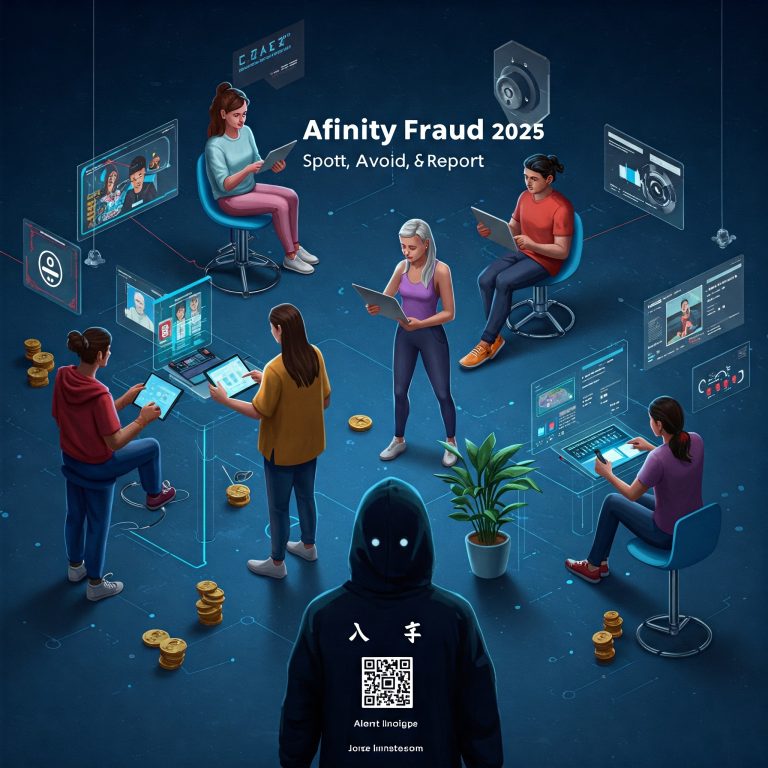

Hong Kong Students Targeted: A Growing Scam Epidemic in 2024

The digital landscape for students in Hong Kong has become increasingly treacherous in 2024, with nearly 1,000 post-secondary students falling victim to sophisticated scams that have drained over HK$100 million from their accounts. Recent police data reveals a stark and alarming trend that demands immediate attention and awareness.

From January to July 2024, Hong Kong witnessed a staggering 24,644 total scam incidents, resulting in massive financial losses of HK$4.34 billion. Within this broader context, students have emerged as particularly vulnerable targets, with 957 students—644 local and 313 mainland Chinese—suffering significant financial setbacks.

The scam landscape is diverse and evolving, with online shopping fraud leading the charge. A total of 422 cases involved deceptive transactions, frequently centered around concert tickets and second-hand marketplace exchanges. However, the most financially devastating category remains phone scams, which, despite fewer incidents (174 cases), generated nearly HK$69.9 million in losses.

Notably, mainland Chinese students have been disproportionately impacted. Their average losses in phone scams were 4.5 times higher than local students, accumulating HK$60.31 million—representing 55.5% of total student-related scam losses. A shocking example includes a 25-year-old mainland master’s student who lost an unprecedented HK$10.97 million to scammers impersonating mainland police in April 2024.

Different student populations also show distinct vulnerability patterns. While mainland students predominantly suffered from rental fraud (comprising 94.4% of such cases), local students were more susceptible to investment scams, accounting for 85.7% of those incidents.

A revealing survey by Hong Kong Polytechnic University in May 2024 underscored the pervasiveness of this issue. Among 3,189 students from four universities, 82% reported encountering scams, with 6% experiencing financial losses averaging HK$40,000. Disturbingly, many victims hesitate to report these incidents due to embarrassment or perceiving their losses as insignificant.

Authorities are not sitting idle. The Hong Kong Monetary Authority (HKMA) and police have launched comprehensive awareness campaigns, including designating a month as “Anti-Scam Month” and reaching over 4,000 students across 17 post-secondary institutions. They’ve implemented advanced fraud monitoring systems that have already shown promising results, reducing the average loss per scam case from HK$1.15 million to HK$760,000.

Banks are also stepping up, establishing special interception rules for student accounts and developing sophisticated risk assessment mechanisms. By September 2024, new fraud risk indicators will be provided to retail banks to enhance monitoring and protection.

The implications extend beyond immediate financial losses. Some students have even been inadvertently drawn into criminal activities, with a 19-year-old university student arrested for acting as a runner in a scam syndicate.

For students navigating this complex digital landscape, awareness is the first line of defense. Understanding the various scam types, maintaining vigilance in online transactions, and promptly reporting suspicious activities can significantly mitigate risks.

As scam techniques continue to evolve, students must remain informed, cautious, and proactive in protecting their financial well-being. The digital world offers immense opportunities, but it also demands heightened awareness and strategic personal risk management.