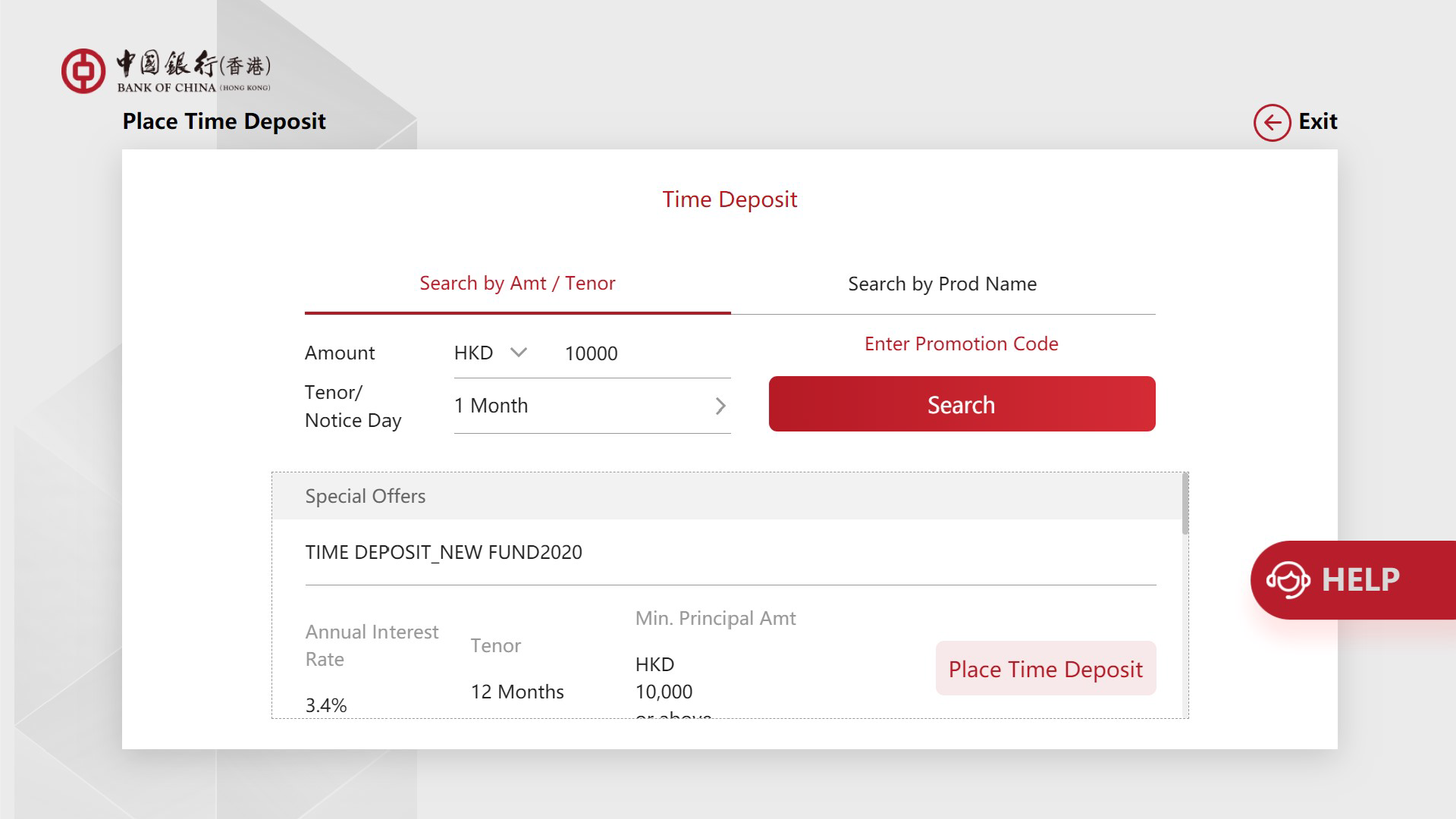

In the dynamic world of banking and finance, BOC Hong Kong (BOCHK) has recently caught the attention of savers with a compelling deposit rate offer that reflects the complex interplay of local and global economic factors. The bank is currently providing a standout 4.8 percent interest rate for one-month time deposits, specifically targeting new clients and capped at deposits of HK$100,000 until September 30.

This attractive rate emerges against a backdrop of cautious market sentiment, with all eyes fixed on the upcoming U.S. Federal Reserve decision. Market expectations currently suggest a 96 percent probability that interest rates will remain unchanged, though recent comments from U.S. President Donald Trump hint at the possibility of a potential rate cut, adding an element of intrigue to the financial landscape.

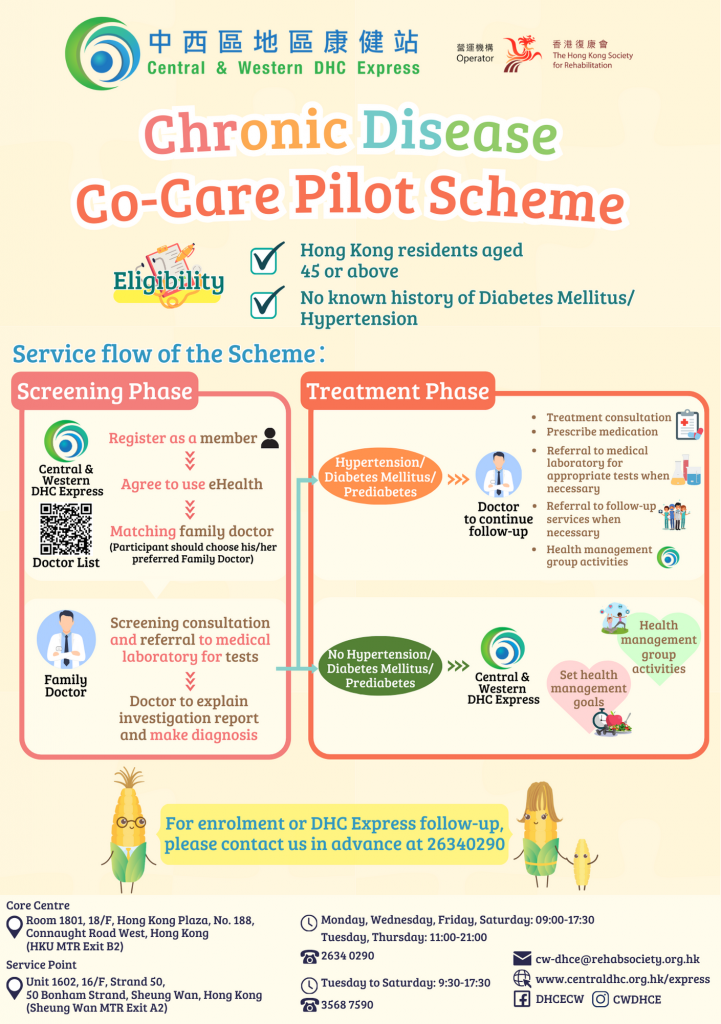

For savvy savers looking beyond BOCHK’s short-term offer, the Hong Kong banking market presents several interesting alternatives. PAObank, for instance, offers competitive rates for longer-term deposits: 1.6 percent for three-month terms, 2.2 percent for six months, and 2.4 percent for 12-month deposits. These options provide flexibility for those seeking more extended investment strategies.

The current state of the Hong Kong Interbank Offered Rates (HIBOR) provides crucial context for understanding these deposit rates. As of July 25, the one-month HIBOR stood at a modest 0.91679 percent, having dropped by 0.15 percentage points in the previous week. This low interbank rate reflects limited liquidity and cautious lending practices among banks, creating a challenging environment for financial institutions.

Fubon Bank offers another compelling option, particularly for those interested in U.S. dollar deposits. Their three-month time deposit rate of 4.2 percent positions them as a competitive player in the market, especially attractive for individuals and businesses looking to park U.S. dollar funds during uncertain economic times.

The strategic approach of banks like BOCHK illustrates the delicate balance financial institutions must maintain. By offering higher deposit rates, they aim to attract new customers in a market characterized by low interbank rates and global economic uncertainty. These promotional rates serve as a powerful tool for customer acquisition, providing an opportunity for savers to maximize their returns in a complex financial environment.

The broader implications of these deposit rates extend beyond simple number-crunching. They reflect the intricate relationship between local banking strategies and international monetary policies. The potential actions of the U.S. Federal Reserve could send ripples through global markets, influencing everything from interbank lending to individual savings strategies.

For consumers, this landscape presents both opportunities and challenges. Short-term offers like BOCHK’s 4.8 percent rate provide an immediate avenue for potentially higher returns, while longer-term options from banks like PAObank offer more sustained investment strategies. The key is to remain informed and adaptable, understanding that the financial market is constantly evolving.

As the September 30 deadline for BOCHK’s promotional rate approaches, savers and financial enthusiasts will be watching closely. The interplay between local banking initiatives, international monetary policy, and market expectations continues to create a fascinating and dynamic financial ecosystem in Hong Kong.