Hong Kong’s Monetary Authority Cuts Interest Rate: What You Need to Know

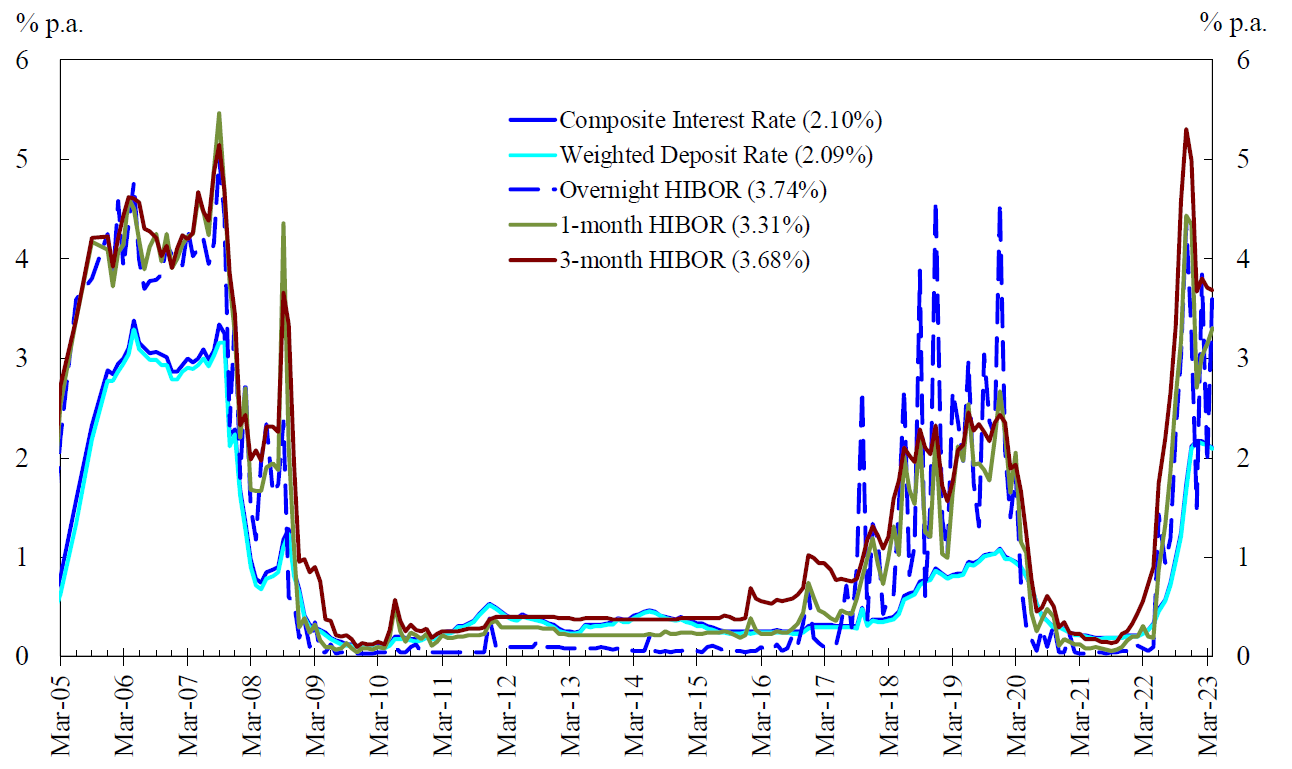

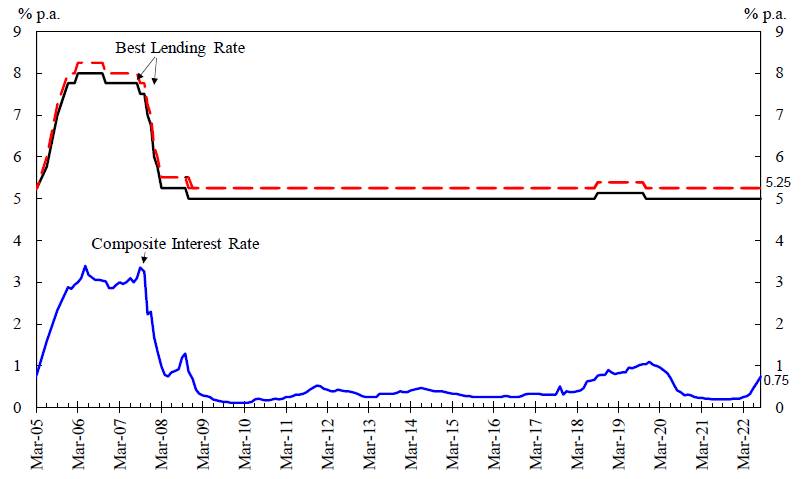

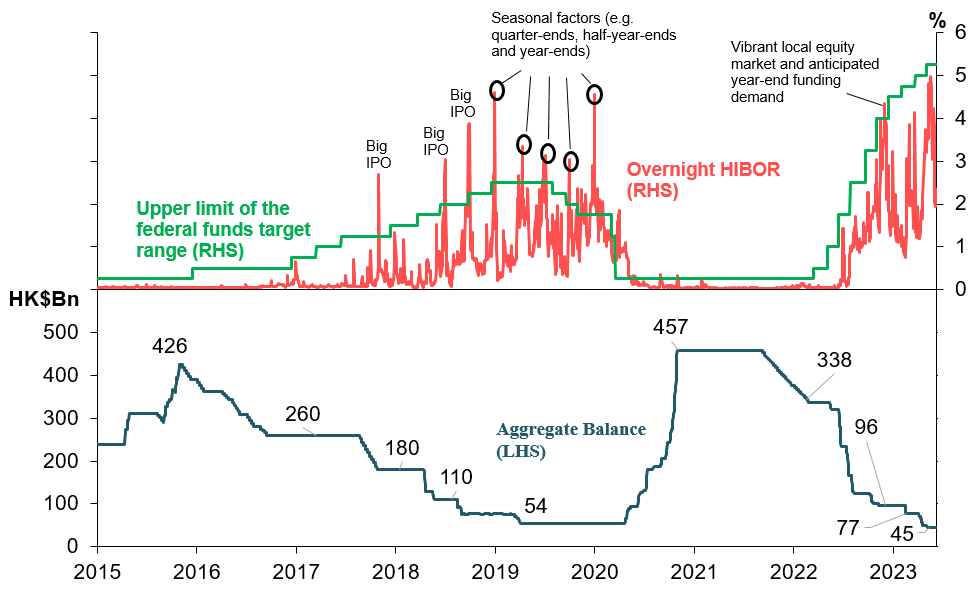

The Hong Kong Monetary Authority (HKMA) has just made a significant move that could impact your financial landscape. On Thursday, the city’s de facto central bank reduced its base interest rate by 25 basis points to 4.5 percent, marking its first rate adjustment in nine months.

This decision isn’t happening in isolation. It’s a carefully choreographed financial dance that follows the US Federal Reserve’s own rate cut just a day earlier. The connection isn’t coincidental—it’s a direct result of Hong Kong’s unique currency relationship with the United States.

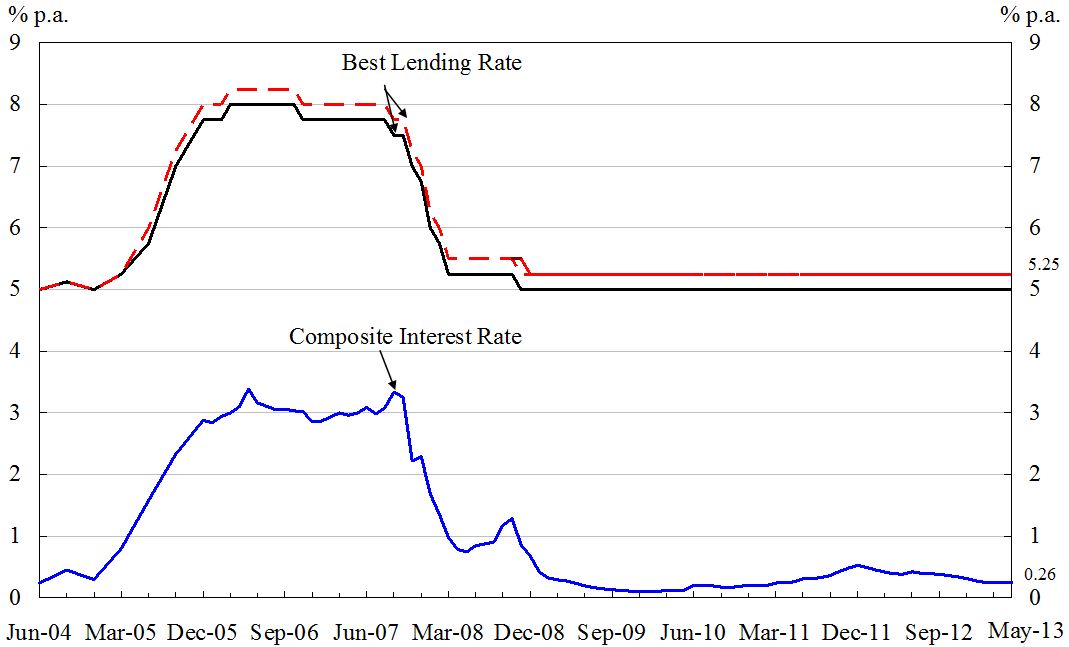

For those unfamiliar with the intricacies of international finance, here’s what makes this interesting: The Hong Kong dollar is pegged to the US dollar within an extremely tight range of 7.75 to 7.85 per dollar. This means Hong Kong’s monetary policy must mirror the United States’ to maintain economic stability. When the Fed adjusts its rates, Hong Kong typically follows suit.

Eddie Yue Wai-man, the HKMA’s Chief Executive, suggests this might be just the beginning. He anticipates the Federal Reserve could implement additional rate cuts totaling 50 basis points before the year concludes. However, he’s also cautious, acknowledging that future adjustments remain uncertain and depend on complex global economic factors.

What does this mean for everyday people and businesses? Lower interest rates generally translate to cheaper borrowing costs. Entrepreneurs might find it more attractive to secure loans for business expansions. Individuals could see more favorable mortgage and personal loan terms. Real estate markets might experience increased activity as borrowing becomes more affordable.

But it’s not all straightforward gains. Savers might see reduced returns on their deposits and savings accounts. The interconnectedness of global financial markets means local economic conditions are increasingly influenced by international trends.

The rate cut highlights Hong Kong’s delicate financial balancing act. While the currency peg provides stability, it also limits the HKMA’s ability to set independent monetary policy. Domestic economic needs must be carefully weighed against maintaining the critical US dollar relationship.

This isn’t just a local story—it’s a window into how modern economies are deeply interconnected. Global financial centers like Hong Kong must constantly adapt to shifting international economic currents. The HKMA’s measured approach demonstrates the sophisticated strategy required to navigate these complex waters.

For investors, businesses, and residents, understanding these monetary policy shifts is crucial. They signal broader economic trends and can provide insights into potential investment opportunities or financial planning strategies.

The HKMA’s decision reflects more than just a numerical adjustment. It represents a nuanced response to global economic conditions, balancing local needs with international financial dynamics. As the year progresses, financial observers will be watching closely to see how these rate changes unfold and what they might mean for Hong Kong’s economic future.

While the immediate impact might seem technical, these monetary policy decisions ultimately touch everyone—from small business owners to individual consumers. They influence borrowing costs, investment opportunities, and the overall economic environment.

Stay informed, stay adaptable, and remember that in today’s global economy, no financial decision happens in isolation.