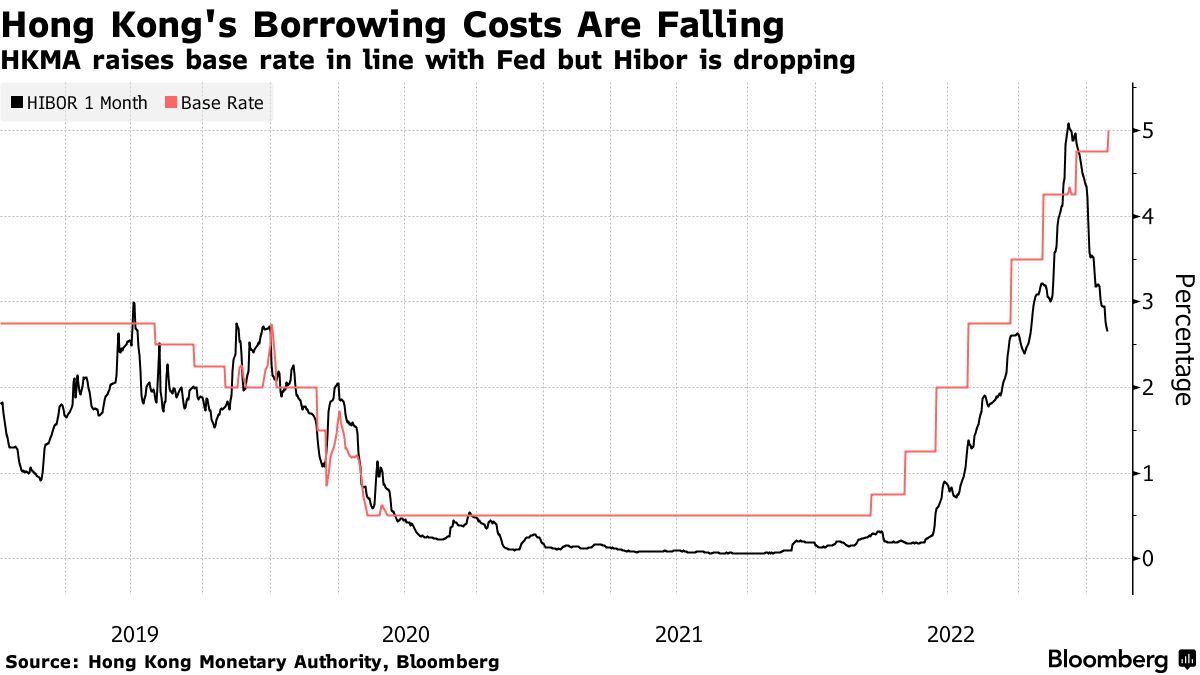

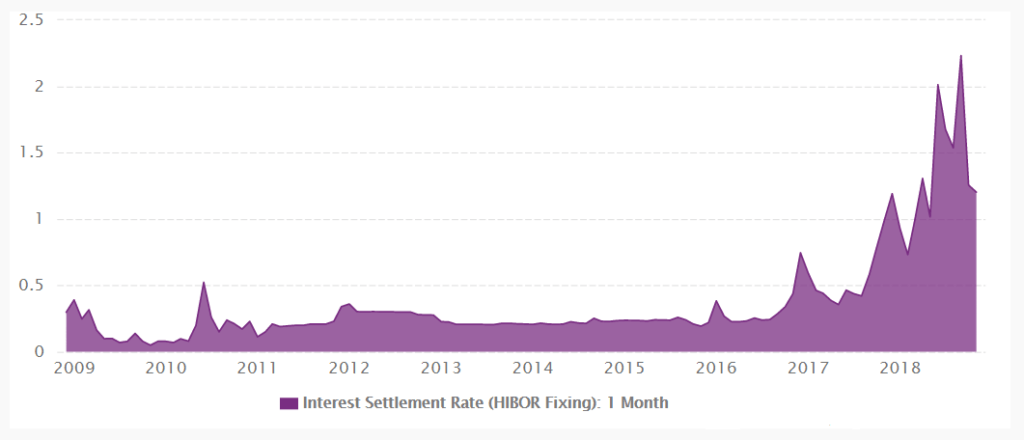

Recent developments in Hong Kong’s financial markets are signaling important shifts that could impact everything from mortgage rates to investment returns. The Hong Kong Interbank Offered Rate (Hibor) has begun climbing across multiple timeframes, reflecting complex economic dynamics that savvy financial consumers should understand.

At the heart of this movement is the Hong Kong dollar’s position against the US dollar. Currently hovering at the weak end of its trading band, the currency’s performance is prompting the Hong Kong Monetary Authority (HKMA) to allow interest rates to adjust. This isn’t just technical financial maneuvering—it has real-world implications for individuals and businesses.

Let’s break down what’s actually happening. The one-month Hibor, which directly influences mortgage rates, has risen to 0.74714 percent—a nearly three-week high representing over a 6 basis point increase. Simultaneously, other Hibor rates are also climbing: the overnight rate is now at 0.02 percent, the one-week rate has reached 0.27536 percent (its highest in over a month), and the one-year rate is approaching 3 percent.

For homeowners and potential property buyers, these shifts matter significantly. Higher Hibor rates typically translate to increased borrowing costs, which means more expensive mortgages. Someone considering a home loan might see slightly higher monthly payments, making it crucial to understand how these financial undercurrents could affect personal budgeting.

Investors and those with investment-linked insurance products should also pay attention. Products like Investment-Linked Insurance Schemes (ILAS) that invest in fixed-income assets or money market funds could see performance changes. Rising interest rates might generate higher returns, but they can simultaneously decrease the value of certain long-duration bond investments.

The broader economic context is equally important. These Hibor movements reflect more than just numbers—they’re indicators of monetary policy, market expectations, and potential economic trends. Insurance companies and financial institutions continuously monitor such signals to assess market risks, adjust investment strategies, and price their products appropriately.

Businesses aren’t immune to these changes either. Companies relying on interbank lending will face higher borrowing costs, which could impact operational expenses and financial planning. This might influence everything from business insurance premiums to overall financial stability.

For individuals with universal life or whole life insurance policies, these interest rate trends could eventually influence the interest credited to policy cash values. While not an immediate or direct correlation, sustained higher interbank rates might enable insurers to offer more attractive crediting rates over time.

The key takeaway is understanding that financial markets are interconnected ecosystems. A seemingly technical adjustment like a Hibor rate increase ripples through multiple sectors, affecting mortgages, investments, insurance products, and broader economic conditions.

Staying informed doesn’t mean becoming a financial expert overnight. It means paying attention to these underlying trends, understanding how they might impact personal financial decisions, and being prepared to adapt. Whether you’re a homeowner, investor, or simply someone interested in understanding the financial landscape, recognizing these dynamics can help you make more informed choices.

As Hong Kong’s financial markets continue to evolve, keeping an eye on indicators like Hibor can provide valuable insights into the economic environment and potential opportunities or challenges ahead.