香港保險市場在2024年展現出顯著的穩定性,進一步鞏固了其作為亞洲戰略性再保險樞紐的關鍵地位。市場的韌性體現在高達131億美元的一般保險毛保費收入中,這涵蓋了本地及國際再保險業務。

現時有157家獲授權保險公司在香港營運,持續的市場需求及戰略性經濟定位驅使香港繼續成為通往中國內地的重要門戶。市場結構呈現均衡態勢:直接業務貢獻66.8億美元,而流入再保險則佔63.7億美元。財務方面,行業錄得強勁的10.5億美元營業利潤,其中包括4.3億美元的承保利潤。

2024年未有發生重大災害損失,成為市場穩定的關鍵因素,這讓保險公司得以完善其災害建模與再保險保障策略。這段平靜期為戰略提升及風險管理改善提供了契機。

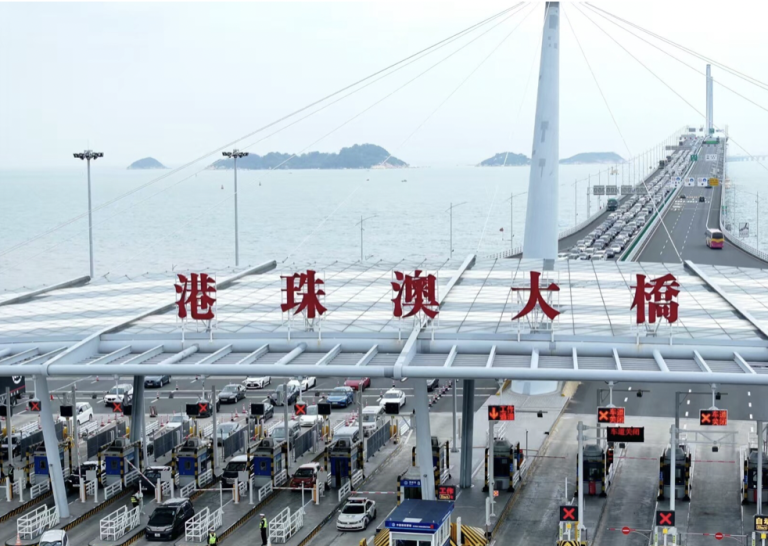

粵港澳大灣區(GBA)整合成為重要發展方向,中國國務院已指定香港作為2025年戰略風險管理中心。監管進展顯而易見,例如試行計劃允許香港車輛經港珠澳大橋進入廣東而無需配額,標誌著跨境合作正持續深化。

監管改革對塑造市場格局產生變革性影響。新的風險為本資本(RBC)制度促使部分保險公司加強資本,而《國際財務報告準則第17號》(IFRS 17)的實施則進展順利。新興重點領域包括氣候披露要求及不斷升級的網絡風險,推動業界採取更全面的風險管理方法。

市場動態顯示原保險市場定價溫和走強,巨災風險暴露的財產險費率上升5%至10%。展望2025年,再保險條件預計將趨緩,無損失超額賠款計劃費率或下調10%至15%,而區域再保險公司擴容將使比例合約佣金小幅上升。

儘管面臨更高資本要求、定價競爭壓力及審慎經濟情緒等挑戰,增長機遇依然樂觀。粵港澳大灣區整合帶來龐大潛力,而香港成熟的再保險地位提供了堅實基礎。潛在監管變革(如網約車服務立法)或將釋放額外市場機遇。

市場對新興趨勢的反應更展現其適應力。數位資產改革引入對託管人、交易平台及穩定幣發行人的許可制度,可能刺激創新型保險產品需求。

雖然前路需應對複雜監管環境及管理不斷演變的風險,香港保險市場已展現非凡韌性。其作為再保險樞紐及中國內地門戶的戰略重要性,將有利於持續增長與發展。

亞洲保險業整體環境顯示出創新與監管協調的動態格局。從東京海上控股計劃拓展美國農業領域,到印度網絡保險採用率上升,該地區持續演變,為保險商帶來挑戰與機遇並存的局面。

香港持續努力應對資本要求、競爭壓力及網絡安全等新興風險,對於維持市場穩定性及競爭優勢至關重要。