In today’s digital age, job seekers must navigate a treacherous landscape of online employment fraud that threatens not just financial security, but personal well-being. Fraudsters have become increasingly sophisticated in their approaches, crafting elaborate schemes designed to exploit job seekers’ hopes and vulnerabilities.

These scams typically begin with seemingly attractive job advertisements spread across social media, forums, and instant messaging platforms. What makes these fraudulent postings particularly dangerous is their carefully constructed appearance of legitimacy. They often feature unrealistic promises like high salaries, same-day pay, or convenient work-from-home arrangements that immediately catch a job seeker’s attention.

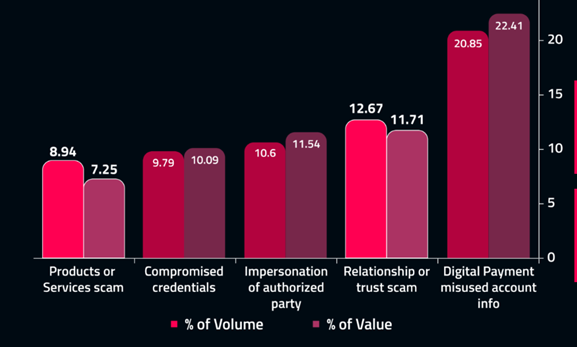

One prevalent scam is the “Boosting Sales” scheme, where fraudsters impersonate well-known online retailers like AliExpress or Amazon. Victims are recruited as “Order Handlers” or “Merchandising Assistants” with vague job descriptions and minimal entry requirements. The initial stages of the scam can be particularly convincing: victims might receive full refunds and commissions after completing initial tasks, creating a false sense of security.

However, the trap springs when victims are instructed to purchase products from specific online merchants, supposedly to “boost sales.” They’re asked to provide screen captures as proof and transfer deposits to designated bank accounts. As the scam progresses, fraudsters invent increasingly complex reasons to refuse refunds, pressuring victims into larger purchases to “recover” their money, ultimately leading to significant financial losses.

Other sophisticated scams include the “Lending an Account” fraud, where criminals request employees to channel funds through their personal accounts. Some go as far as demanding individuals apply for loans in their own name or purchase gold jewelry with credit card cash advances. In some instances, scammers even request ATM cards and PINs to directly withdraw money.

Equally deceptive are schemes like the “Overseas Purchasing Agent” scam, where individuals are hired to travel abroad and purchase luxury products, but must pay their own travel and accommodation expenses upfront. Another variant involves job seekers being asked to purchase goods like smartphones in advance or buy raw materials at inflated prices.

The “Giving Likes” scam represents yet another digital manipulation, where fraudsters offer commissions for artificially boosting social media engagement through purchased likes, often introducing tiered packages with increasingly expensive options promising higher returns.

Protecting oneself requires vigilance and skepticism. Job seekers should always use reputable recruitment channels and conduct thorough background research on potential employers. Red flags include job postings with no specific company information, vague job descriptions, and offers that seem too good to be true.

Critical prevention strategies include:

– Never sharing personal information indiscriminately

– Being extremely cautious about paying any employment-related fees

– Avoiding jobs requiring loan applications or upfront product purchases

– Verifying company credentials through official channels

– Using risk assessment tools like Scameter to check potential employer information

By understanding these sophisticated fraud mechanisms, job seekers can better protect themselves in the digital employment marketplace. Awareness, critical thinking, and a healthy dose of skepticism are the best defenses against these increasingly complex online employment scams.