Introduction

When planning a small wedding or birthday party, it’s easy to get excited about things like who to invite, what food to serve, and how to decorate. But you also need to think about things that could go wrong. Insurance can help protect your event from unexpected problems. Even small parties can have issues, and having the right insurance can keep you from losing money or worrying too much. In this article, we’ll explain what event insurance is, the different kinds you can get, and how to decide if you need it for your small celebration.

What is Event Insurance?

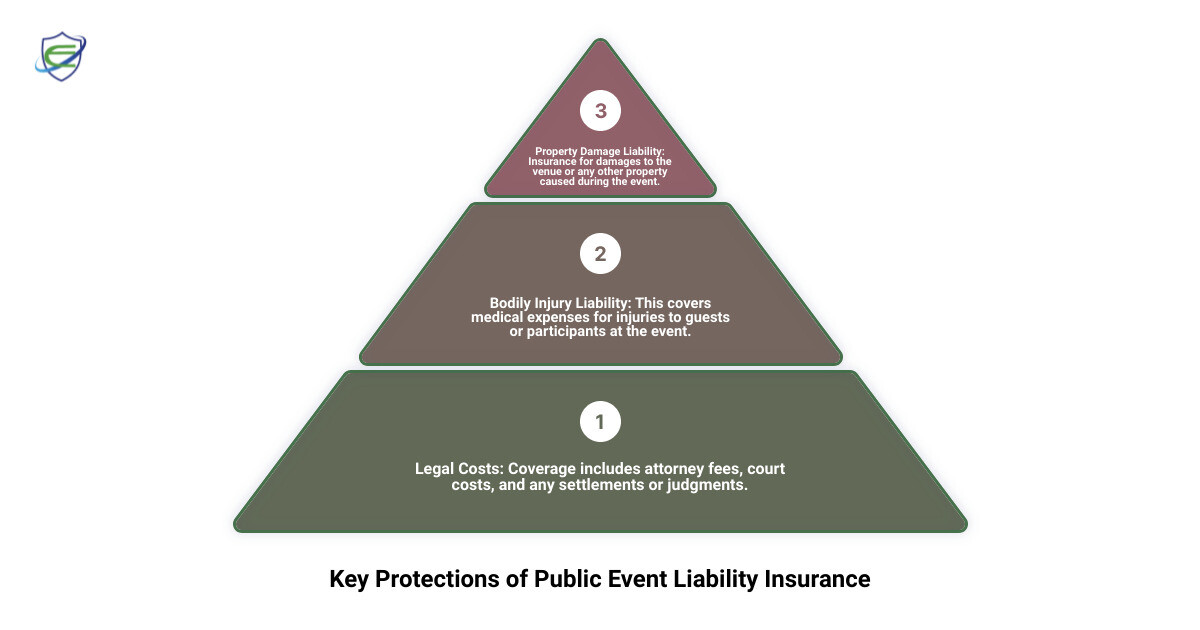

Event insurance is a special kind of protection that helps if something goes wrong during your event. It can cover things like accidents, injuries, damage to property, or even bad weather that ruins your plans. There are different types of event insurance depending on what you’re planning and how big it is. Some common ones are liability insurance, event cancellation insurance, equipment insurance, and weather insurance. For small events like a wedding or birthday party, liability insurance is often the most important to have.

Do I Need Insurance for a Small Wedding or Birthday Party?

Whether you need insurance for a small event depends on a few things. Think about what kind of event it is, where it’s happening, how many people are coming, and if there are any risks. Liability insurance is a must if you’re renting a space for your event because many places won’t let you use their venue without it. Even if you’re having the party at home, you might want insurance if you’re serving alcohol, inviting a lot of people, or doing activities that could lead to someone getting hurt.

Types of Insurance Coverage for Small Events

1. Liability Insurance: This covers injuries, damage to property, or issues with advertising. For example, if someone slips and falls at your party, this insurance can pay for their doctor bills or legal costs.

2. Event Cancellation Insurance: This helps if your event gets canceled for reasons you can’t control, like a vendor closing down or someone important getting sick. It can cover money you’ve already spent or deposits you can’t get back.

3. Equipment Insurance: This protects rented items like tents, chairs, or speakers if they get damaged or lost.

4. Weather-Related Insurance: This helps if bad weather, like a storm or heavy rain, messes up or cancels your event.

Resident Association Public Liability Insurance: What You Need to Know

There’s been recent news about Resident Association Public Liability Insurance, which protects shared community spaces from risks. This kind of insurance can also matter for small events. It covers the people hosting the event and the guests if someone gets hurt or there’s an accident. If your event is in a community area, check if the association’s insurance includes your party or if you need to buy extra coverage.

How Much Does Event Insurance Cost?

The price of event insurance depends on what kind you get, how big your event is, where it’s happening, and how risky it might be. For small events like weddings or birthday parties, liability insurance can cost between $100 and $500 or more. This depends on how many guests you have and how much protection you want. Event cancellation insurance usually costs 1% to 3% of your total event budget. Equipment or weather insurance might add more to the cost. Make sure to look at different insurance companies and compare prices to find the best deal for what you need.

When is Event Insurance a Must-Have?

1. If you’re serving alcohol: In many places, you can be held responsible if someone drinks too much at your event and causes an accident, like a car crash. Liquor liability insurance can protect you from these problems.

2. If you’re hosting a lot of guests: More people means a higher chance of accidents or injuries. Liability insurance can help pay for any issues.

3. If you’re using a rented space: Many venues will ask for liability insurance before letting you use their space.

4. If you’re spending a lot of money: Event cancellation insurance can save you from losing money if something goes wrong and the event can’t happen.

5. If it’s an outdoor event: Weather insurance can help if rain or a storm ruins your plans.

When Can You Skip Event Insurance?

1. Small, low-risk events: If it’s just a tiny gathering with a few people and no big risks, you might not need much insurance.

2. Events at home: If the party is at your house and your homeowners insurance already covers small events, you might not need extra protection.

3. Events with low costs: If you’re not spending much money on the event, buying insurance might not be worth it.

4. Events covered by other policies: Some credit cards or other insurance plans might already cover events, so check those before buying more.

How to Choose the Right Insurance for Your Event

1. Assess Your Risks: Think about the size of your event, where it’s happening, and what could go wrong to figure out what insurance you need.

2. Shop Around: Look at different insurance companies and get quotes to find the best price and coverage for your event.

3. Read the Policy: Make sure you understand what the insurance covers and what it doesn’t before you buy it.

4. Consult an Expert: If you’re not sure what to get, talk to an insurance agent or event planner who knows about event insurance.

Case Studies: Real-Life Examples of Event Insurance in Action

1. At a wedding, a guest slipped on a spilled drink and sued the host for medical costs. Liability insurance paid for everything.

2. During a birthday party, a rented bounce house got damaged by strong winds. Equipment insurance covered the repair costs.

3. An outdoor wedding was canceled because of a hurricane. Event cancellation insurance helped the couple get their money back.

4. At a community event, someone got hurt playing a game. Resident Association Public Liability Insurance paid for the medical bills.

Conclusion

Event insurance might feel like an extra cost you don’t need, but it can save you from big problems and money loss if something goes wrong. By learning about the different types of insurance and thinking about what your event needs, you can decide if it’s worth getting. It’s always better to be prepared and safe than to be sorry later when protecting your special day.

FAQs

1. Q: Is event insurance required by law?

A: No, but some venues or vendors might require it.

2. Q: Can I purchase event insurance online?

A: Yes, many companies let you get quotes and buy policies online.

3. Q: Does my homeowners insurance cover events?

A: It depends on your policy. Some might cover small events, but check to be sure.

4. Q: How far in advance should I purchase event insurance?

A: Buy it as soon as you start spending money on the event to protect your investment.

5. Q: Can I customize my event insurance policy?

A: Yes, many companies let you adjust the policy to fit what you need.