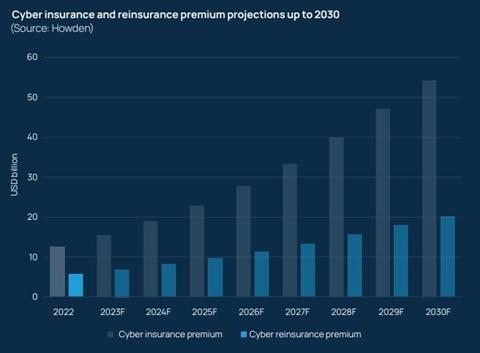

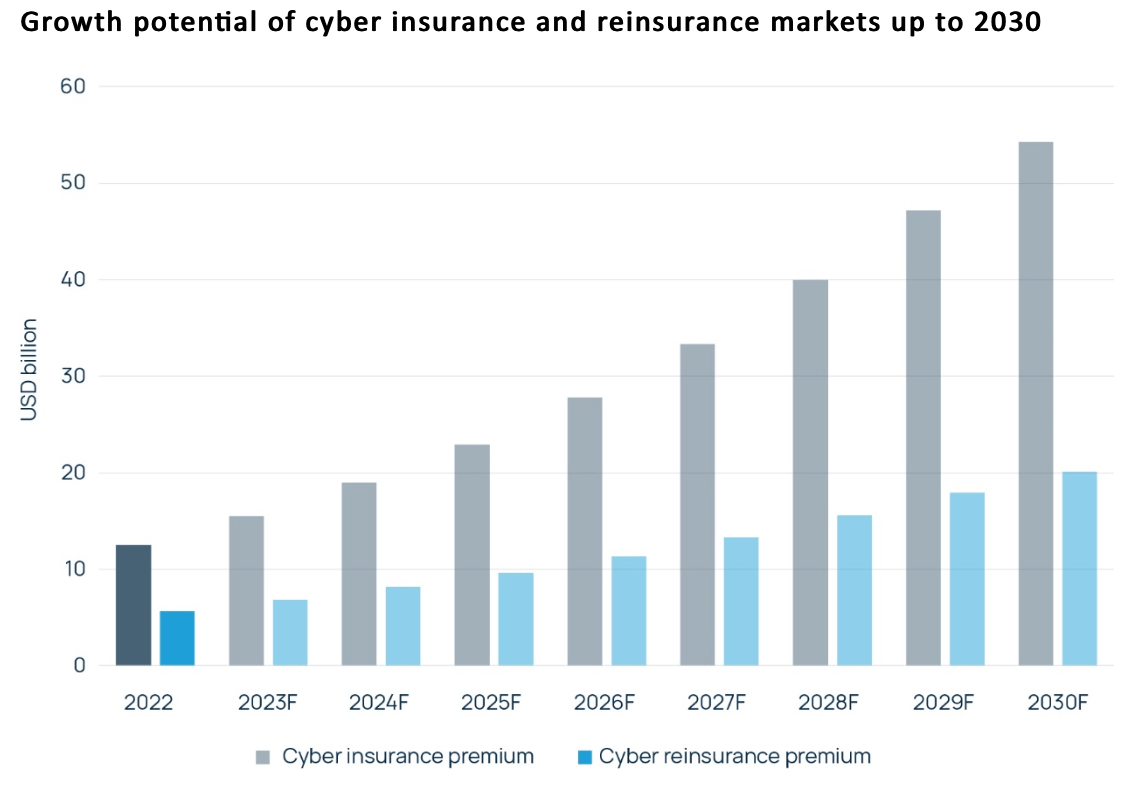

The global cyber insurance landscape is undergoing significant transformation, reflecting the increasingly complex digital risks businesses face today. In 2024, the market reached nearly $15 billion in premiums, growing 7% but showing signs of a decelerating expansion. This nuanced growth tells a story of adaptation, challenge, and strategic evolution in the world of cyber risk management.

While the overall market expanded, regional variations paint an intriguing picture. Non-US markets drove growth, contrasting sharply with the United States, where premiums actually declined by 1.5% to $7.1 billion. Despite this softening demand, insurers maintained impressive profitability, with combined ratios of 79% for primary cyber insurance and 84% for excess coverage—indicating effective claims and expense management.

Ransomware remains the primary catalyst for cyber insurance claims, though the threat landscape is shifting. Total ransom payments dramatically decreased by 35% last year, dropping to $814 million. This reduction might signal improved cybersecurity measures or changing criminal tactics, but the underlying risk remains substantial. Typical cyber insurance policies now comprehensively cover expenses ranging from ransom payments (where legally permissible) to legal fees, reputation management, and system restoration costs.

The market is experiencing significant pricing pressures, with increased competition driving down premiums. Marsh data reveals that US cyber insurance rates dropped 7% in the first half of 2025, while UK rates saw an even steeper decline of nearly 19%. This trend could paradoxically benefit the market by making coverage more accessible and potentially encouraging broader adoption, especially among small and medium-sized enterprises (SMEs).

Currently, only about 10% of SMEs have cyber insurance, representing a massive untapped market. These smaller organizations are often more vulnerable to cyber threats due to limited cybersecurity resources, making them prime candidates for targeted insurance products. Insurers are recognizing this opportunity and developing more tailored solutions to address SMEs’ unique risk profiles.

Strategic innovation is also reshaping the cyber insurance landscape. Insurers are moving from traditional risk-sharing models to more sophisticated approaches like excess-of-loss reinsurance, which limits exposure to large-scale cyber events. They’re also exploring innovative risk transfer mechanisms such as catastrophe bonds and industry loss warranties, designed to distribute systemic risks across broader financial markets.

The persistent nature of cyber threats continues to underscore the importance of this market. Allianz’s 2025 Risk Barometer has ranked cyber incidents as the top global risk for the fourth consecutive year. This consistent ranking reflects the growing complexity and frequency of digital threats across industries and geographies.

Regional regulatory environments are also playing a crucial role in market development. In areas like Hong Kong, stricter cyber laws are expected to drive higher premiums and encourage more proactive cybersecurity strategies. Insurers are increasingly viewed not just as financial protection providers but as active partners in managing digital risk.

For businesses, cyber insurance offers more than just financial protection. These policies provide access to incident response services, including forensic investigations and crisis management support. They also enhance organizational credibility by demonstrating a proactive approach to managing digital risks—a critical consideration in an era of increasing digital transparency and stakeholder scrutiny.

As cyber threats continue to evolve, so too will the cyber insurance market. The current trajectory suggests continued growth, innovation, and increasing sophistication in how businesses and insurers approach digital risk management.