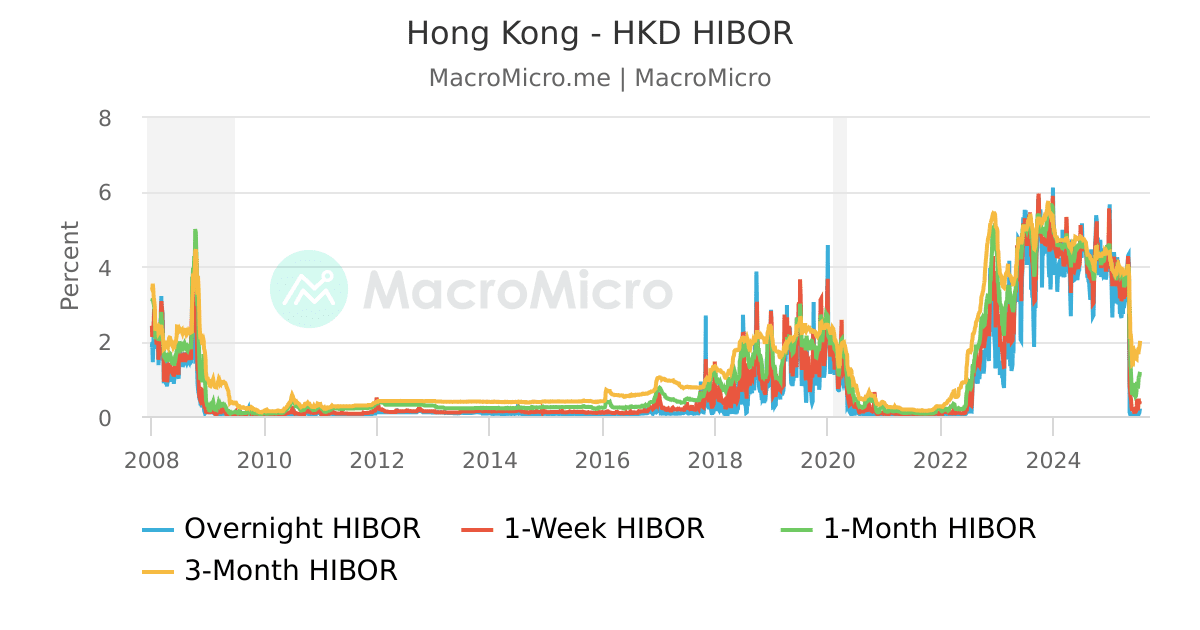

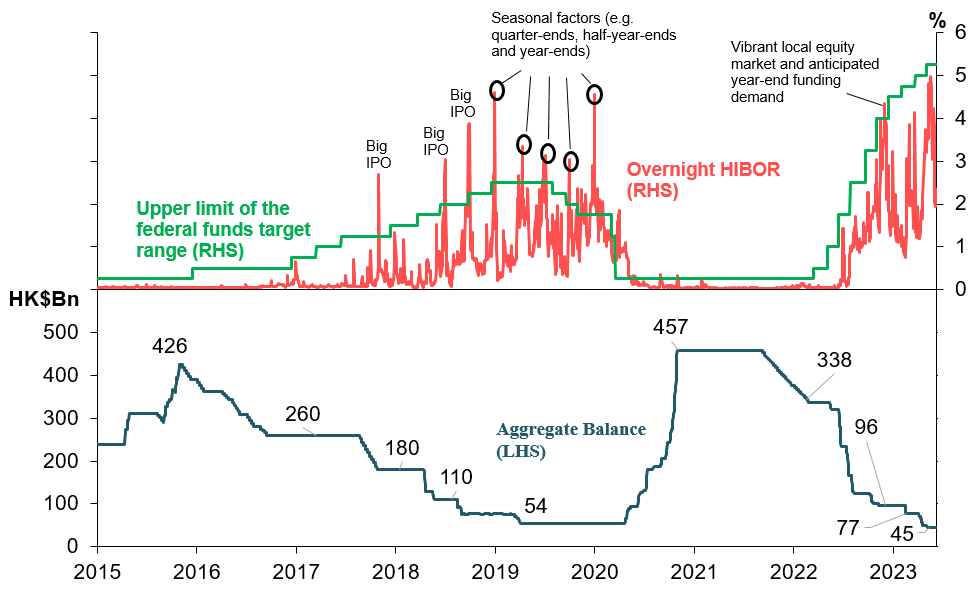

Hong Kong’s financial markets experienced a notable surge in the overnight interbank borrowing rate, reaching a striking 5.018 percent—the highest point this year. This dramatic spike occurred on a month- and quarter-end settlement day, highlighting the intricate dynamics of liquidity in the financial system.

The overnight Hong Kong Interbank Offered Rate (Hibor) jumped an impressive 1.3 percentage points in a single day, representing the largest such movement in 2023. This significant increase reflects the intense pressures banks face during critical settlement periods when they must carefully balance their books and meet stringent regulatory requirements.

:max_bytes(150000):strip_icc()/GettyImages-913866368-a83e50a077b344fd831111af77785a67.jpg)

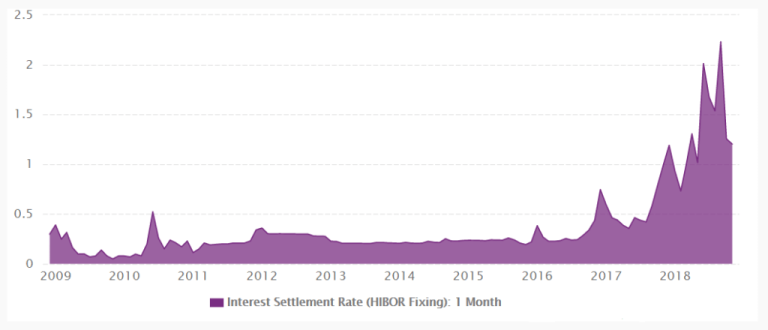

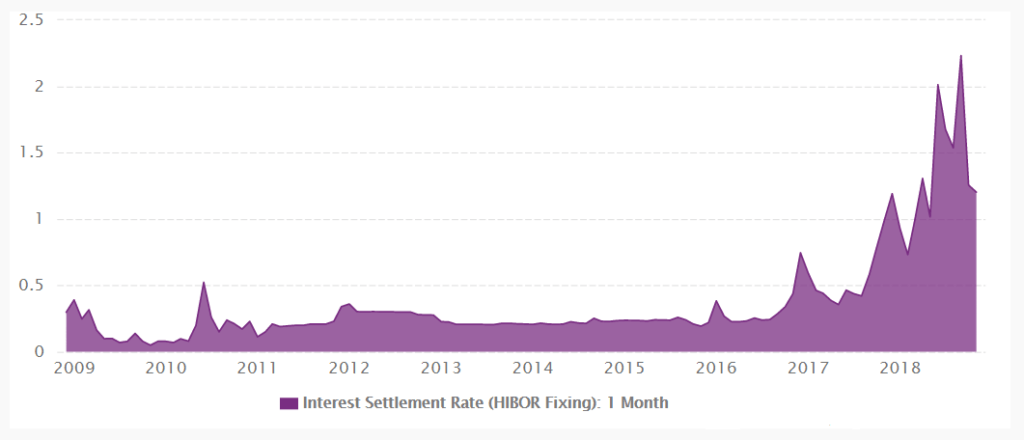

Interestingly, while the overnight rate soared, other Hibor tenors told a different story. The one-month Hibor, which is particularly significant for mortgage rates, actually declined to 3.538 percent—its lowest level in over a week. This downward trend continued for the fourth consecutive day, potentially offering a glimmer of hope for borrowers with adjustable-rate mortgages. Similarly, the three-month Hibor edged slightly lower to 3.526 percent, suggesting a nuanced and complex picture of the current financial landscape.

The broader context involves the Hong Kong dollar’s exchange rate, which hovered near HK$7.781 against the US dollar. Operating under a linked exchange rate system, the Hong Kong dollar maintains a narrow peg to the US currency. While the provided information doesn’t explicitly connect the Hibor surge to specific currency interventions, the exchange rate’s position near the stronger end of the peg hints at underlying pressures within the financial system.

These interbank rate fluctuations have real-world implications for residents and businesses. Those with loans tied to the one-month Hibor might find some temporary relief in the recent rate declines. However, the volatility serves as a stark reminder of how quickly borrowing costs can shift, requiring constant vigilance from financial stakeholders.

The spike in the overnight rate could signal temporary liquidity tightness, potentially driven by seasonal or cyclical factors such as end-of-quarter settlements. Yet, the softening of longer-term rates suggests that the market does not anticipate sustained pressure on funding costs in the immediate future.

For banks, navigating these fluctuations becomes a delicate balancing act. They must manage funding needs effectively, especially during periods of heightened cash demand. The interplay between overnight and longer-term rates demonstrates the complex mechanisms that underpin Hong Kong’s financial ecosystem.

This development underscores the importance of interbank rates in the broader economic landscape. These rates influence everything from corporate financing to mortgage affordability, serving as critical indicators of financial health and market sentiment.

While the overnight Hibor’s peak at 5.018 percent might seem like a technical detail, it represents a significant moment in Hong Kong’s financial narrative. It reflects the continuous evolution of global and regional economic conditions, where seemingly small percentage changes can signal broader market trends.

For those keen to stay informed, resources like The Standard app provide real-time coverage of such market movements, offering insights into the intricate world of financial indicators and economic shifts.

As Hong Kong continues to navigate its unique financial environment, these rate fluctuations remind us of the dynamic and interconnected nature of modern financial markets—where a single percentage point can tell a complex story of supply, demand, and economic strategy.