When Extreme Weather Meets Gig Work: Understanding Worker Protection and Insurance Risks

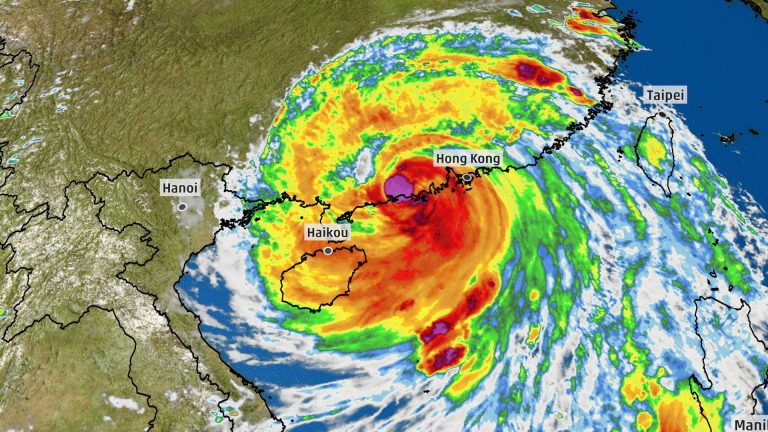

In August 2020, a routine food delivery shift for Khan Farooq Ahmed turned into a landmark legal case that exposes the complex risks facing gig economy workers during extreme weather conditions. As Typhoon Signal No. 8 loomed over Hong Kong, Ahmed, a 48-year-old Foodpanda motorcycle rider, continued working despite escalating dangers—a decision that would ultimately result in serious injuries and a groundbreaking court ruling.

The incident unfolded when Foodpanda’s parent company, Delivery Hero Food Hong Kong Limited, warned riders about the impending severe weather and suspended new orders. However, the platform’s operational model created a subtle yet significant pressure for riders to continue working. Ahmed accepted three additional delivery orders after receiving the warning, completing his final delivery at 10:58 AM, just after the typhoon signal was officially raised.

Tragically, while returning home, Ahmed encountered powerful winds that caused him to lose balance and fall. The resulting injuries were severe—damage to his back, right knee, and fingers required extensive medical treatment, including orthopedic surgery and 785 days of sick leave. This wasn’t just a personal misfortune but a systemic issue highlighting the precarious working conditions in the gig economy.

In the subsequent High Court case, Deputy Judge Li Shuxu critically examined Foodpanda’s business model. The court recognized that riders’ income and performance evaluations were directly tied to order completion, creating an implicit mandate to work through dangerous conditions. Riders like Ahmed faced a stark choice: refuse orders and risk reduced earnings or continue working and potentially endanger themselves.

The court’s ruling was decisive, finding Foodpanda 80% responsible for the incident. The company was ordered to pay approximately HK$1.34 million in compensation, acknowledging the inherent risks in its operational structure. While Ahmed was deemed 20% responsible for not seeking shelter, the judgment fundamentally challenged the notion that gig workers bear sole responsibility for workplace safety.

This case raises critical questions for insurance providers about coverage for gig economy workers. Traditional employment injury insurance might not adequately address the unique risks faced by platform-based workers. Potential insurance solutions could include comprehensive personal injury coverage, income protection during recovery periods, and provisions addressing platform liability during extreme events.

Effective insurance for gig workers might incorporate features like:

– Medical expense coverage for work-related injuries

– Income replacement during extended recovery periods

– Protection against performance metric penalties for prioritizing personal safety

– Compensation for injuries resulting from employer or platform negligence

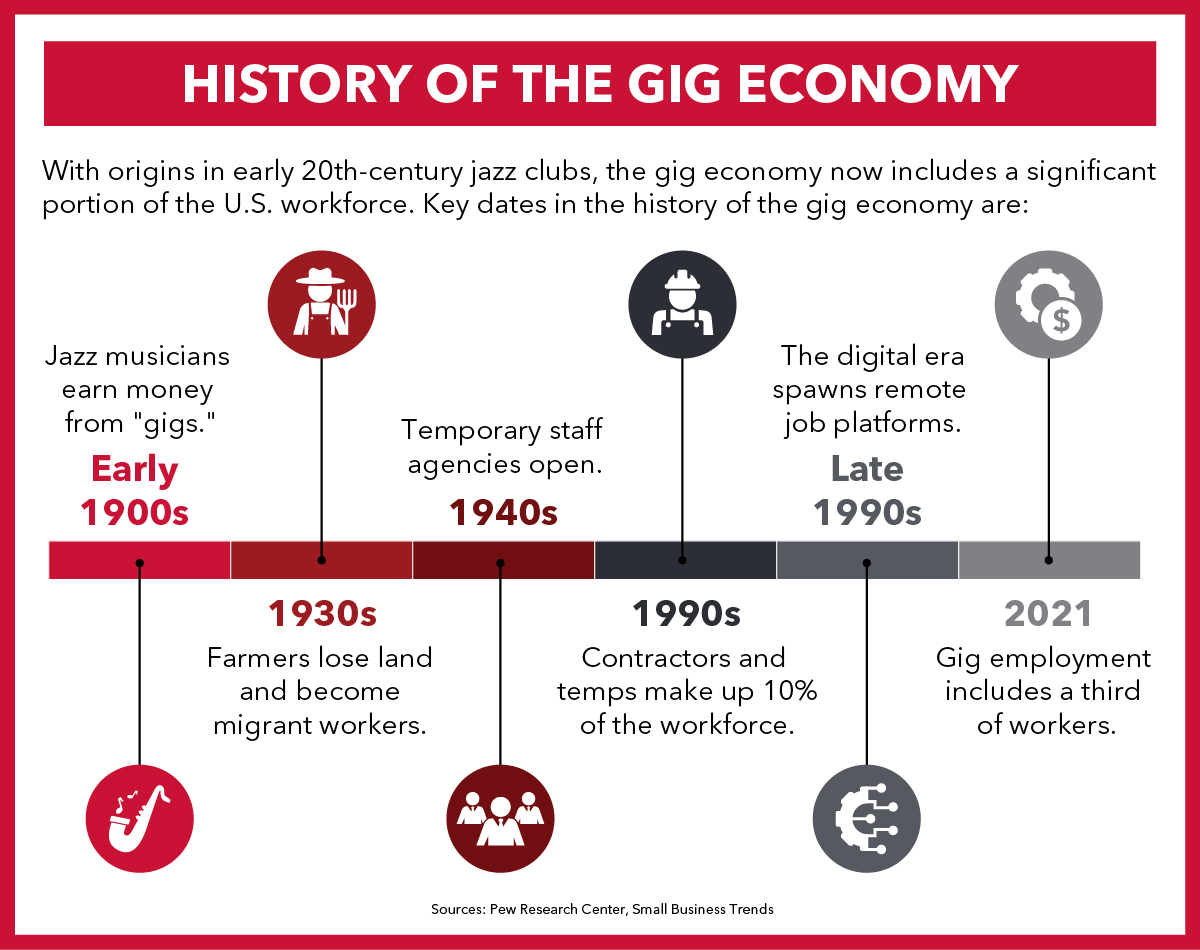

The Ahmed versus Foodpanda case serves as a pivotal moment in understanding workplace protection for gig economy workers. It demonstrates that insurance products must evolve to match the dynamic and often unpredictable nature of modern work arrangements. As extreme weather events become more frequent and gig work continues to expand, comprehensive, adaptable insurance solutions are no longer optional—they’re essential.

For gig workers, platforms, and insurers alike, this case underscores a fundamental truth: workplace safety isn’t just about rules and warnings, but about creating systems that genuinely prioritize worker well-being.