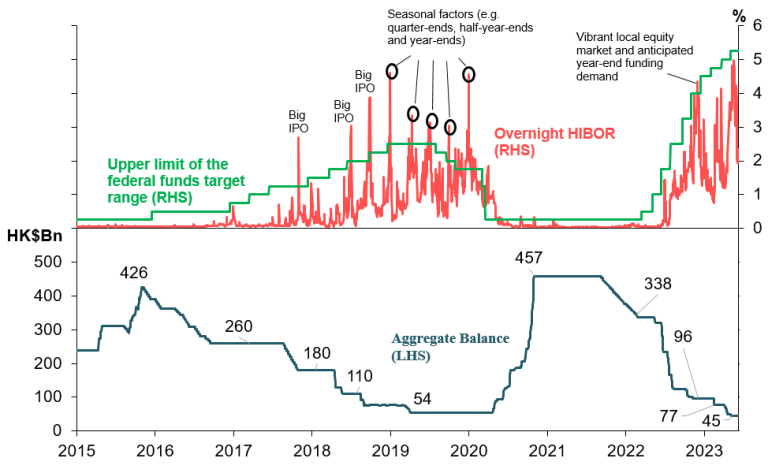

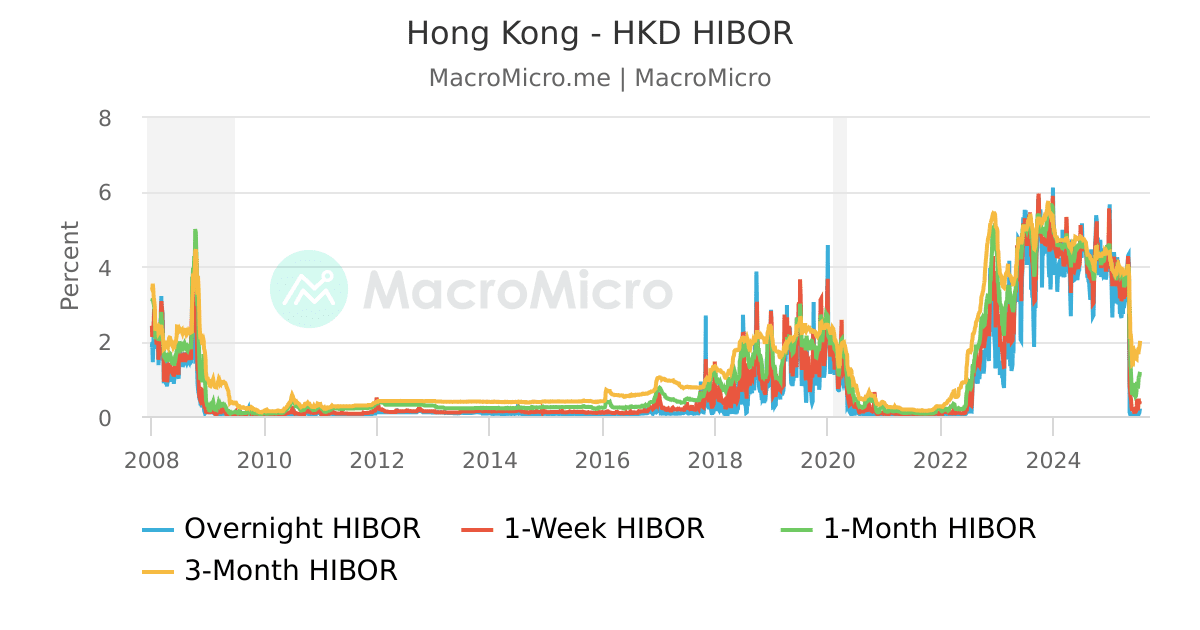

Hong Kong’s Interbank Offered Rates (Hibor) are experiencing notable shifts that could impact financial markets and individual borrowers. On Monday, July 28, 2025, the overnight Hibor reached a significant three-month high, signaling important changes in the city’s financial landscape.

The overnight rate climbed 30 basis points to 0.569 percent, marking its third consecutive day of increase. This movement isn’t isolated—shorter-term rates are also showing dynamic changes. The one-week Hibor jumped between 26 to 35 basis points, settling at 0.7991 percent, while the two-week Hibor experienced a similar upward trajectory, reaching 0.8597 percent.

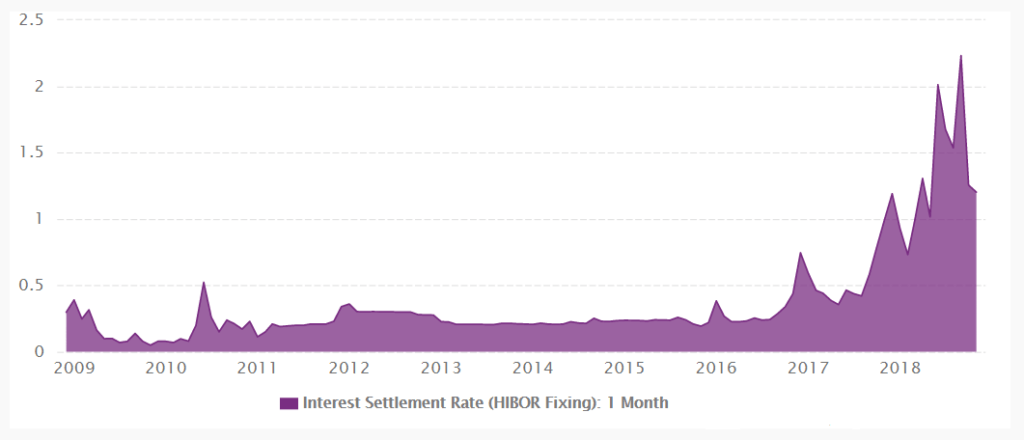

For Hong Kong residents and financial professionals, the one-month Hibor holds particular significance. This benchmark, which plays a crucial role in pricing residential mortgage loans, rose nearly 11 basis points to approximately 1.023 percent. This increase represents its highest level in a week and a return above the psychologically important 1 percent threshold.

Interestingly, not all rates are moving in the same direction. The three-month Hibor tells a different story, continuing its downward trend for the seventh consecutive trading day. Dropping to a one-month low of 1.703 percent, this rate stands in contrast to the rising shorter-term rates, highlighting the complex dynamics within Hong Kong’s interbank lending market.

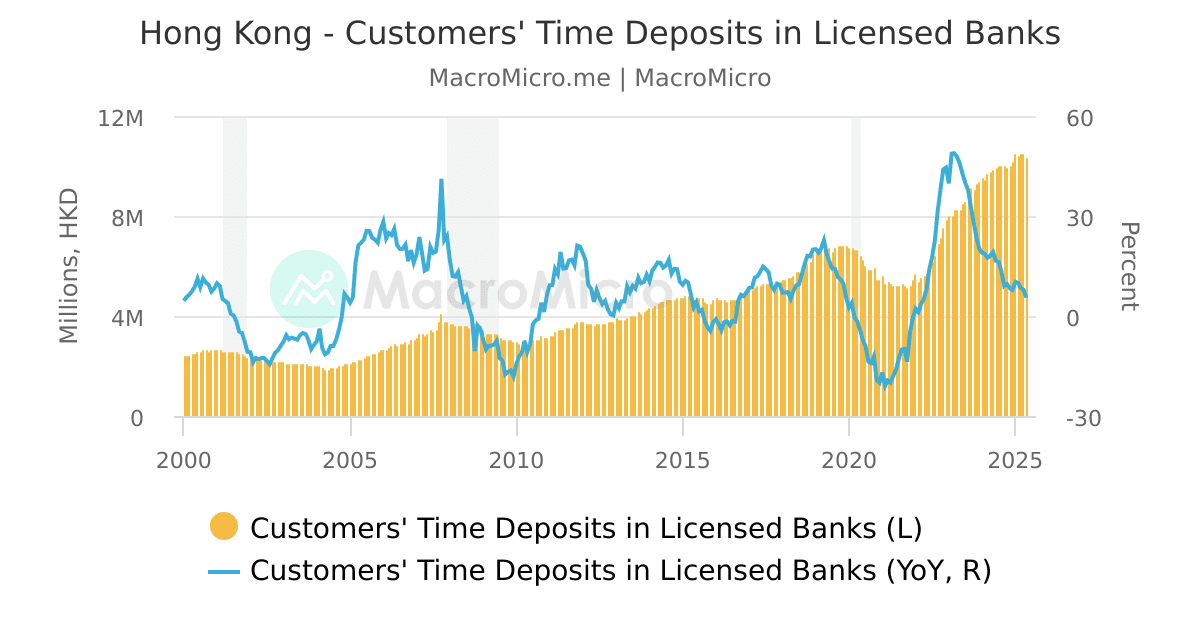

These fluctuations aren’t merely abstract numbers—they have real-world implications. Banks, businesses, and individual borrowers all feel the ripple effects of these rate changes. Short-term rate increases might indicate tightening liquidity or increased demand for immediate funds. The simultaneous decline in longer-term rates could suggest more nuanced expectations about future financial conditions.

For everyday consumers, these shifts can translate into tangible financial experiences. Mortgage holders might notice slight changes in their loan pricing, while businesses could see subtle adjustments in borrowing costs. The interplay between overnight, short-term, and longer-term rates creates a complex financial ecosystem that reflects broader economic trends.

Understanding Hibor requires recognizing its role as a key indicator of financial health. These rates represent the interest rates at which banks lend to each other in the Hong Kong interbank market. When rates move, they provide insights into liquidity, banking sector confidence, and potential economic pressures.

The current pattern—rising shorter-term rates alongside declining longer-term rates—invites careful observation. Financial analysts and economists will be watching closely to understand whether this represents a temporary fluctuation or signals deeper market transformations.

For individuals and businesses in Hong Kong, staying informed about these rate movements can help in making more strategic financial decisions. Whether you’re considering a mortgage, planning business investments, or simply interested in economic trends, tracking Hibor provides valuable insights into the city’s financial pulse.

As financial markets continue to evolve, these nuanced rate changes remind us that economic landscapes are never static. Each basis point shift tells a story of supply, demand, confidence, and complex interconnected financial mechanisms that shape our economic reality.