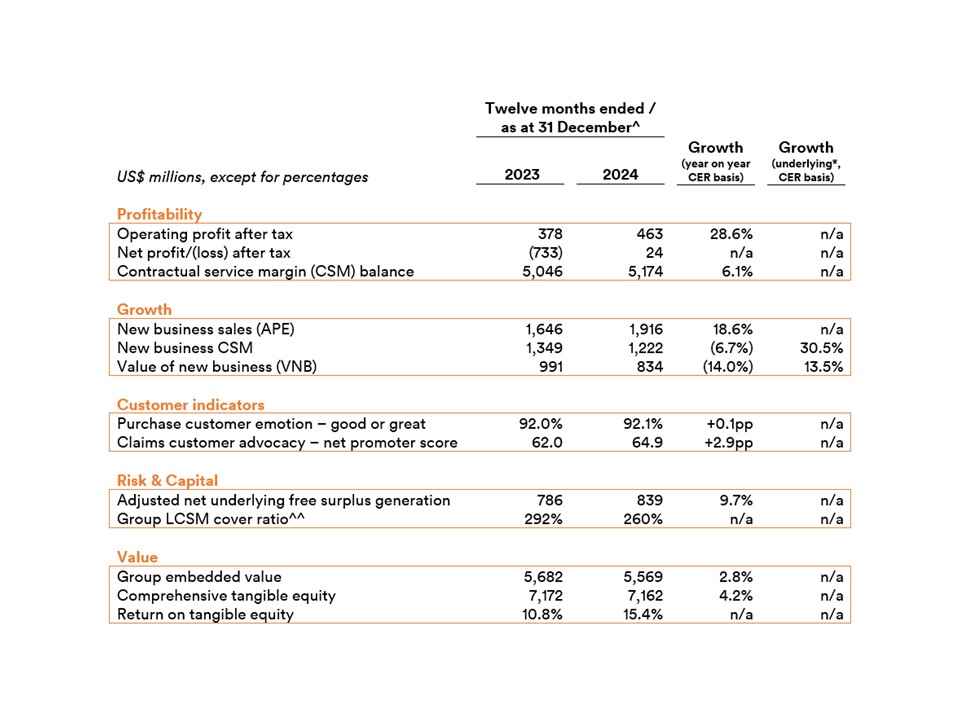

FWD Group, a prominent insurance company, is set to experience a promising financial trajectory in 2024, according to Fitch Ratings’ recent analysis. After reporting its first net profit of $10 million in 2024, the company is positioned for continued growth and improved profitability.

Despite currently experiencing a negative return on equity at -1.3%, the insurance group has several strategic factors driving its potential financial improvement. The anticipated growth stems from sustained new business expansion, enhanced investment returns, and a reduction in one-off expenses. Key markets in Hong Kong and Thailand are expected to be primary contributors to this positive momentum.

The company’s new business metrics demonstrate robust performance, with significant year-on-year increases in critical indicators. The Contractual Service Margin (CSM) has grown by 31%, while the Value of New Business (VNB) has increased by 14%. Core subsidiaries FWD Life HK and FWD Japan play a crucial role, collectively accounting for over 50% of the total weighted premium income.

A strategic reinsurance deal with Athene is also expected to contribute positively to profitability. The gradual release of margins from this 2023 arrangement will provide additional financial support. The group has also managed to decrease its risk asset ratio to 92%, which aligns favorably with its current rating profile.

The broader insurance landscape reveals interesting trends that contextualize FWD Group’s strategic positioning. Technological innovation is rapidly transforming the industry, with artificial intelligence (AI) playing an increasingly significant role in reshaping insurance operations. Companies are exploring embedded finance options, integrating insurance services into non-financial platforms to improve customer accessibility and engagement.

Emerging markets like Malaysia and Vietnam are experiencing digital transformation challenges, highlighting the complex journey of technological adaptation in the insurance sector. Meanwhile, global firms are exploring innovative risk management strategies, such as establishing captive insurance companies in financial hubs like Hong Kong.

Specific market developments underscore the dynamic nature of the insurance industry. For instance, some insurers are expanding product offerings—like Prudential’s introduction of pet coverage—while others are focusing on niche markets or strategic geographic segments. The Indonesian market has seen FWD Indonesia shifting its focus towards protection and unit-linked plans, reflecting adaptive business strategies.

Environmental considerations are also emerging as a significant factor. Indonesia’s launch of a marine trust to fund coral reef insurance demonstrates how insurers are exploring innovative approaches to address environmental risks and create new market opportunities.

Technological advancements are simultaneously presenting challenges and opportunities. Auto insurers are grappling with increased repair costs for high-tech vehicles, particularly electric vehicles, which are more frequently being declared total losses. Simultaneously, generative AI is being explored as a transformative tool for personalizing insurance services, though companies must carefully balance technological innovation with data privacy and security concerns.

For FWD Group, these industry dynamics present both challenges and opportunities. The company’s strategic focus on key markets, commitment to technological adaptation, and ability to manage risk effectively position it favorably in an evolving insurance landscape.

As the insurance sector continues to transform, FWD Group’s projected profit growth represents not just a financial milestone, but a testament to strategic resilience and forward-thinking management in a rapidly changing global market.