China’s biotechnology sector is rapidly emerging as a global powerhouse, transforming from a cost-effective manufacturing hub to an innovative research leader. Over the past two decades, the country has strategically invested in biotech, allocating at least CNY 20 billion (EUR 2.6 billion) in public funding in 2023 alone, with the goal of becoming a world-class scientific and technological innovator.

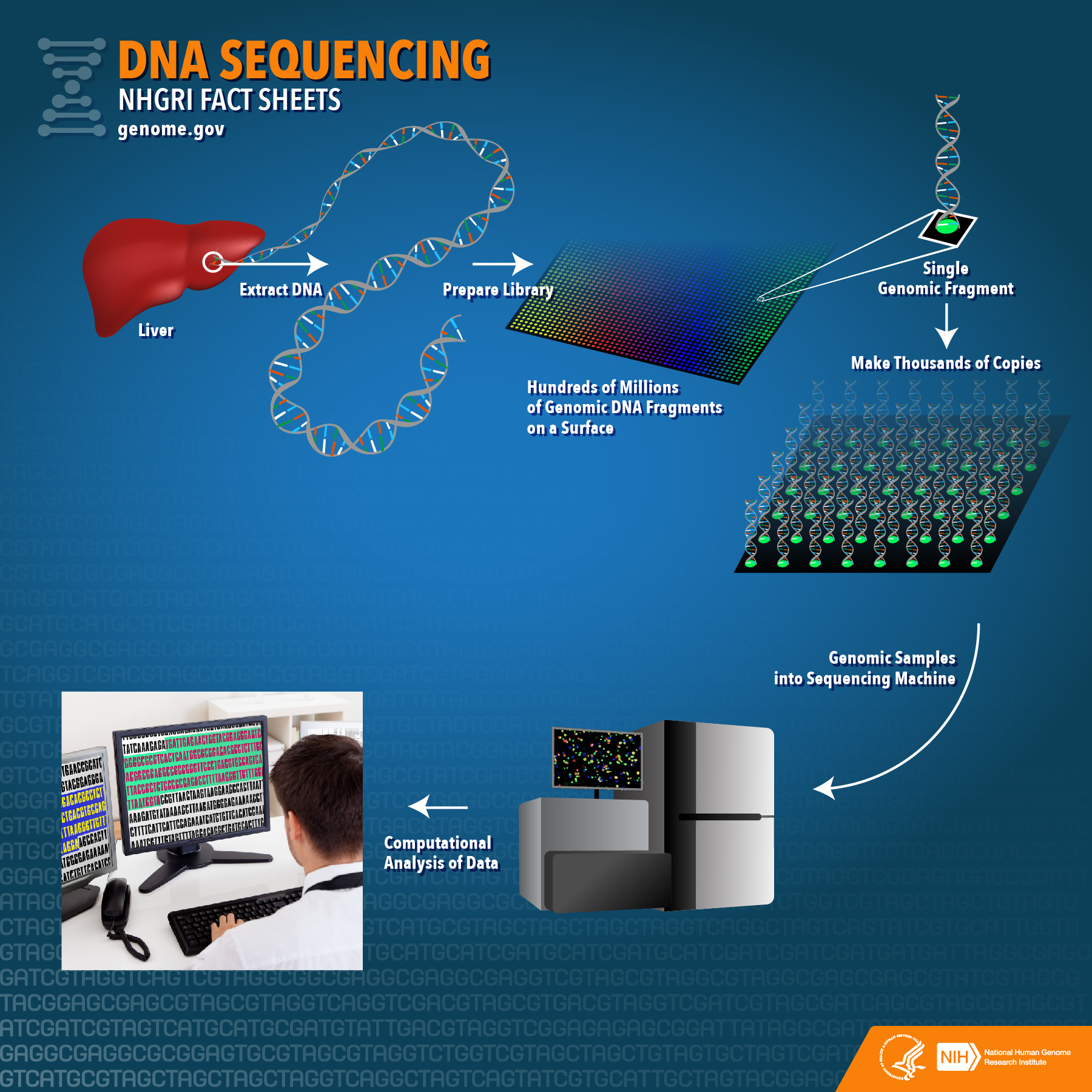

The journey has been marked by impressive achievements. China now leads in scientific publications across critical domains like synthetic biology, genomic sequencing, novel antibiotics, and biological manufacturing. Cities like Shanghai have become vibrant biotech clusters, attracting significant research investment and government support. Companies such as BGI Group and MGI have made substantial strides in reducing dependence on foreign genetic sequencing technologies, demonstrating China’s commitment to technological self-reliance.

However, China’s biotech ambitions are nuanced. While research capabilities have surged, the domestic market presents challenges. Strict healthcare cost controls and limited market size constrain profitability, pushing Chinese firms to seek opportunities internationally. This has led to an interesting dynamic where Chinese biotech companies increasingly collaborate with European and American pharmaceutical firms, offering innovative drug prototypes, integrated contract services, and cost-effective research solutions.

The government’s approach has been deliberate. China’s 2022 five-year plan for the bioeconomy explicitly aims to overcome technological barriers and achieve scientific independence. This strategy extends beyond healthcare, encompassing industrial, energy, and environmental applications. Policymakers are actively working to bridge academia and corporate sectors, creating pathways for research commercialization.

Regulatory reforms have also played a crucial role. Improvements in drug review and approval processes have increased multinational interest in Chinese-developed pharmaceuticals. More Chinese drugs are now being approved in US and European markets, signaling growing confidence in the sector’s capabilities.

Yet, the path is not without obstacles. Geopolitical tensions and increasing regulatory scrutiny, particularly around data handling and cross-border collaborations, pose significant challenges. The proposed US Biosecure Act and European Biotech Act reflect growing concerns about technological competition and strategic dependencies.

For European stakeholders, China’s biotech rise presents a complex opportunity. While collaborations can reduce drug discovery risks and production costs, they also come with potential vulnerabilities. The EU is carefully navigating this landscape, seeking to maintain beneficial engagement while protecting strategic interests.

The genomics sector offers a prime example of this complexity. BGI Group has become a national champion in genetic sequencing, but corporate and geopolitical tensions have complicated its global expansion. Differences in data regulation—with China treating health data as a national resource versus the EU’s individual protection focus—further complicate potential partnerships.

Looking forward, China’s biotech sector appears poised for continued growth. By leveraging public funding, promoting technology transfer, and supporting high-tech small and medium enterprises, the country is positioning itself as a significant global player. For European and American firms, this means both competition and collaboration opportunities.

The key for global stakeholders will be maintaining a balanced approach: screening investments carefully, securing critical supply chains, and fostering mutually beneficial research partnerships. As the biotech landscape evolves, strategic adaptability will be crucial in navigating this dynamic and rapidly changing field.