Hong Kong’s Retail Landscape: A Snapshot of Economic Resilience in July 2025

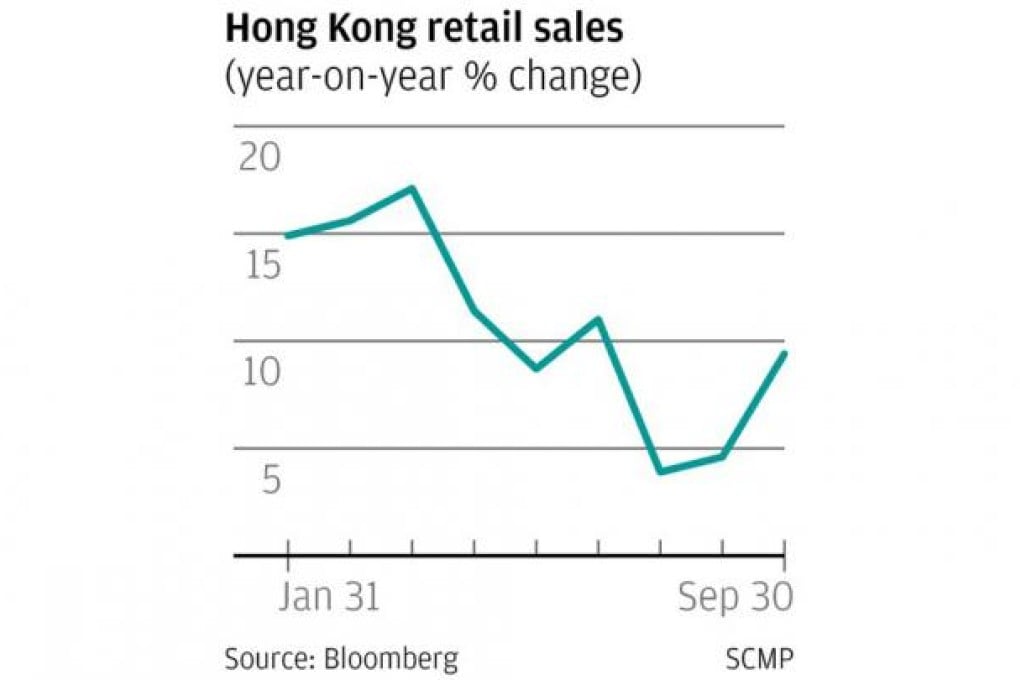

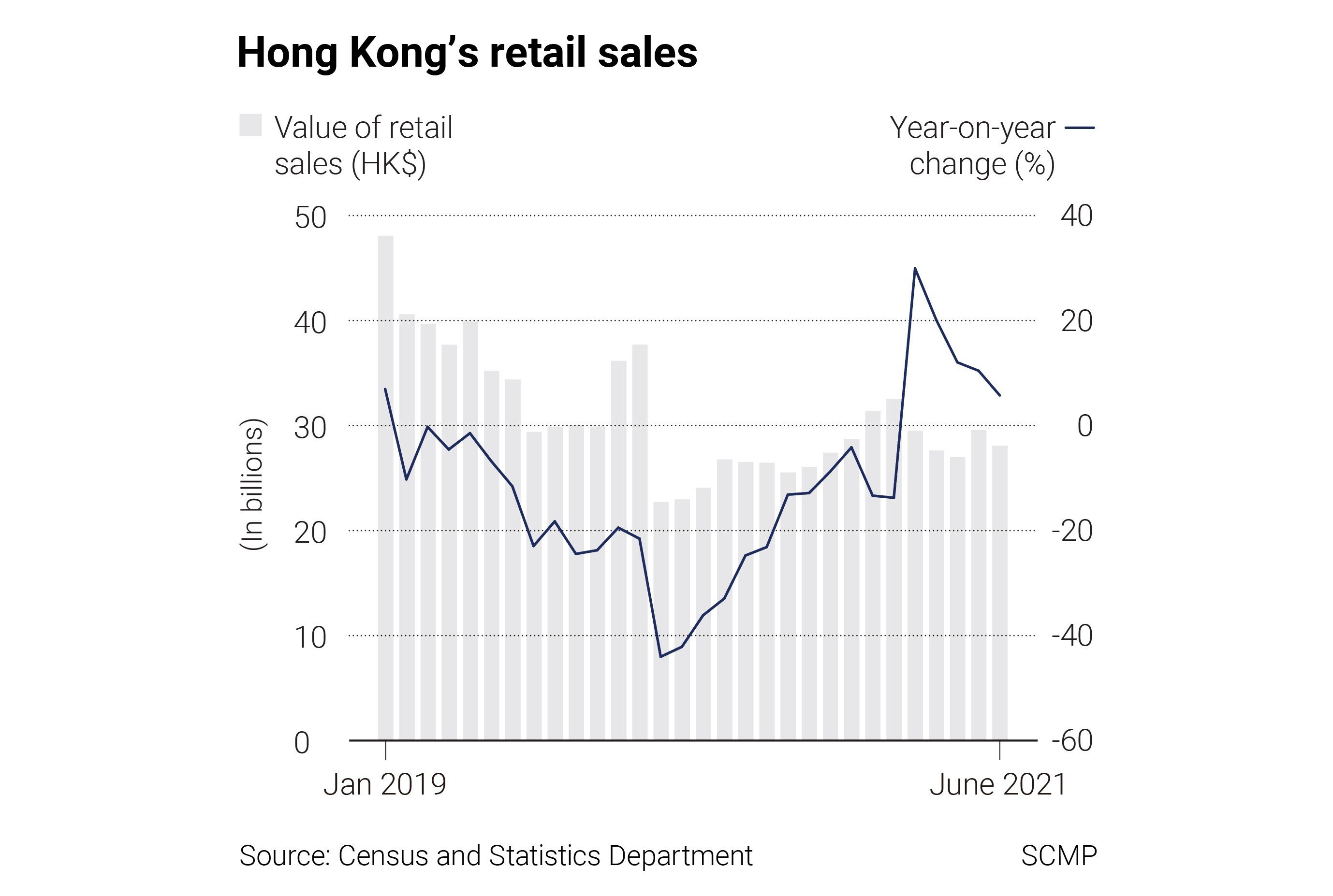

The latest retail sales data from Hong Kong reveals a nuanced economic story of modest growth and shifting consumer behaviors. According to the Census & Statistics Department’s September 1, 2025 report, total retail sales reached $29.7 billion in July, marking a 1.8% increase compared to the same period in 2024. When accounting for price fluctuations, the actual sales volume grew by 1%, signaling a cautiously optimistic economic environment.

Digital commerce continues to reshape the retail landscape, with online sales capturing 8.7% of total retail transactions. The digital marketplace demonstrated remarkable resilience, expanding by 13.2% to $2.6 billion compared to the previous year. This trend underscores the increasing consumer comfort with digital shopping platforms and suggests a fundamental transformation in purchasing habits.

The retail sector displayed a complex performance across different product categories. Some segments experienced notable growth, highlighting consumer preferences and market dynamics. Specialty categories saw particularly impressive gains: Chinese drugs and herbs surged by 19.6%, while books, newspapers, stationery, and gifts jumped an impressive 20.5%. Jewelry, watches, and valuable gifts also performed strongly, with a 9.4% increase, indicating continued consumer interest in premium and gift-oriented products.

Apparel and personal care segments showed moderate growth, with clothing sales rising 1.3% and medicines and cosmetics increasing by 2.6%. Supermarkets maintained relatively stable sales, with a marginal 0.2% uptick, reflecting consistent demand for essential goods.

However, not all categories experienced positive momentum. Significant declines were observed in several sectors, potentially signaling broader economic challenges or changing consumer priorities. Motor vehicles and parts saw a substantial 12.4% decrease, while electrical goods dropped by 8.2%. Fuel sales declined by 10.3%, and furniture and fixtures experienced a 9.4% reduction. These contractions might reflect cautious consumer spending, particularly on big-ticket items and durable goods.

Government officials remain optimistic about the retail sector’s future. They anticipate sustained consumption sentiment, bolstered by strategic initiatives to promote tourism and host major events. These efforts are expected to provide additional economic stimulus and support for local businesses.

The data paints a multifaceted picture of Hong Kong’s retail ecosystem in July 2025. While the overall growth is modest, the underlying trends reveal a market in transition. The robust performance of online sales and specialty categories contrasts with declines in traditional sectors, suggesting a dynamic and evolving consumer landscape.

For businesses and economic observers, these figures offer valuable insights. They highlight the importance of adaptability, digital integration, and understanding shifting consumer preferences. The retail sector continues to demonstrate resilience, navigating economic complexities with strategic responsiveness.

As Hong Kong moves forward, the retail data serves as a critical barometer of economic health, consumer confidence, and market potential. The 1.8% growth, though subtle, indicates an economy finding its footing and consumers maintaining their purchasing power amid global economic uncertainties.