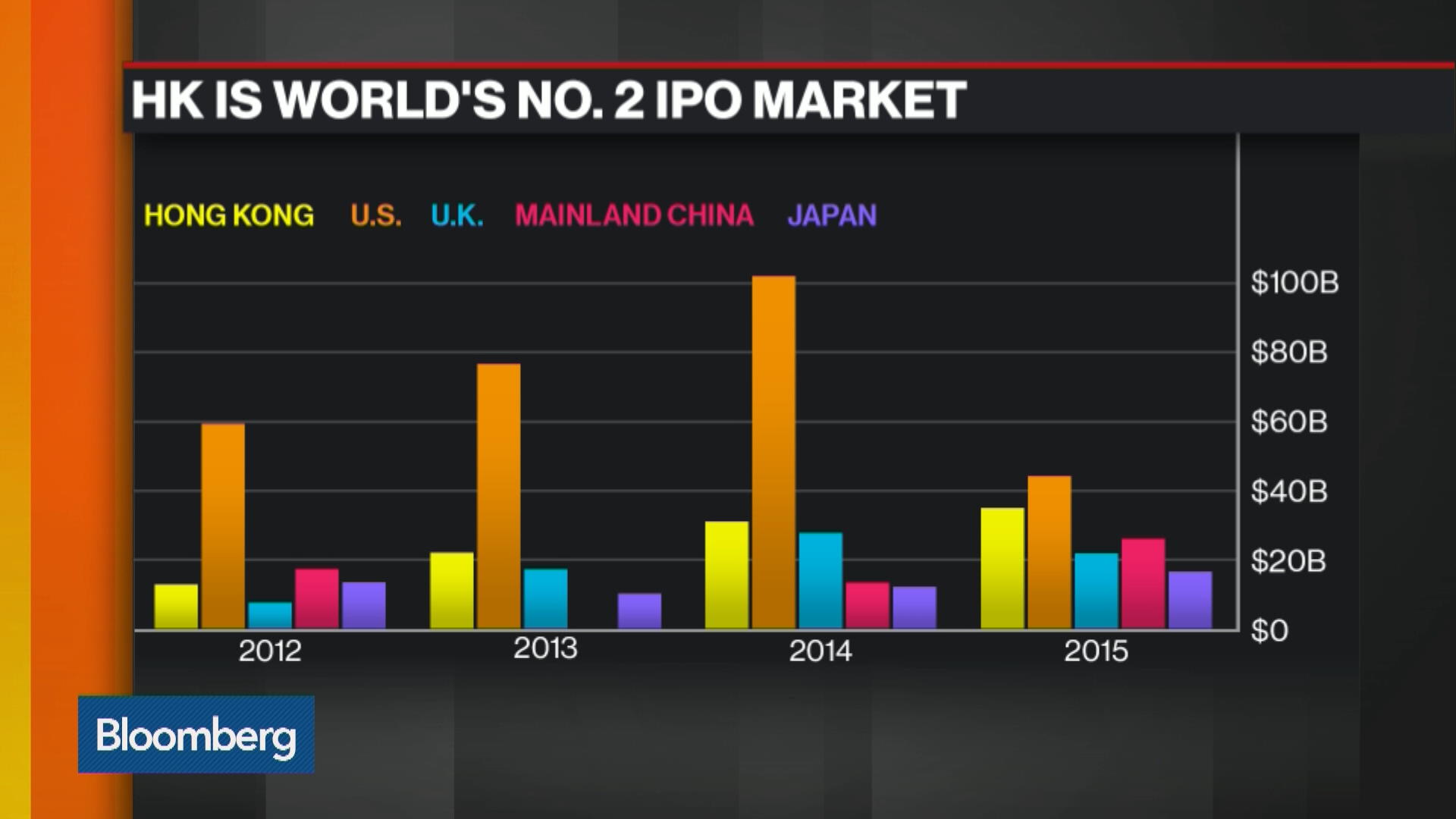

World Impact: Hong Kong’s Resurgence on the Global Stage

Hong Kong’s strong IPO market in 2025 sends a message to the world. As a top financial center, this growth can attract more international companies to list here. It also draws in global investors looking for good opportunities. If Hong Kong keeps up this momentum, it can strengthen its place among other big markets like New York or London. This rebound matters not just locally, but globally.

Looking Ahead: What’s Next for the Hong Kong IPO Market?

What can we expect for the rest of 2025? The future looks bright, but there are challenges to watch. Global economic issues, like rising costs or trade problems, could slow things down. Changes in rules for listing might also affect the market. On the positive side, if more companies are planning IPOs, the pipeline could keep growing. We’ll keep an eye on these factors to predict if this strong start will last.

Conclusion: A Promising Start to 2025 for Hong Kong’s Capital Market

Hong Kong’s IPO market kicked off 2025 with impressive results. With 15 IPOs and HKD18.2 billion raised, the city shows a big improvement over last year. This growth highlights Hong Kong’s strength as a financial hub and sets a hopeful tone for the year. As we move forward, this rebound could bring even more opportunities for companies and investors alike.