Introduction: Beyond the Hype – Deconstructing Stablecoins

Stablecoins are a type of cryptocurrency designed to keep their value steady. Unlike Bitcoin or Ethereum, which can go up and down in price a lot, stablecoins aim to stay close to a fixed value, often tied to something like the U.S. dollar. They promise to mix the benefits of digital money with the safety of traditional cash. But are they really as safe as they seem? Let’s break down what stablecoins are, how they work, and what risks or rules come with them.

The ‘Stable’ Promise: How Stablecoins Aim to Bridge the Gap Between Crypto Volatility and Traditional Finance

Stablecoins try to solve a big problem in crypto: wild price swings. They do this by linking their value to something stable. There are three main ways they keep their value steady, called pegging mechanisms. First, fiat-collateralized stablecoins, like Tether (USDT), hold real money, such as dollars, in a bank to back up each coin. Second, crypto-collateralized stablecoins, like DAI, use other cryptocurrencies as backup but often hold more than needed to handle price drops. Third, algorithmic stablecoins don’t hold anything as backup. Instead, they use computer rules to adjust the number of coins in circulation to keep the price stable. Each method has its own strengths and weaknesses, but they all aim to make crypto more usable for everyday things like payments.

Unpacking the Risks: A Deep Dive into Stablecoin Vulnerabilities

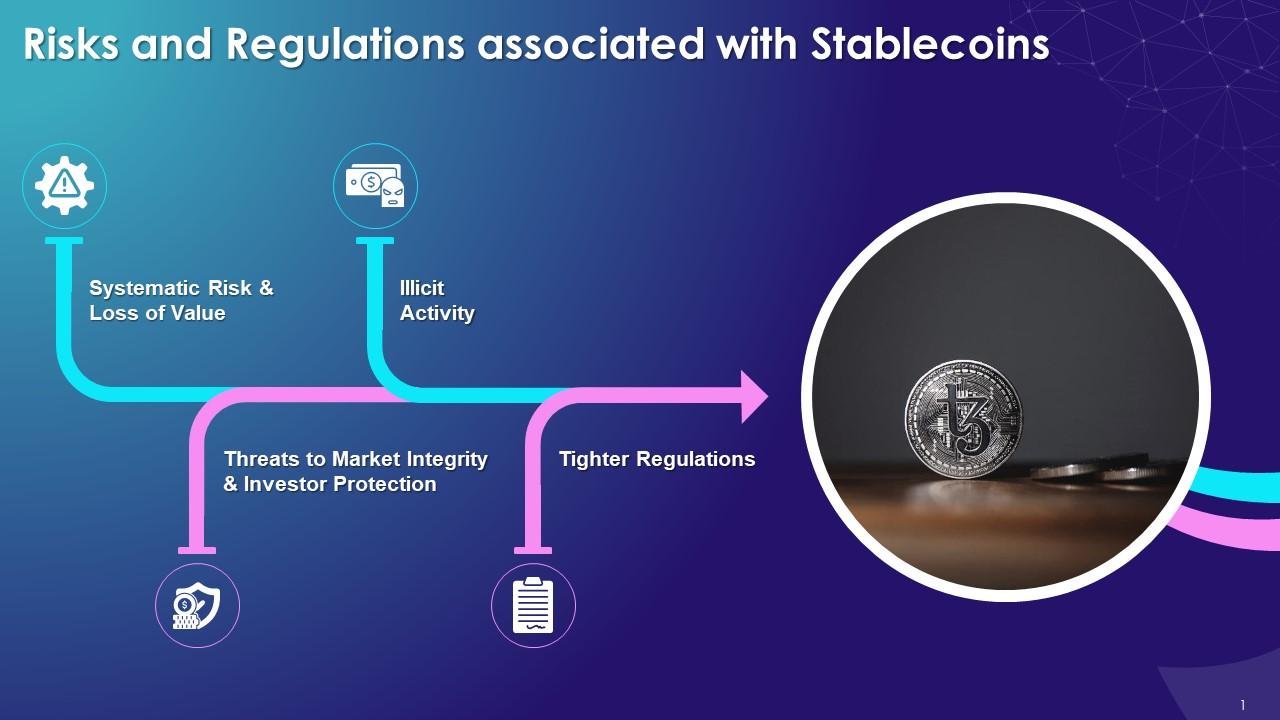

Stablecoins sound great, but they come with risks. Operational risks happen if the company behind the stablecoin messes up or gets hacked. Smart contract risks come from bugs in the computer code that runs some stablecoins, which can lead to money being stolen. Counterparty risks mean you trust someone else, like a bank holding the backup money, and they might fail to deliver. Liquidity risks show up if there isn’t enough cash or assets to cover everyone trying to cash out at once. Worst of all, a “bank run” can happen if too many people lose trust and try to pull out their money at the same time, crashing the system. These dangers show that “stable” doesn’t always mean “safe.”

The Regulatory Tightrope: Navigating the Evolving Landscape for Stablecoins

Governments around the world are trying to figure out how to control stablecoins. Right now, there’s no single set of rules. Some countries look at stablecoins as securities, like stocks, which need strict oversight. Others see them as commodities, like gold, or as payment tools, like digital cash. In the U.S., lawmakers debate whether stablecoins should follow bank rules. In Europe, new laws aim to make sure stablecoin companies hold enough backup money. These rules are still changing, and they matter because they decide how safe stablecoins are for users and how much they can grow.

Global Stablecoin Ambitions: Analyzing the Potential and Challenges of Projects like Libra 2.0

Some big projects, like Libra (now called Diem before it stopped), want to make stablecoins that work everywhere. They claim to offer 24/7 access, no borders for sending money, the ability to split coins into tiny amounts, and even connect with other services like shopping apps. These ideas could change how we use money. But they face huge challenges. Governments worry about losing control over money flow and fear these coins could be used for illegal things. Strict rules often slow down or stop these projects, showing how hard it is to balance new ideas with safety.

Economic Implications: How Stablecoins Could Impact Monetary Policy and Financial Stability

Stablecoins might change how money works in bigger ways. If lots of people use stablecoins instead of regular money, it could mess with a country’s control over things like inflation or interest rates. For example, if a stablecoin tied to the dollar grows huge, the U.S. might struggle to manage its economy. Also, if a major stablecoin fails, it could shake up the whole financial system, just like a bank collapse. These risks make experts and leaders think hard about how to handle stablecoins without causing problems.

The Future of Stablecoins: Innovation, Adoption, and the Path Forward

Stablecoins could do more than just payments. They might help with things like loans, savings, or even voting systems using digital money. At the same time, many countries are making their own digital money, called central bank digital currencies (CBDCs), which could compete with stablecoins. There’s also a big debate: should we make strict rules to keep things safe, or let new ideas grow without too many limits? The future depends on finding a middle ground where stablecoins can help people but not cause big risks.

Conclusion: Balancing Innovation and Stability in the Age of Digital Currencies

Stablecoins offer exciting ways to use digital money, but they aren’t perfect. They come with risks and need clear rules to protect users. As they grow, we must balance the cool new things they can do with the need to keep our money system safe. By understanding stablecoins better, we can make smart choices about how to use them in the future.