Understanding the Impact of Rising Hibor and a Stronger Hong Kong Dollar

Financial markets are complex ecosystems where even subtle shifts can signal significant economic movements. Recent developments in Hong Kong’s financial landscape offer a compelling snapshot of these intricate dynamics, particularly surrounding interbank offered rates and currency performance.

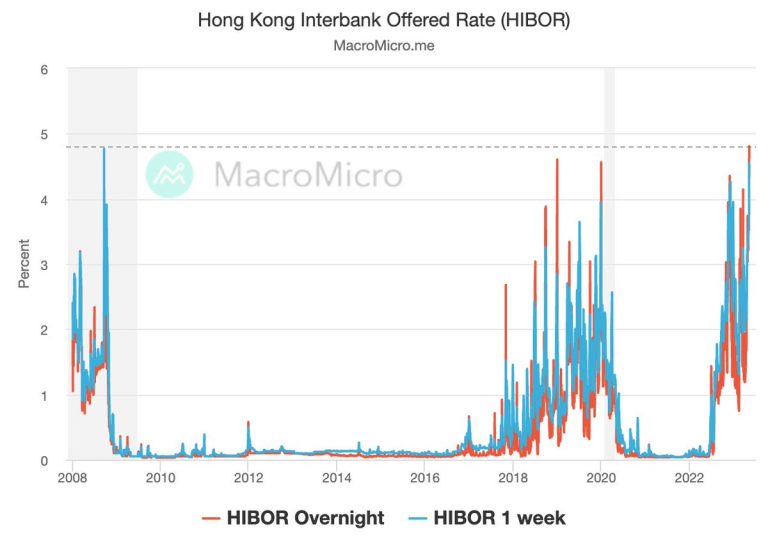

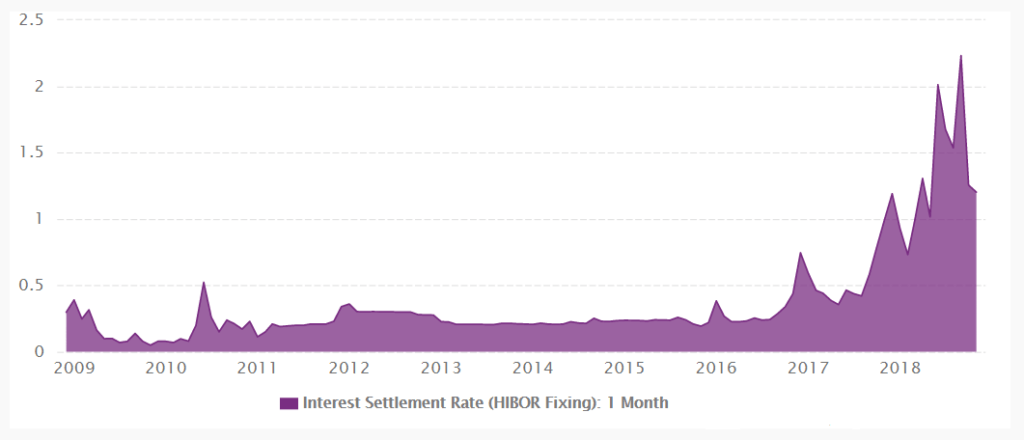

The Hong Kong Interbank Offered Rate (Hibor) has recently experienced a notable surge, crossing the 3 percent threshold across multiple tenors. This increase, observed on a Monday preceding a Federal Reserve meeting, represents more than just a numerical change—it’s a potential harbinger of broader monetary policy expectations.

Drilling into the specifics, the one-month Hibor, which plays a crucial role in determining mortgage rates, climbed by 3 basis points to reach 3.19 percent. Even more dramatic was the overnight Hibor’s movement, which jumped a substantial 43 basis points to 3.061 percent. These aren’t just abstract numbers; they directly impact borrowing costs for businesses and individuals, particularly those with loans and mortgages tied to these benchmark rates.

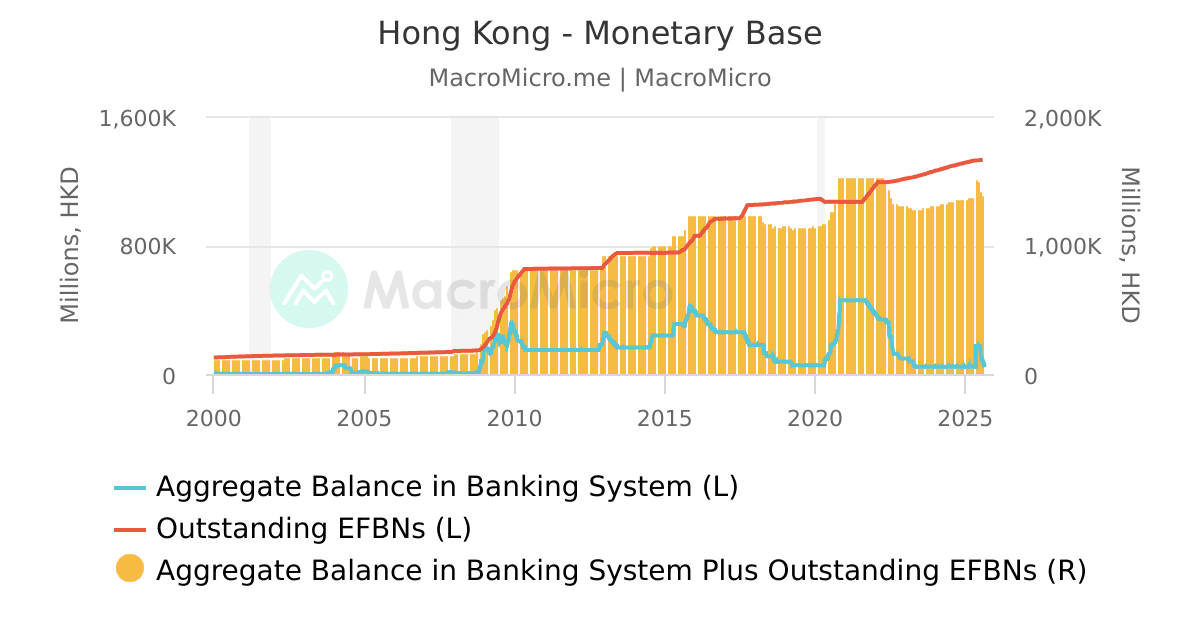

Concurrent with Hibor’s rise, the Hong Kong dollar has demonstrated remarkable strength, appreciating to its highest level in over four months. The local currency has positioned itself above the midpoint of its designated trading band, settling around 7.77 against the U.S. dollar. This band, ranging from 7.75 to 7.85, provides a structured mechanism for managing exchange rate fluctuations and maintaining economic stability.

The interplay between rising Hibor rates and a strengthening currency offers insights into the region’s financial health. Higher interbank rates typically suggest increased borrowing costs, which can influence everything from personal loans to corporate financing. For consumers and businesses, this might mean slightly more expensive credit in the short term.

However, the Hong Kong dollar’s robust performance signals underlying market confidence. A strong currency can attract international investors, potentially bringing additional capital into the region. It also reflects the effectiveness of Hong Kong’s monetary management strategies, which aim to maintain economic predictability in a dynamic global financial environment.

These developments aren’t occurring in isolation. They’re part of a broader economic narrative influenced by global monetary policies, particularly those of the Federal Reserve. The timing of these changes—occurring just before a Fed meeting—underscores the interconnected nature of international financial markets.

For individuals and businesses in Hong Kong, understanding these shifts is crucial. While the immediate impact might seem technical, these rate and currency movements can have tangible consequences on investment strategies, borrowing decisions, and overall financial planning.

The current financial landscape in Hong Kong demonstrates the delicate balance of economic indicators. Hibor’s rise and the dollar’s strength are not just numbers on a chart, but living, breathing reflections of complex economic interactions. They remind us that financial markets are dynamic systems where every movement tells a story of economic expectations, policy decisions, and market sentiments.

As global economic conditions continue to evolve, staying informed about these nuanced changes becomes increasingly important. Whether you’re an investor, a business owner, or simply someone interested in understanding economic trends, these indicators provide valuable insights into the financial world’s intricate mechanisms.