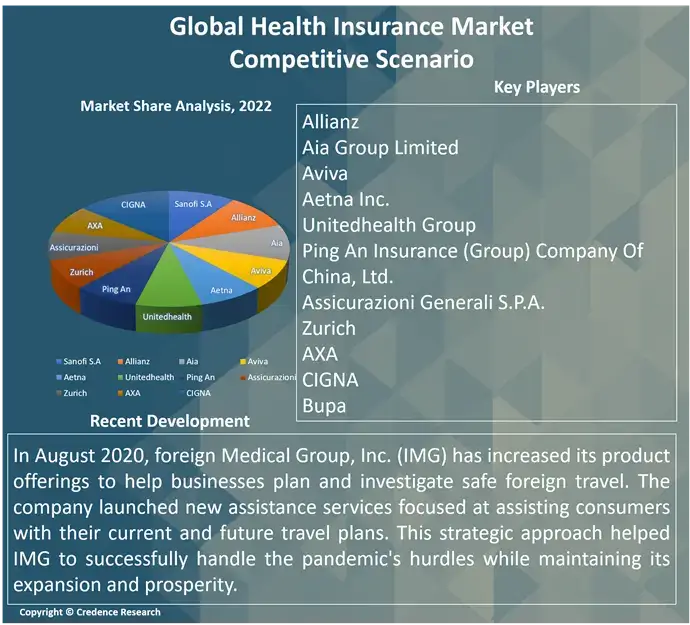

The global health insurance market is undergoing a remarkable transformation, with projections indicating substantial growth and evolving dynamics that could reshape how people access and manage healthcare worldwide. Recent data from The Business Research Company reveals an impressive trajectory, with the market expected to expand from $29.04 billion in 2024 to $44.29 billion by 2029, demonstrating a robust compound annual growth rate (CAGR) of 9.1% through 2025.

This growth isn’t just about numbers—it reflects profound changes in how people approach healthcare in an increasingly interconnected world. One of the most significant drivers is the rise of cross-border medical travel, where individuals are increasingly seeking healthcare services beyond their home countries. Imagine a patient from the United States traveling to Thailand for a specialized surgical procedure that might be more affordable or offer cutting-edge treatment options. Insurers are responding by developing more flexible networks and coverage options that support these international medical journeys.

Technological advancements are also playing a crucial role in reshaping health insurance. Telehealth consultations are becoming a game-changer, allowing patients to access medical advice remotely—a trend accelerated by recent global events and technological innovations. This means policyholders can now consult with healthcare professionals from the comfort of their homes, expanding the traditional boundaries of medical care and insurance coverage.

Demographic shifts are another critical factor driving market expansion. The global population is aging, with more elderly individuals seeking comprehensive international health insurance plans. This trend is particularly pronounced in regions like the Asia-Pacific (APAC), which is projected to experience the fastest growth in the health insurance market. While North America currently dominates the market with its established infrastructure, APAC is emerging as a hotspot of opportunity, fueled by increasing healthcare awareness and rising disposable incomes in emerging economies.

The implications of these trends extend beyond mere market growth. Insurers are being compelled to develop more inclusive and adaptable plans that cater to diverse populations and unique regional healthcare challenges. For consumers, this means more options, greater flexibility, and potentially more comprehensive coverage that goes beyond traditional local healthcare models.

Looking ahead, the health insurance landscape is likely to be characterized by increased personalization and technological integration. Plans may increasingly include provisions for international medical travel, remote consultations, and specialized care for aging populations. The focus will be on creating insurance products that are not just financial protection mechanisms but holistic healthcare solutions.

It’s worth noting that this growth isn’t happening in isolation. The broader insurance claims market is also expanding, projected to reach $519.21 billion by 2032, indicating a broader trend of increased reliance on insurance mechanisms across various sectors.

For individuals and businesses navigating this evolving landscape, staying informed is key. The health insurance market of tomorrow will be defined by its ability to adapt to changing healthcare needs, technological innovations, and global demographic shifts. Whether you’re a potential policyholder or simply interested in healthcare trends, understanding these dynamics can help you make more informed decisions about health coverage in an increasingly complex global environment.

The journey of health insurance is far from static—it’s a dynamic, rapidly evolving ecosystem that promises more choices, better accessibility, and more comprehensive care for people around the world.