Gold Breaks Through $3,500: A Landmark Moment in Precious Metals

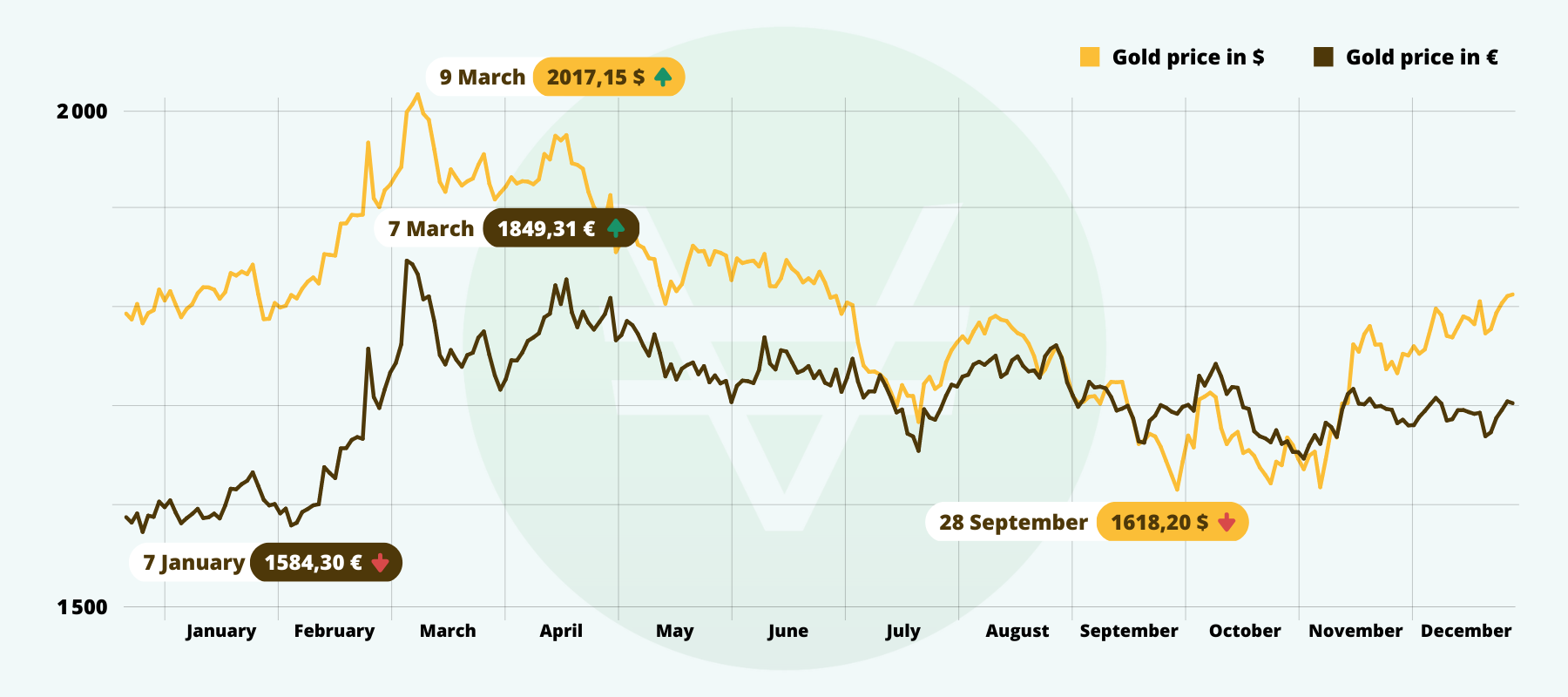

In a stunning market development, spot gold prices have shattered previous records, rocketing past the $3,500 mark to reach an unprecedented $3,508.73 per ounce during Asian trading on September 2. This milestone isn’t just a number—it’s a powerful signal of global economic uncertainty and shifting investment landscapes.

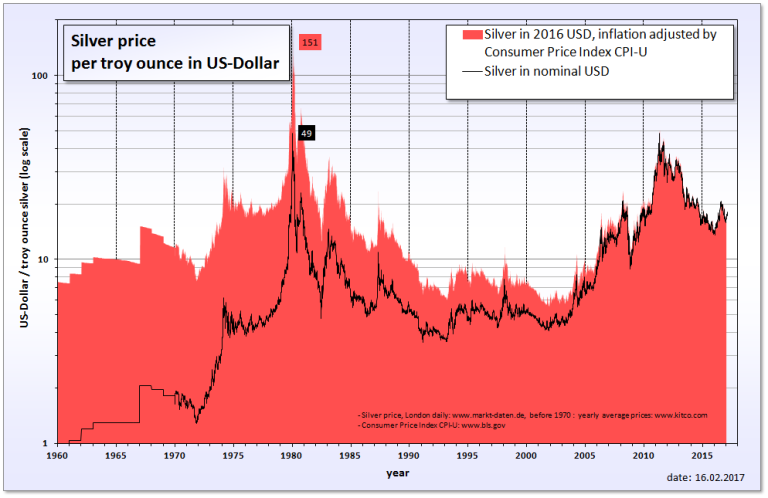

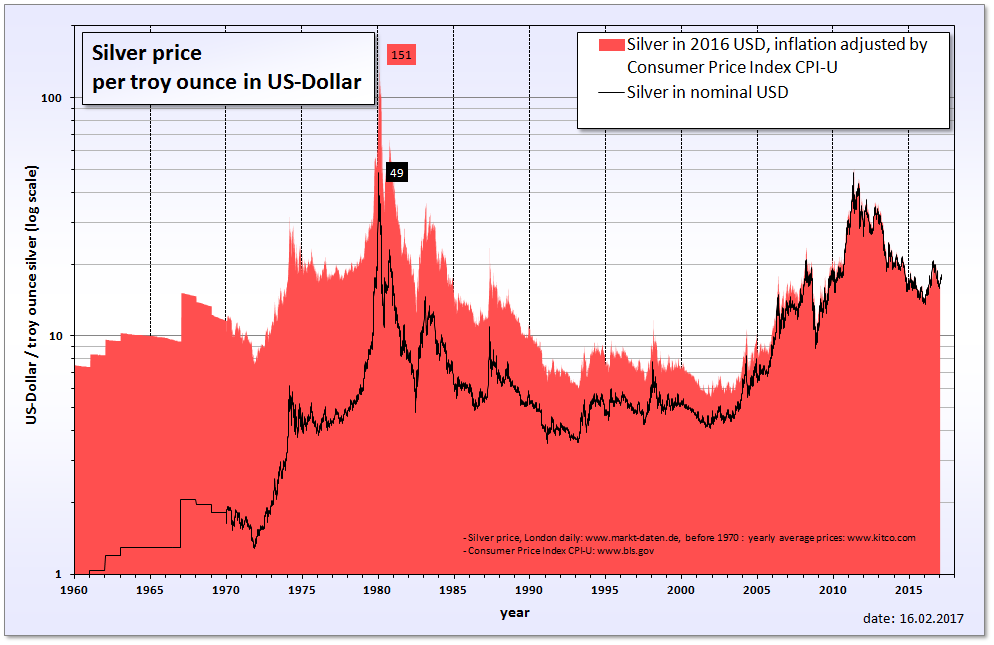

The surge represents more than just a momentary spike. Gold has climbed over 33% year-to-date, positioning itself as one of 2025’s top-performing commodities. But gold isn’t alone in its remarkable ascent. Silver has also made a dramatic comeback, breaking through $40 per ounce for the first time since 2011 and posting an impressive 40% increase this year.

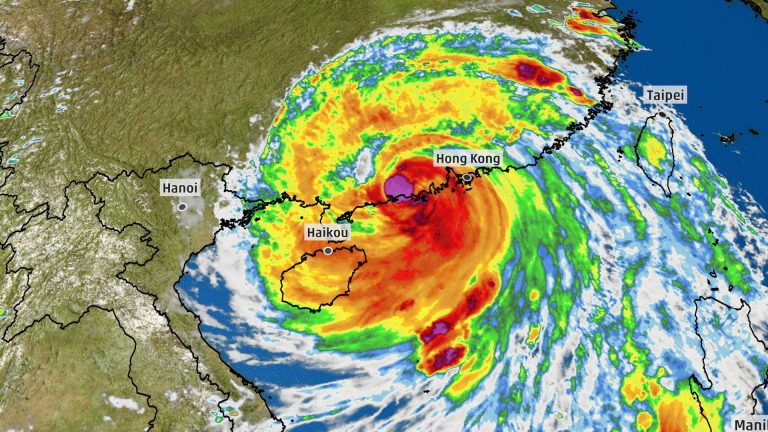

What’s driving these extraordinary price movements? A perfect storm of geopolitical tensions, economic uncertainties, and complex market dynamics are converging to push precious metals to new heights. The Federal Reserve’s potential policy shifts play a crucial role. With growing speculation about potential interest rate cuts, investors are increasingly viewing gold and silver as safe-haven assets.

Market experts like Helen Amos from BMO Capital Markets point to deeper underlying factors. Threats to institutional stability in the United States have naturally boosted gold’s appeal as a protective investment. Political pressures, including recent criticisms of the Federal Reserve and ongoing legal uncertainties around tariff policies, have further undermined confidence in traditional assets.

The silver market tells an equally compelling story. Beyond its status as a safe-haven asset, silver is gaining momentum through its critical role in clean energy technologies like solar panels. The market is heading toward its fifth consecutive year of supply deficits, with weakening dollar values boosting purchasing power in major consuming countries like China and India.

Investor behavior reflects these market dynamics. Gold ETF holdings recently experienced their largest increase since April, with expectations of continued net inflows. Silver ETF holdings have been expanding for seven consecutive months, depleting available inventories and driving lease rates to around 2%—significantly above normal levels.

Analysts like Tim Waterer from KCM Trade and Ole Hansen from Saxo Bank highlight additional contributing factors: persistent U.S. inflation, weak consumer sentiment, and expectations of interest rate cuts. The global bond market selloff has further redirected capital toward precious metals, reinforcing their attractiveness.

Intriguingly, the U.S. Geological Survey’s proposal to classify silver as a critical mineral could introduce additional market support, potentially influencing future pricing and trade dynamics.

Over the past three years, both gold and silver have more than doubled in price. This remarkable growth reflects escalating geopolitical risks, economic uncertainties, and global trade tensions that have transformed these metals from mere commodities to critical financial instruments.

The upcoming U.S. non-farm payroll report could provide further insights, potentially justifying anticipated rate cuts and supporting continued investment demand. Federal Reserve Chairman Powell’s recent cautious openness to policy adjustments has already heightened market anticipation.

For investors and market watchers, this moment represents more than a price milestone. It’s a nuanced reflection of global economic sentiment, institutional challenges, and the ongoing search for financial stability in an increasingly complex world.

As gold and silver continue to shine, their trajectory offers a fascinating lens into broader economic trends, reminding us that in times of uncertainty, some assets truly are timeless.