In the volatility of global financial markets, the recent performance of the Japanese yen against the US dollar has been particularly noteworthy, with the exchange rate falling to its lowest level in nearly eight months, reflecting the complex dynamics of the international economy.

The yen’s weakness in the international foreign exchange market is primarily evident in its significant decline against the US dollar. Data shows that the exchange rate once fell to 152.99 yen, and ultimately closed at 152.67 yen in the New York afternoon, a decline of about 0.5%. This trend is driven by multiple factors, with the current political and economic environment in the United States playing a key role.

The US federal government is currently in a shutdown, and the lack of economic data releases may unexpectedly benefit the US dollar. The US Dollar Index once broke above the 99 level under this backdrop, although it slightly retraced at the end of the session, it remained at a relatively high position of 98.833, up 0.2%. This trend not only affects the yen but also other major currencies, such as the euro and the British pound, which both saw slight declines.

It is worth noting that besides the strength of the US dollar, other geopolitical and economic factors may also influence exchange rate movements. Recent assessments by the International Monetary Fund (IMF) indicate that the global economy still faces significant uncertainties. The IMF’s chief has pointed out that the full impact of certain economic policies has yet to be fully realized, suggesting that exchange rate markets may experience further volatility.

In the Asia-Pacific region, the yuan’s central parity rate also hit a near two-week low, reflecting the general volatility in the exchange rate market. This situation underscores the complexity of the current international financial environment, and investors and businesses need to remain highly vigilant and flexible in their responses.

From a broader market perspective, the changes in the yen exchange rate are not isolated events. During the same period, global stock markets and commodity markets have also shown significant fluctuations. For example, gold prices hit a historic high, once breaking the $4010 mark and approaching $4060; the Nasdaq Composite Index surpassed 23,000 points for the first time; and the oil market experienced volatility due to inventory data from the US Energy Information Administration.

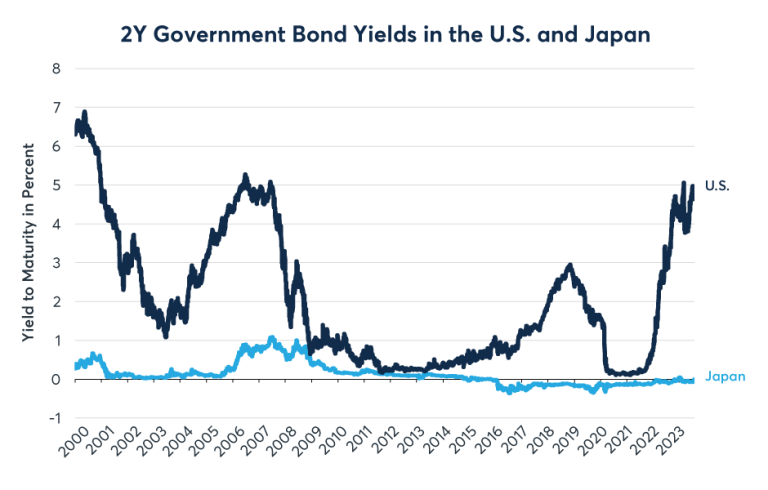

For ordinary investors and businesses, understanding the deeper logic behind these exchange rate changes is crucial. Currency fluctuations not only reflect immediate market sentiment but also reflect deeper economic structures and policy changes. The internal分歧 (disagreements) within the US Federal Reserve regarding the number of interest rate cuts this year, as well as the monetary policies of central banks in countries like New Zealand and Thailand, will continue to influence exchange rate movements.

In this challenging and opportunity-filled global financial environment, maintaining an open and keen observational attitude will help better grasp market dynamics and make informed investment and business decisions.