Hong Kong’s Monetary Policy Shift: Understanding the Latest Interest Rate Cut

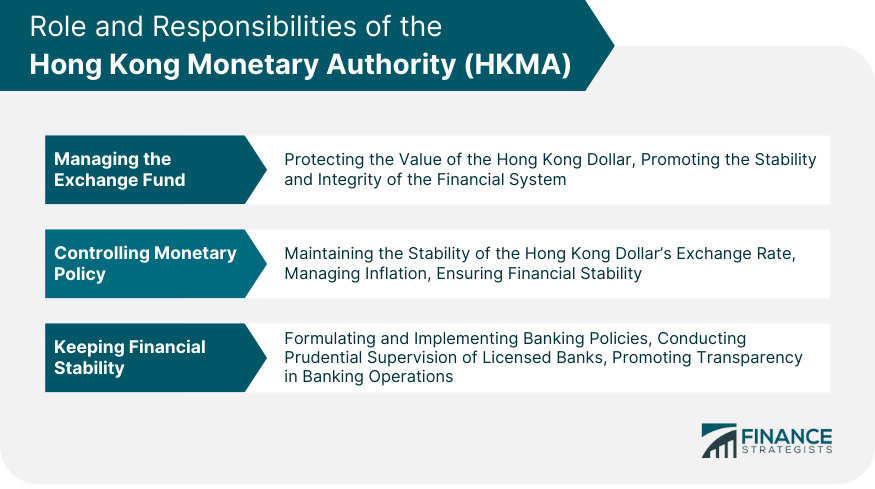

The Hong Kong Monetary Authority (HKMA) has recently made a significant move in its monetary strategy, reducing its base interest rate by 25 basis points to 4.25 percent. This decision, synchronized with the US Federal Reserve’s similar rate cut, highlights the intricate relationship between Hong Kong’s financial system and global economic dynamics.

The rate adjustment is not arbitrary but stems from a fundamental economic mechanism: Hong Kong’s currency peg to the US dollar. This long-standing arrangement requires Hong Kong to maintain its interest rates in close alignment with those of the United States, ensuring currency stability within a tight range of 7.75 to 7.85 Hong Kong dollars per US dollar.

HKMA Chief Executive Eddie Yue Wai-man has been transparent about the complexities surrounding this decision. While the current rate cut follows a previous reduction in September, Yue emphasized the inherent uncertainty in future US interest rate movements. The unpredictability of potential Federal Reserve cuts adds a layer of complexity to Hong Kong’s monetary policy planning.

For everyday citizens and businesses, this rate reduction carries practical implications. Lower interest rates typically aim to stimulate economic activity by making borrowing more affordable. Businesses might find it easier to access capital, and individuals could see reduced costs for loans and mortgages. However, the actual impact depends on a nuanced interplay of global market trends and local economic conditions.

The timing of this rate cut is particularly noteworthy. It represents the second interest rate reduction this year, reflecting a responsive approach to changing economic landscapes. The HKMA’s decision mirrors the US Federal Reserve’s own policy rate cut, which adjusted rates to a range of 3.75 to 4.00 percent.

What makes this development fascinating is the broader context of global financial interconnectedness. Hong Kong’s monetary policy isn’t developed in isolation but is deeply influenced by international economic currents. The currency peg to the US dollar means that Hong Kong’s financial strategies are inherently linked to American monetary decisions.

Despite the rate cut, economic experts and policymakers remain cautious. The uncertainty surrounding future interest rate trajectories suggests that while this adjustment provides short-term economic stimulus, long-term strategies must remain flexible and adaptive.

For those interested in understanding these complex financial mechanisms, it’s crucial to recognize that monetary policy is not just about numbers, but about creating economic environments that support growth, stability, and opportunity. The HKMA’s careful, measured approach demonstrates a commitment to navigating these challenging economic waters with prudence and strategic thinking.

As global economic conditions continue to evolve, Hong Kong’s financial authorities will undoubtedly continue to monitor and respond to emerging trends. The current rate cut is not an endpoint, but part of an ongoing dialogue about economic management in an increasingly interconnected world.

Readers seeking to stay informed about such developments are encouraged to follow reliable financial news sources and official communications from monetary authorities like the HKMA. Understanding these nuanced economic shifts can provide valuable insights into broader financial landscapes and potential future trends.