The Hong Kong banking system is experiencing a nuanced financial moment, with recent data from the Hong Kong Monetary Authority revealing subtle but significant shifts in loan performance and bank profitability. At the heart of these developments is a modest yet noteworthy increase in bad and doubtful loans, which have climbed to nearly 2 percent in the first quarter of 2025.

Specifically, the classified loan ratio—a critical metric tracking potentially problematic loans—rose by 0.02 percentage points, reaching 1.98 percent. While this increment might seem small, it signals an emerging trend that financial analysts and investors are carefully monitoring. Interestingly, mainland-related lending showed a contrasting pattern, with its classified loan ratio actually decreasing by 0.1 percentage point to 2.27 percent.

Another layer of complexity emerges when examining “special mention loans,” which are financial instruments extended to borrowers experiencing financial difficulties. These loans expanded to represent 2.25 percent of total lending by the end of March, marking a 0.1 percentage point increase. Such metrics provide insight into the underlying economic pressures facing borrowers and the banking sector’s risk management strategies.

Despite these challenges, the banking sector demonstrates remarkable resilience. Retail banks reported an impressive 15.8 percent year-on-year increase in aggregate pre-tax operating profit during the first quarter. This growth wasn’t uniform but stemmed from strategic income diversification. Foreign exchange and derivatives operations, along with fees and commissions, played pivotal roles in driving this financial performance.

However, the profit narrative isn’t without nuance. The positive momentum was partially tempered by a decline in income from trading investments, highlighting the dynamic and sometimes unpredictable nature of financial markets. This balanced picture suggests banks are navigating a complex economic environment with strategic adaptability.

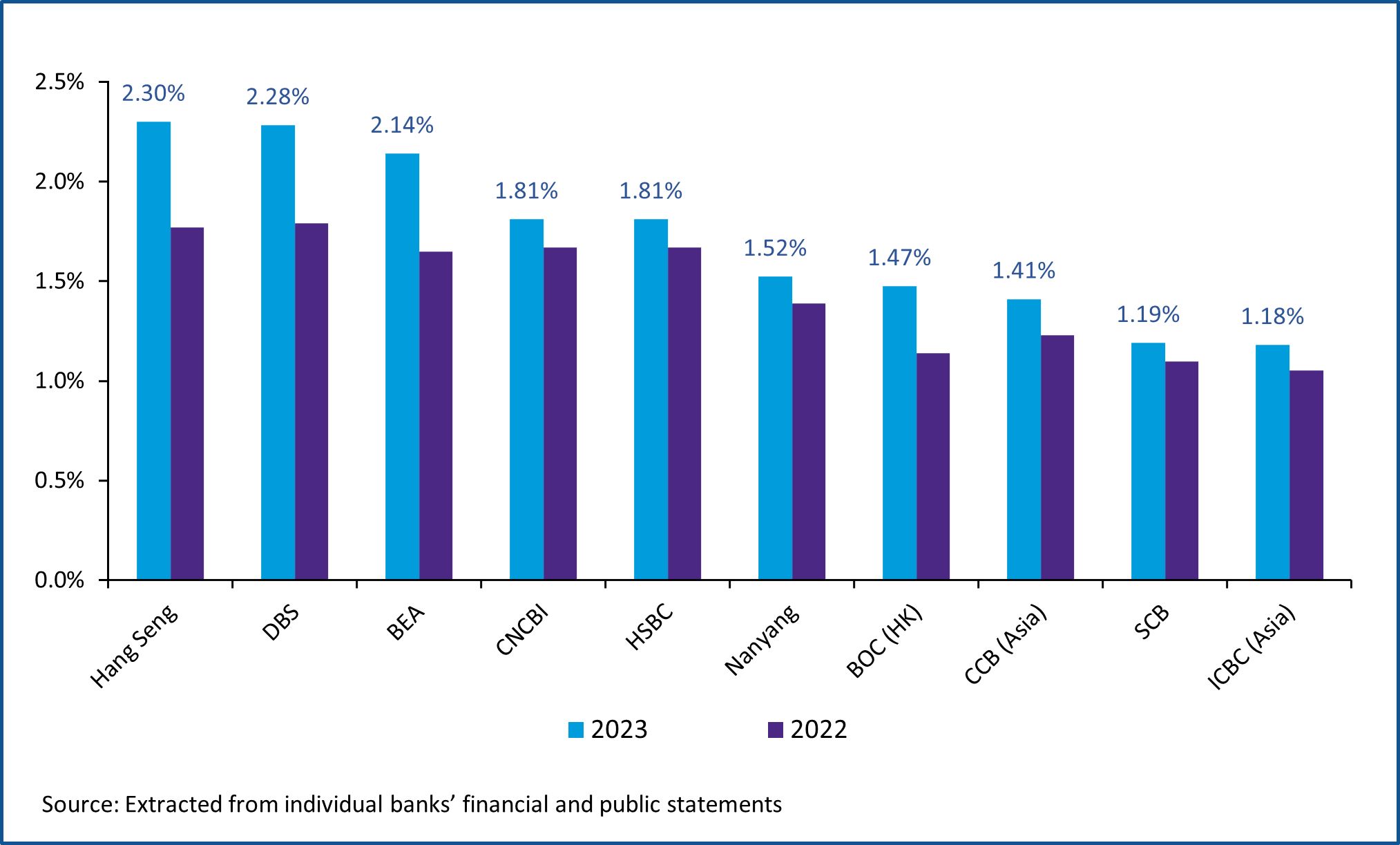

A critical indicator of banking health—the net interest margin—experienced a slight contraction, narrowing by 2 basis points to 1.51 percent during the quarter. While modest, such shifts can reflect broader economic conditions, including interest rate environments and competitive lending landscapes.

These developments underscore the intricate balance banks must maintain between risk management and profitability. The marginal increases in bad loans and special mention loans don’t necessarily signal alarm but rather indicate a need for continued vigilance and proactive financial strategies.

For investors, economists, and banking professionals, these figures offer a snapshot of Hong Kong’s financial ecosystem—a system demonstrating both vulnerability and strength. The ability to generate substantial operating profits while managing rising loan risks speaks to the sophistication of the city’s banking sector.

As global economic dynamics continue to evolve, Hong Kong’s banks appear positioned to adapt, leveraging diversified income streams and maintaining a measured approach to risk. The first quarter of 2025 reveals a banking landscape that is neither in crisis nor complacent, but actively responding to changing economic currents.