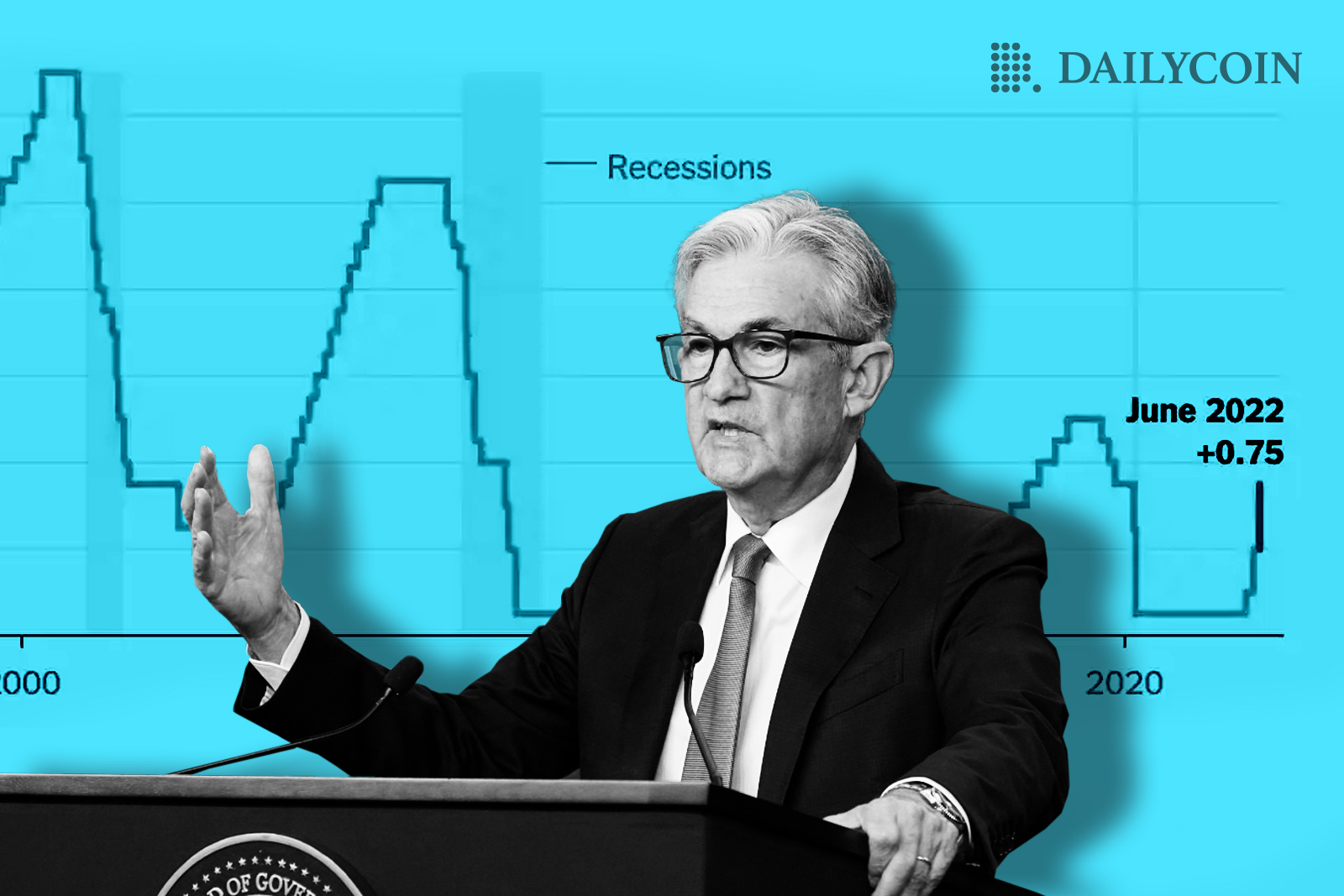

The financial world is buzzing with anticipation as Federal Reserve Chief Jerome Powell offers nuanced insights into potential interest rate cuts in 2025. While many investors and economists are eager for definitive predictions, Powell’s recent statements underscore a more measured and flexible approach to monetary policy.

During a recent press briefing, Powell made it clear that while a narrow majority of Federal Reserve officials see potential for at least two rate cuts in 2025, this outlook is far from a guaranteed roadmap. The key message is adaptability: the Fed remains committed to making decisions based on real-time economic data, evolving market conditions, and a careful assessment of potential risks.

This approach reflects the central bank’s sophisticated understanding of economic complexity. Rather than locking into a predetermined path, Powell emphasizes the importance of remaining responsive to emerging economic signals. Each potential rate cut will be evaluated against a comprehensive backdrop of economic indicators, ensuring that monetary policy remains precisely calibrated to current conditions.

The Fed’s strategy goes beyond simple number-watching. Powell highlighted the need to monitor multiple economic factors, including inflation trends, labor market dynamics, and potential external influences like tariffs. This holistic perspective demonstrates the intricate decision-making process behind what might seem like straightforward financial adjustments.

Critically, Powell also addressed concerns about potential political interference, reaffirming the Federal Reserve’s commitment to independence. When questioned about the inclusion of a key adviser to President Donald Trump among its ranks, he emphasized the institution’s dedication to impartiality. This commitment ensures that monetary policy decisions are driven by economic fundamentals rather than political considerations.

The potential rate cuts are not a signal of economic weakness, but rather a strategic tool for maintaining economic stability. By carefully considering the timing and magnitude of these adjustments, the Fed aims to support economic growth while preventing potential overheating or unnecessary volatility.

Investors and economic observers should interpret Powell’s statements as a balanced, forward-looking approach. The possibility of two rate cuts in 2025 exists, but it’s not a promise. The Fed remains vigilant, ready to adjust its strategy as new information emerges.

For everyday Americans and global market participants, this means continued uncertainty—but also a sense of measured confidence. The Federal Reserve is demonstrating its ability to navigate complex economic landscapes with precision and thoughtfulness.

As we move closer to 2025, financial stakeholders will continue to parse every word from Powell and his colleagues, seeking insights into potential economic trajectories. What remains clear is the Fed’s unwavering commitment to data-driven, independent decision-making that prioritizes long-term economic health over short-term political expediency.

The message is simple yet profound: economic policy is not about making absolute predictions, but about maintaining flexibility, independence, and a keen understanding of ever-changing economic dynamics.